Analysts and brokerage firms often use ratings when they issue stock recommendations to stock traders.

Analysts arrive at stock ratings by researching public financial statements, communicating with executives and customers and following industry trends.

Here are the latest analyst rating updates for Lucid Group Inc (NASDAQ:LCID), Rhythm Pharmaceuticals Inc (NASDAQ:RYTM) and Kohl's Corporation (NYSE:KSS):

The latest analyst rating for Lucid was by Redburn Partners on Jan. 11. The analyst firm initiated coverage on Lucid with a Neutral rating. Five analyst firms have reported ratings in the last year.

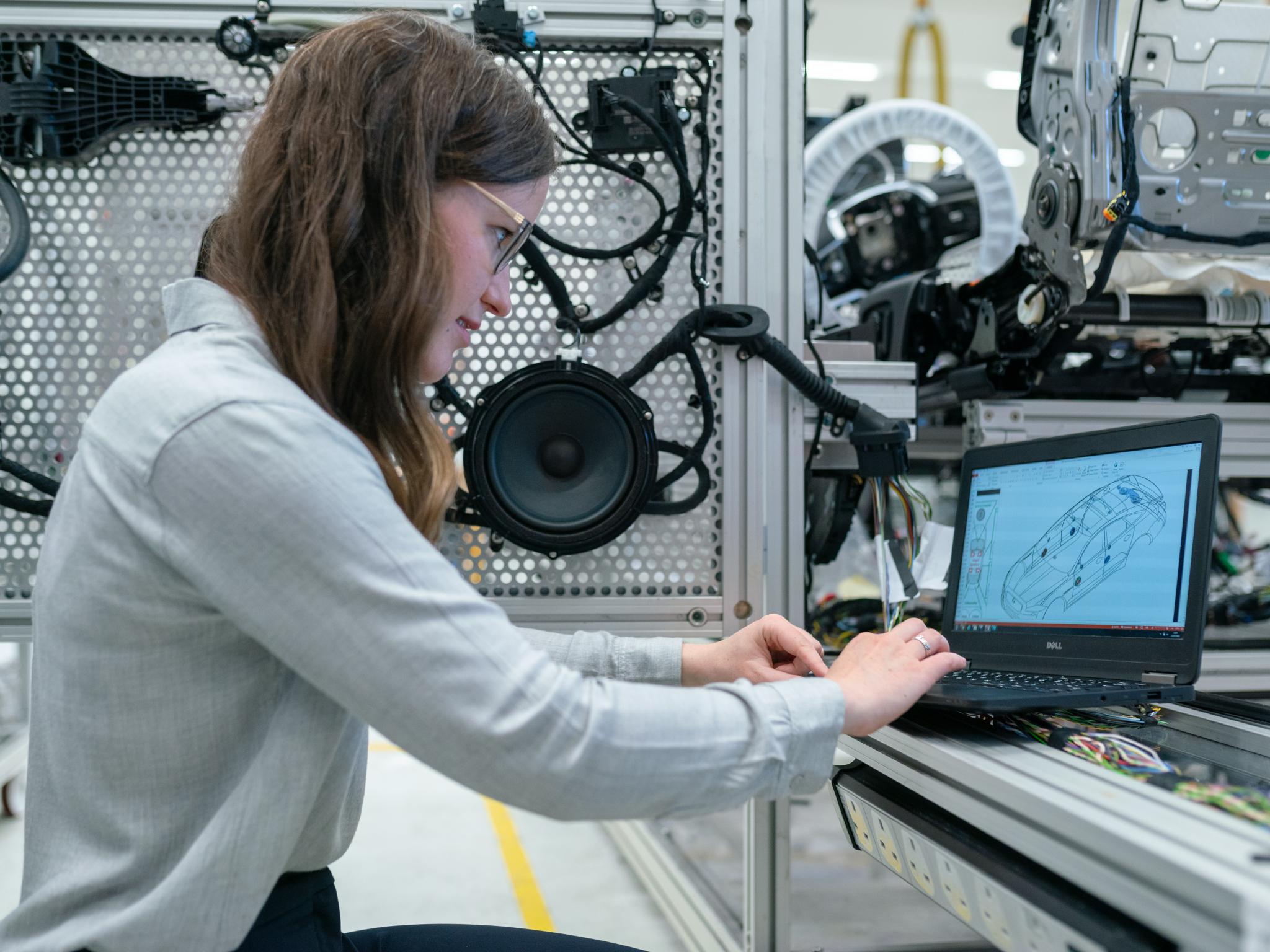

Lucid is a technology and automotive company. The company develops the next generation of electric vehicle (EV) technologies.

Lucid’s fourth-quarter earnings report is confirmed for Monday’s after-hours session. According to analyst consensus estimates, Lucid is expected to report an EPS loss of 35 cents on revenue of $36.74 million.

The latest price target for Rhythm Pharmaceuticals was by Needham on Feb. 25. The analyst firm set a price target of $45, a possible 503.22% upside. Eight analyst firms have reported ratings in the last year.

Rhythm is a biopharmaceutical company focused on the development and commercialization of peptide therapeutics for the treatment of gastrointestinal diseases and genetic deficiencies that result in metabolic disorders.

Rhythm’s fourth-quarter earnings report is confirmed for Tuesday’s pre-market session. According to analyst consensus estimates, Rhythm is expected to report an EPS loss of 91 cents on revenue of $1.70 million.

The latest price target for Kohl's was by Gordon Haskett on Feb. 10. The analyst firm set a price target of $70, a possible 26.97% upside. Fifteen analyst firms have reported ratings in the last year.

Kohl's operates 1,162 department stores in 49 states that sell moderately priced private-label and national brand clothing, shoes, accessories, cosmetics and home furnishings.

Kohl’s fourth-quarter earnings report is confirmed for Tuesday’s pre-market session. According to analyst consensus estimates, Kohl’s is expected to report EPS of $2.12 on revenue of $6.54 billion.