The surge in home prices over the past two years means higher property tax bills for homeowners.

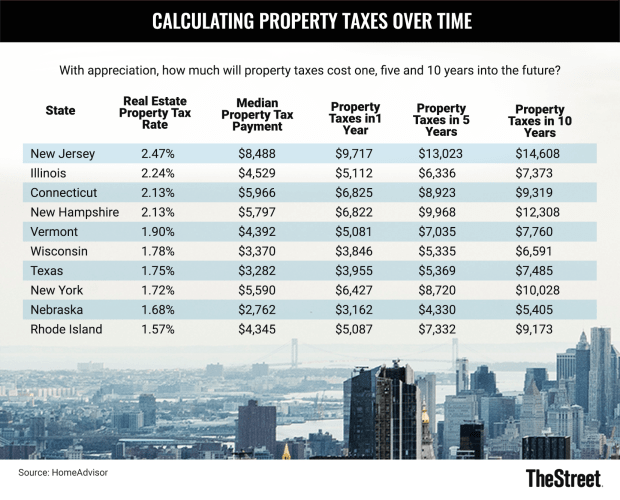

HomeAdvisor, an online marketplace for home services, created a list with each state’s property tax rate and median tax payment now, and projected their payments for one, five and 10 years from now.

For those of you who are renters, property tax rates are the percentage of a home’s assessed value that owners must pay.

Here’s a chart of the 10 states with the highest property tax rates now and the projections for their future.

TheStreet

You also might be interested in knowing what portion of your household income goes to property tax payments. Here’s a list of the top 10 states.

1. New Jersey: 9.96%

2. New York: 7.86%

3. Connecticut: 7.47%

4. New Hampshire: 7.44%

5. Vermont: 6.92%

6. Illinois: 6.62%

7. Rhode Island: 6.18%

8. Massachusetts: 5.73%

9. Wisconsin: 5.32%

10. Texas 5.14%.

And here’s a list of the bottom 10 states.

1. Alabama: 1.17%

2. West Virginia: 1.5%

3. Arkansas: 1.67%

4. South Carolina: 1.75%

5. Louisiana: 1.82%

6. Wyoming: 2.11%

7. Delaware: 2.12%

8. Indiana: 2.13%

9. Hawaii: 2.15%

10. Mississippi: 2.15%

Of course, you don’t want to choose where to live solely by the size of your property tax bill. High property taxes can be a sign of a good public-school system, parks and other services that are funded by property taxes.

To Buy or Rent?

Meanwhile, it makes sense that the elevated home prices and surge in mortgage rates this year would create an increase in renters and reduce the number of homeowners.

But the trend was already getting started in the past decade. RentCafe, an apartment-search website, found that among 1,553 Zip codes it analyzed in 50 major cities, 101 switched to renter majority from homeowner majority from 2011 to 2020.

That put the number of renter-majority zip codes at 632, which represents 41% of total Zip codes.

The number of renters rose by 12% between 2011 and 2020, compared with a 4% increase in homeowners, according to the U.S. Census.

if you’re a prospective home buyer now, you too might want to stay on the sidelines until mortgage rates retreat and home prices fall to reasonable levels.

The 30-year fixed-rate mortgage averaged a 20-year high of 6.92% in the week ended Oct. 13. And the median existing-home-sale price totaled $389,500 in August, up 7.7% from a year earlier, though down 3.5% from July.

Of course, it may take a year or more for mortgage rates and home prices to return to reasonable levels. So as a prospective buyer, you either have to be patient or pay up.