The Question

Do octopuses throw shells at one another when agitated?

Talking Points

- Elon Musk said Twitter bankruptcy was possible

- Meta said it plans to lay off 11,000 employees

- Elizabeth Holmes was denied a retrial

- Alex Jones must pay another $473m to Sandy Hook families

- London and Paris saw major metro strikes

- The EU investigated Microsoft's Activision purchase

- Renault and Google plan to make cars more "like phones"

- Imran Khan restarted his march on Islamabad

- Pakistan and England blasted their way into the T20 decider

- China's zero-Covid policy weighed heavily on its economy

Deep Dive

Sam Bankman-Fried's cryptocurrency empire collapsed this week. His $16bn personal fortune was incinerated in a matter of days (another rousing win for the normative determinists). Not bad for a 30-year-old.

The prince-in-waiting

Sam Bankman-Fried, we were repeatedly assured, was one of the smart ones. And one of the good ones. A rising star on the international ETF desk at Jane Street, a contemplative student of Will MacAskill's effective altruism movement, a trader with an impeccable eye and boundless ambition. We could spend all day navigating the public relations detritus of the man better known as SBF. He's left plenty of interviews to pore over. But while that would no doubt be a fun and enlightening thing to do, it's less fun and enlightening than answering this question: how does a cryptocurrency exchange go from a valuation of $32.5bn one month to ~$0 the next?

It has been said that how you acquire money is a fairly good indicator of how you'll lose it. To wit, lottery winners. SBF started building his fortune in arbitrage: buying Bitcoins on US exchanges and then selling them on East Asian exchanges for a healthy profit. In 2017, he set up Alameda Research to conduct more of these trades. He managed to raise $100m to place bigger bets and take advantage of the 'Kimchi premium' (not our term, thankfully). In 2018, Alameda began funnelling investors' millions into the trades; at one point he was making $10m a day in crypto trades.

FTX: it's for the pros

By 2018, there was gold in them thar hills — crypto exchanges (the loci for trading) were booming. But it was the Wild West. Exchanges suffered from technical failures, massive hacks, and a general lack of governance. So SBF decided to build his own - FTX. It was to be a stable, transparent, and well-governed exchange. A safe pair of hands though which SBF, Alameda, and other pros (professional investors) could make their bets. The exchange boasted that it was over-capitalised, and that it used an automated system to liquidate any trades that approached a certain risk threshold. It also stayed away from all that funny business that the crypto space was rife with. And as a result, FTX was a great business. It grew and grew and grew. As that was happening, Alameda too was using FTX to make its own bets. And it too was growing fast. At one point it had accumulated a whopping $15bn in assets across the crypto world. And SBF had earned a moniker: the prince of risk.

But as you may have heard, some stuff has happened in the crypto space since 2018. It would be churlish to say that the confidence tricks fell flat. So we'll just say that a number of high-profile stable-coins, exchanges, and cryptocurrency lenders detonated in spectacular fashion. In May, Do Kwon's stablecoin Terra went into a death spiral and wiped out $45bn in a week. From the safety of Europe, the founder assured Singaporean and South Korean police that he was not on the run. Terra's collapse was a turning point. It revealed the soft, noxious, rotting underbelly of the industry. Three Arrows Capital, which was exposed (totally nude) to Do Kwon's wealth-destruction scheme, got crunched by margin calls in June. Voyager Digital was made to look like the amateur operation it was: when 3AC failed to cough up, it too went under.

Now it turns out that Alameda too was in trouble alongside 3AC in July. It had lent $500m to Voyager — oops. In September, FTX snapped up Voyager's assets (not to mention Celsius and BlockFi). At the same time, SBF moved $4bn from FTX to Alameda to keep the latter afloat. If it's all getting a little soupy, let's pause for a moment. SBF made bets with one company, including some monumentally big and bad ones. He bailed himself out with funds from another company. One hand washed the other - or perhaps in this case, it rubbed grime all over it. And here's the best part: the assets the prince was using for his bail out, didn't belong to FTX. He was handing over all sorts of stuff: FTX's in-house tokens (FTT), a 7% stake in the trading platform Robinhood, and, quite extraordinarily, customers' deposits. SBF describes it as "rotating wallets". The dispassionate observer may describe it as fraud.

The November meltdown

Things got very heated in November. It was becoming clear that Alameda had a hole in its balance sheet and a big one at that . The press got wind of the fact that the vast majority of Alameda's assets were in FTT, a token issued by none other than FTX. In other words, one company minted a fake, value-less token, "sold" it to another (closely-related) company, and the second company used the inflated value of the spurious collateral to place insanely risky bets in the most volatile sector of the economy. If that sounds like fraudulent, and possibly criminal, activity to you, well, dear reader, you're not alone. Changpeng Zhao of Binance, SBF's one-time backer and more recent nemesis, declared that he would liquidate his stake in FTT. It's unclear whether the move was also spurred by spite, rivalry or strategic intent. What is clear is that SBF's inner circle (ten 30-somethings who had all slept with one another in a shared house in the Bahamas) completely failed to reassure investors that despite the declining value of the FTT token, FTX, the company, was fine.

FTX users rushed for the doors but were locked out of their accounts. The exchange couldn't honour withdrawals (on Wednesday, SBF was frantically searching for an $8bn lifeline). What this means is that he had lied through his teeth when telling customers that his exchange had a greater sum of assets and collateral than customer deposits. He lied, like Do Kwon and Zu Shu lied, and now the money is gone. Thousands of people have lost their money because the smartest guy in the room apparently hadn't come across the concept of a bank run. SBF also reached out of Binance for a bailout — Changpeng Zhao took one look at the books and said thanks, but no thanks . Right now FTX and Alameda are holding a lot of worthless FTT tokens. And they're on the hook for billions. Which is how you turn a $32.5bn valuation into a ~$0 valuation .

As is always the case, this chicanery wouldn't happen if it weren't for a cloying and ludicrously credulous cryptocurrency press. PR, marketing, news, and social media hype all get churned into a frothy mess. SBF was described in messianic terms by the trade press and a few credulous traditional news outlets. One of the world's most powerful venture capital firms published a piece a month ago musing that FTX may one day eclipse the big four of American banking (JPMorgan Chase, BoA, Wells Fargo, and Citi). Get a grip. SBF is not the messiah, he's just a very naughty boy.

Worldlywise

The wave

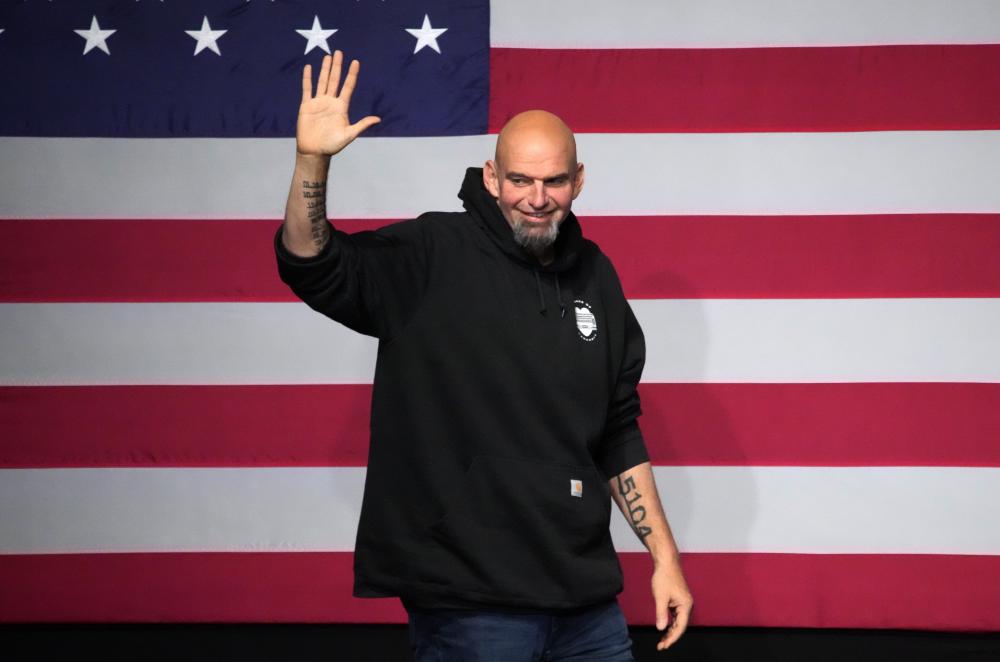

In the wee hours of Wednesday morning, the hulking figure of John Fetterman strode across the stage to rapturous applause. The blue-collar Democrat had just snatched the vacant Pennsylvania Senate seat from the Trump-endorsed Dr Oz. The value of flipping the Republican seat was not lost on anyone: it teased the prospect of the Dems retaining control of the Senate. All across the nation, Senate races had fallen roughly as predicted, except for a handful of highly competitive races that did not deliver the conclusive wins expected. Georgia is going to a run-off on December 6, and counting is still underway in Nevada and Arizona . A GOP majority in the upper house will likely come down to the tantalising Herschel Walker/Raphael Warnock rematch down South. A 50-50 tie (which falls in the Dems favour) is very possible.

House races were full of surprise. The predicted "red wave" crested briefly and early. Polls predicting a 30-50 seat wipeout were set aside as soon as the results started trickling in. The GOP will likely take the House, but the lead could be in single digits. We've got a few days to go before we know for sure, but one pattern is clear as day. The Republican Party tied to Donald Trump has lost the last three elections in a row. There is trouble brewing in the ranks, and Trump is waiting until after the Georgia runoff to announce whether he'll run in 2024. Joe Biden didn't need to be asked twice: he's definitely running.

Incredibly, the gentler-than-expected CPI figures this week sparked an outpouring of good vibes on Wall Street. The S&P 500 rose 4.7% and the tech-heavy Nasdaq jumped 6.1% ! All this just a week after Jerome Powell was warning of more pain. Are the storm clouds clearing? Well, if we take the lessons of this election seriously, let's not rush to conclusions.

The retreat from Kherson

On the last day of September, Russia formalised its annexation of Kherson oblast. This week Russian Defence Minister Sergei Shoigu announced a strategic withdrawal of Russian forces to the east bank of the Dnipro river. Strategic or not, it is a stunning loss of face for Moscow. The "difficult decision" to retreat to shorter defensive lines shows just how costly the southern Ukrainian advance has been. This brutal campaign has left tens of thousands of combatants dead on either side, as Ukraine presses closer towards Kherson city. Kyiv is on the brink of reclaiming the only regional capital that it lost in the first phase of the war.

There will be no triumphant race into the city centre. Russia will move its 30,000 fighters back, but leave all kinds of traps in place . Key routes have been heavily mined. In recent months, Ukraine's reconnaissance drones and heavy artillery have turned the open fields to the west of Kherson city into a killing field for Russian armour. A handful of Russian stay-behind units hiding in houses could extract a heavy cost on the liberating army. And still the northern winter closes. Several centuries of experience would suggest that no-one advances far during the colder months.

This week, a US intelligence report alleged that military losses had crossed 100,000 on both sides. The loss of life and livelihood of civilians is always a poor afterthought. Anything that prolongs this conflict is unconscionable.

The Best Of Times

More bronzed Mediterraneans

The discovery of 24 exquisite bronze statues under thermal baths in Tuscany demands a sharp reappraisal of Mediterranean history. The gorgeous hollow-cast statues depict Greco-Roman figues like Hygieia and Apollo and were created between 200 BCE and 100 CE. It suggests "cultural osmosis" during a the gradual envelopment of the Etruscan civilisation by the rising Romans; a dialogue between those with a shared history. A better end of the stick to what the rest of the known world got.

Super poo

For those unacquainted with the delicate art of Faecal Microbiota Transplants (FMT): a healthy individual donates poo to someone whose microbiome in a poor state. It is a potentially life-saving treatment. But medical authorities have not landed on a good working definition, let alone regulatory framework. The Brits see it as a medicinal product, the Europeans a human cell product, and the Americans a biological product. This week Australia became the first country to grant regulatory approval to FMT. If you have healthy microbiota, consider sharing it!

The Worst Of Times

COoPted27

Week one of the United Nations Climate Change Conference (COP27) is underway in Sharm el-Sheikh. In attendance this year are 636 delegates of that rare breed: fossil fuel lobbyists . They've flown from all corners of the world to — if you came down in the last shower — outline how their employers are navigating the transition away from oil and gas. What they are really doing is fighting a rearguard action to delay consensus on actions that would impact their employers' near-term future earnings. Very Serious People often chide the public that the regulated must have a seat at the high table alongside the regulator. But that didn't work with Purdue, or British American Tobacco, so why would it work with Chevron or Woodside?

Own goal

The brief given to Qatar's spinners ahead of the FIFA World Cup was crystal clear. Do: talk about the tournament. Don't: talk about migrant workers or the LGBT+ community. The gap between what journalists ask and what flak-catchers divulge is vast. But it is in that dark space that all good public relations happens. Less than two weeks out, one of the Qatar Sports Ambassadors told a German television host that "homosexuality is haram... because it is damage to the mind". Needless to say the interview was discontinued. We eagerly await response from the kEeP PoLiTiCs oUt oF SpOrT crowd.

Highlights

The Image

Italian ultra-cyclist (madman) Omar Di Felice trains for his 2,000km coast-to-coast ride across Antarctica. The bike commute to work doesn't seem so far now, eh? Photo supplied by The Guardian .

The Quote

"I just killed it... Please note that Twitter will do lots of dumb things in coming months. We will keep what works & change what doesn't."

– Elon Musk brings his famous management style and product development nous to Twitter. No doubt a lot more dumb things are in the pipeline to help cover the billion of dollars in annual loan repayments that Musk is on the hook for ever since Twitter's board (and a Delaware judge) called his bluff and made him buy the business.

The Numbers

40-year-old footballers

- Popular wisdom holds that the 'perfect age' for a top-flight footballer is around 26; a fine balance of vigour and maturity. But Benzema is 34, Messi 35, and Cristiano Ronaldo a venerable 37. This piece asks a question for the ages: why aren't sports stars ageing out?

40 rotisserie chickens

- Philadelphia man Alexander Tominsky completed a gastronomic marathon last weekend: consuming an entire rotisserie chicken a day for 40 days. He polished off the final bird to raucous cheers. A hero for our time.

The Headlines

"Can a really, really big flagpole unite America? That's the plan" — Financial Times . You'd have to be on some pretty potent hallucinogens to think that colourful fabric fluttering in the wind would be affecting enough to engender oceanic feelings amongst the people.

"Have fun outside, but please don't lick the hallucinogenic toads, US National Park Service says" — Los Angeles Times . Ah...

The Special Mention

The award in Marketing Magic is shared this week. Drake gets the gong for the Her Loss album launch promotion which involved a heap of fake copies of Vogue . He was instantly sued by Condé Nast for obvious reasons. More like His Loss , am I right? Drizzy has to share his Special Mention with the Colonel himself. KFC apologised profusely this week for sending this curious promotion , "It's memorial day for Kristallnacht! Treat yourself with more tender cheese on your crispy chicken. Now at KFCheese." 10/10, no notes.

The Best Long Reads

- Bloomberg admits that the preppers were right all along

- Financial Times spend a week with Elon

- Foreign Policy scratches away at Iran's gender problems

The Answer...

A video has surfaced of octopuses getting stroppy and hurling things at one another. It's become something of a Rorschach test for those grappling with the problem of animal consciousness .