KEY POINTS

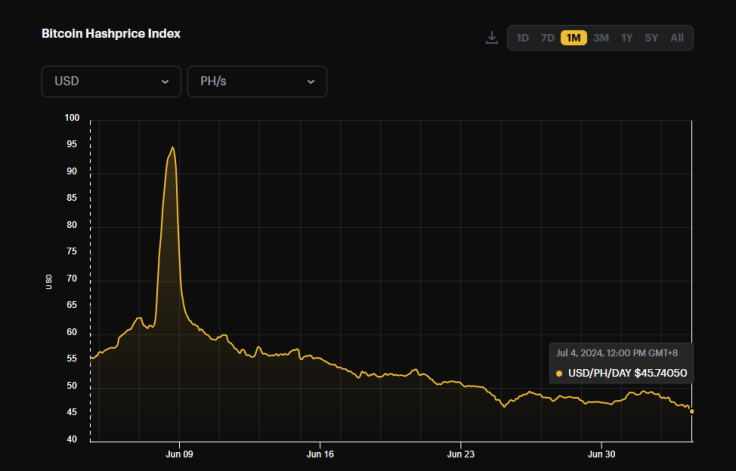

- Hashrate Index data shows that Bitcoin's hashprice was at $45 on Friday morning, compared to $172 on April 21

- Bitcoin prices have also plunged below $58,000, significantly down from an ATH of $73,000 in March

- Some analysts said BTC miners are still 'bleeding out' and capitulation levels have reached the same as those in December 2022

Miners of Bitcoin are the backbone of the burgeoning $BTC market, but they have been struggling in recent weeks as the impact of the halving earlier this year and the digital coin's plunging prices are pushing smaller miners to the brink.

Halving impact continues to bite

When $BTC went through its fourth halving event in April, the rewards miners earned were split in half. Profit margins became tighter, and the digital asset's hashprice has been plunging.

Data from the Hashrate Index shows that Bitcoin's hashprice per petahash/second (PH/s) was at $45.76 on Friday morning. The hashprice is a metric that quantifies miners' earnings from a specific quantity of hashrate – the rate at which miners solve problems to produce a Bitcoin block. Friday's hashprice is a far cry from the hashprice of $172 on Apr. 21, 2024, a day after the halving.

Bitcoin prices plummet

Aside from the hashprices plunging since the halving, it doesn't help that $BTC prices have also been on a downtrend. The world's largest cryptocurrency by market value started the day at around $58,600 – some $15,000 away from its glorious all-time high of over $73,000 in mid-March.

How are miners holding up?

Prominent Bitcoin analyst Willy Woo said that at this point, "miners are still bleeding out, writhing in pain." His observation comes a day after Bitfarms revealed in its June 2024 operational update that it sold a huge chunk of the Bitcoins it mined in the month.

Every day I look at 7 squiggly lines to see if its time.

— Willy Woo (@woonomic) July 3, 2024

Nope, not yet.

Miners are still bleeding out, writhing in pain.

Let's have a silent moment for them. pic.twitter.com/modqCocaoD

Another well-followed Bitcoin analyst, James Check, noted Thursday that the mining industry will not collapse, but "miners can and will go bankrupt" as long as capitalism rules.

#Bitcoin miners can and will go bankrupt.

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) July 4, 2024

Mining as an industry, won't, as the difficulty adjustment ensures it is always profitable to miner for someone...it just may not be you.

ASIC rigs simply change cost basis to a new buyer with a better balance sheet.

Capitalism 101.

What's next for the mining industry?

Crypto analytics firm CryptoQuant said in a recent report that miners were "hit by a 63% decline in daily revenues due to the halving and the collapse of transaction fees to 3.2% of total revenue." The levels of capitulation – when miners give up or retire – have become comparable to those in December 2022, when the market bottomed following the collapse of crypto behemoth FTX.

Mining the world's first decentralized cryptocurrency comes with many challenges, but with expectations that Bitcoin will bounce back and is only headed up, miners who survive the season's beating may find themselves no longer just surviving, but thriving. Furthermore, many Bitcoiners observed that "when all the weak miners are cleaned out, it's bullrun time."