Retirement is much more than saving enough money and hoping it works out. It's about deciding the purpose of each dollar and where it goes.

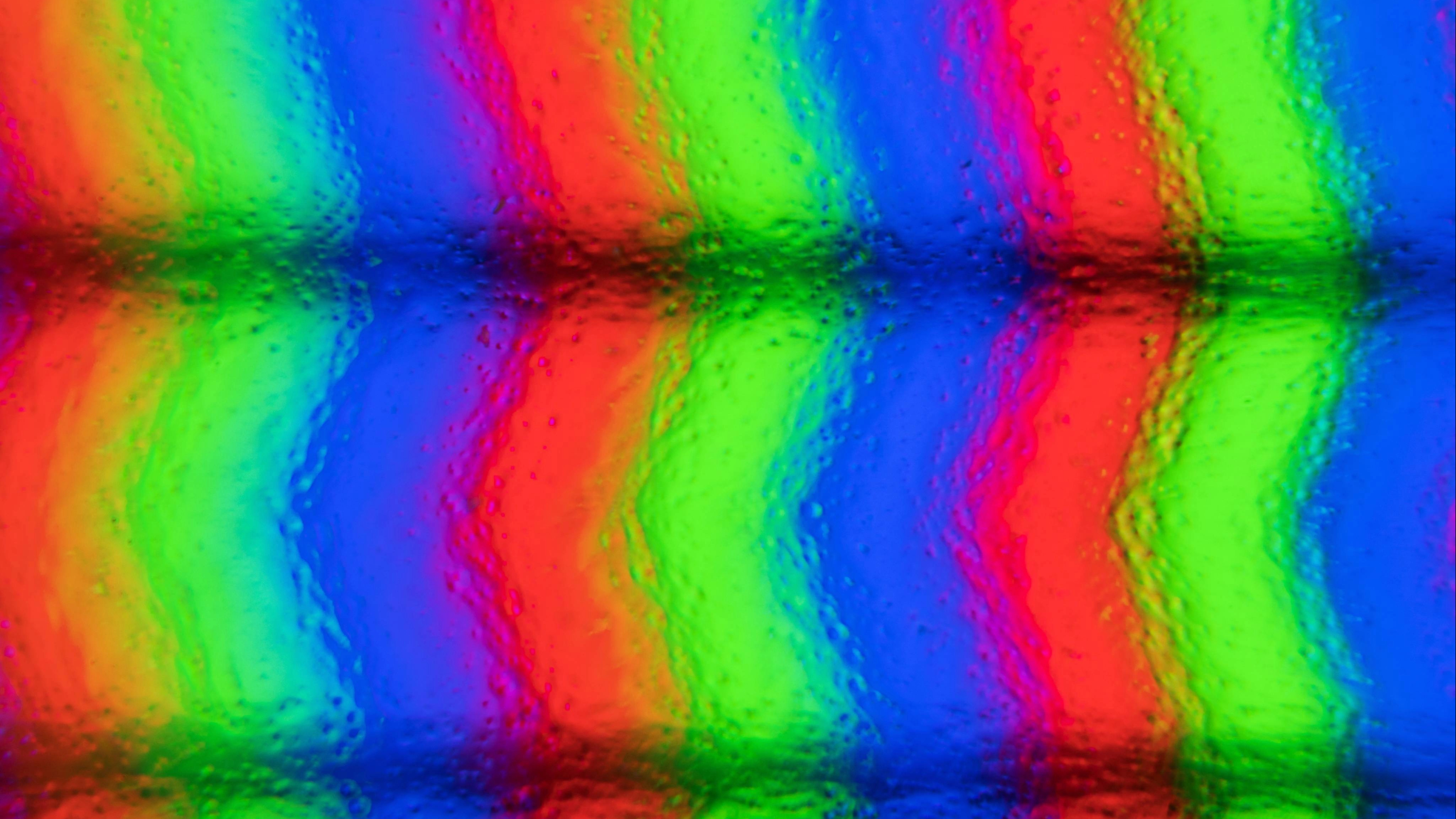

Picture a beam of light hitting a prism and breaking into colors. Now do the same with your savings, and you'll see three clear zones with distinct purposes and timelines.

This is what I call "The Money Prism," a simple system that can match money to purpose, keep emotions in check and address one of retirement's biggest headaches: Poor early returns while you're withdrawing (often called sequence of returns risk).

Most people treat their portfolios like one big bucket, but your dollars don't all have the same job. Some pay next month's bills, some won't be touched for years, and some might go to kids or charity. When those needs get blended, a market drop can feel like a threat to everything.

The fix is to separate your money by purpose and time. This is what behavioral folks call solving a mental accounting problem:

- Blue Zone. Short-term reserve for liquidity and stability

- Green Zone. Midterm income for steady cash flow

- Red Zone. Long-term growth for compounding and legacy

Let's explore how each one functions within the broader retirement strategy, and how aligning your assets to these time horizons helps create balance between growth, income and security.

The Blue Zone

This is the short-term reserve built for liquidity and stability. It covers immediate cash needs and near-term, one-time expenses, typically about six months of planned withdrawals plus any big expenses you can already see coming (taxes, a remodel, an anniversary trip).

What happens early in retirement matters, and losses in the first years can hurt more because you're also taking withdrawals.

Accordingly, Blue Zone dollars live in vehicles that keep spending money safe and handy. Think cash, T-bills, a short Treasury ladder, money market funds and very short-term high-quality bonds. Yield is a bonus here, not the point.

The Green Zone

This is the midterm income engine of your plan. It bridges today's cash and tomorrow's growth, covering roughly years three through 10. The Green Zone's job is to refill the Blue Zone on schedule and keep your "paycheck" steady through changing markets.

In many retirement plans, keeping some exposure to stocks rather than shifting everything to bonds can help balance longevity risk and growth, though this involves more market volatility and no guarantees.

Green Zone assets often include balanced or income funds (commonly 40/60 – 60/40), dividend-focused stock funds, Treasury Inflation-Protected Securities (TIPS), short- to intermediate-term Treasuries or CDs, and, when appropriate, fixed indexed annuities.

The goal is to seek inflation-aware cash flow, understanding values and income can still fluctuate and are not guaranteed. Market-based investments can drop in value, and annuities, even with their advantages, have fees, expenses and contractual limitations of which to be aware.

With these investments, it's also always important to remember that past performance is no guarantee of future results.

The Red Zone

This is the long-term growth engine of your plan. It's money you don't expect to touch for at least 10 years, and its purpose is to outpace inflation, replenish the Blue and Green Zones after strong market years, and fund your long-range or legacy goals.

Because your short- and midterm needs are already secured elsewhere, you can afford to ride out volatility here and let compounding do its work. Red Zone assets focus on long-term appreciation and diversification.

They typically include global equity funds, growth-oriented mutual funds or ETFs, and a measured sleeve of real estate assets or REITs. The goal is long-term growth and future flexibility.

But even the best growth strategy can falter if timing turns against you. Bad early returns, combined with withdrawals, can shorten a plan's lifespan — a risk MIT Sloan research highlights as one of the biggest threats to income sustainability. The Money Prism addresses that challenge by structuring time, not just investments:

- Blue covers immediate and near-term needs, so you're unlikely to be forced to sell in a downturn.

- Green sustains the middle years, giving growth assets time to recover.

- Red compounds over decades, replenishing the other zones after up years.

Together, these three zones work like gears in a well-tuned system, each serving a purpose and each protecting the others.

Putting time on your side

This is all about putting time on your side. Kiplinger Retirement Planning has long described similar three-bucket setups for exactly this reason. When you match money to time, you trade prediction for preparation.

But markets aren't the only challenge — our own behavior can be as well. Money decisions are more than math; they're emotional.

With clear labels, you know what to spend now, what to protect and what to leave alone when headlines get loud. Morningstar's work on behavior gaps and its long-running bucket coverage points to the reality that clarity helps you stay disciplined when it matters most.

That structure is what turns a collection of accounts into a system. A prism doesn't change the light; it reveals its pattern. Your savings work the same way.

Organize your dollars into Blue (bills), Green (paycheck) and Red (growth), and your plan becomes easier to follow and harder to shake when markets move.

Ezra Byer contributed to this article.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Related Content

- The Retirement Bucket Rule: Your Guide to Fear-Free Spending

- Reduce Your Retirement Tax Risk With the Three-Bucket Strategy

- Secure Your Retirement Paycheck: The Power of Three Buckets

- The Big Red Bucket Theory: A Financial Adviser's Simple Way to Visualize Your Retirement Plan

- Kickstart Your 2026 Retirement Plan Now

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.