Saving for retirement should be a lifelong pursuit, but life happens, and recessions, inflation, health issues and salary constraints can hamper the ability to save early and consistently.

An AARP survey found that 20% of respondents aged 50 and over had no retirement savings. Over 50% of current retirees without savings cited everyday expenses as the financial obstacle that prevented them from saving adequately, followed by housing costs (34%), debt payments (31%), unexpected expenses (18%) and health care expenses (16%).

If you are wondering if you have enough saved or are close to the minimum needed to retire in your state, a recent study from GOBankingRates looks at the annual cost of living, your annual expenditures after Social Security, and most importantly, how much savings you need to retire in all 50 states.

You'll notice that the annual Social Security income is an average drawn from SSA data. If you want to go the extra mile and personalize the numbers, you can use your own SS income figures or estimate your benefits if you have yet to file for benefits.

The 30 states where you need the least savings to retire

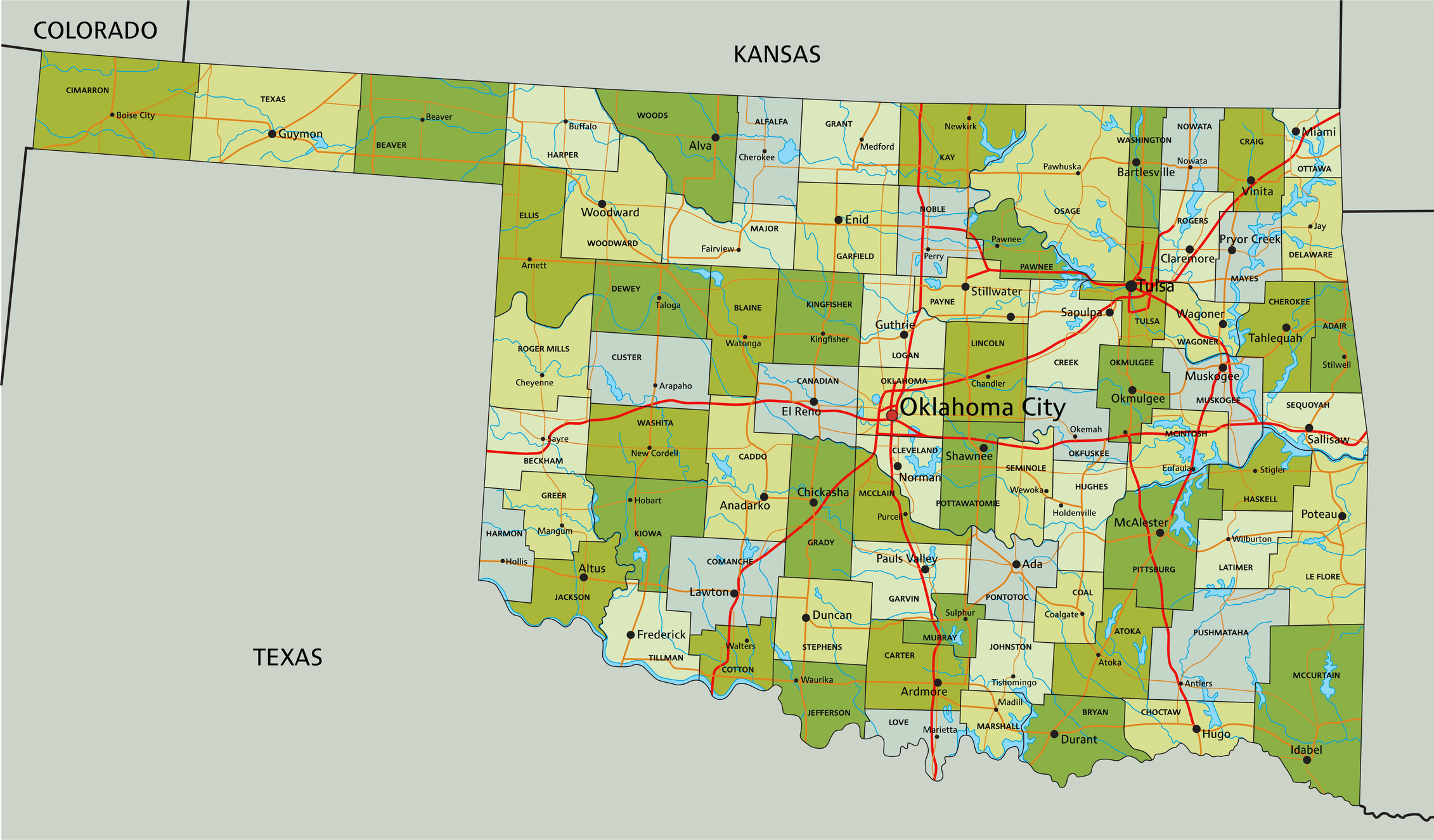

If you are low on savings or want a lower cost of living in retirement, you might want to consider states such as Oklahoma, Alabama, Arkansas, and Texas (4). Cities in these five states occupy ten slots on our list of the 15 Cheapest Places to Live: U.S. Cities Edition. Texas has four cities on the list and has no income, estate, or inheritance taxes; these factors helped make Texas the 10th most tax-friendly state for retirees. The other three states have two cities each on the list.

The 10 states with the lowest savings needs are prominently featured on our list of the cheapest places to live. Cities such as Birmingham, AL, Knoxville, TN, and San Antonio, TX, are among the best places for renters to retire. They have quality hospitals and doctors, plenty of green space, and retiree-friendly amenities.

You might notice that Iowa and Tennessee share the same numbers for expenses and savings needs. That doesn’t mean underlying costs are comparable. For example, the average price of a home in Tennessee is $394,900, which is $156,000 more than in Ohio, where the average cost is only $238,900. Both Tennessee and Iowa are on Kiplinger's list of the top 10 tax-friendly states for retirees, and both states lack an estate or inheritance tax. The stark difference is that Iowa has a state income tax, and Tennessee does not. That also means Tennessee has different revenue sources; in this case, that includes sales taxes on groceries and prescription drugs.

State |

Savings Needed to Retire |

Annual cost of living (total expenditures): |

Annual Social Security income: |

Annual expenditures after Social Security: |

1- Oklahoma |

$735,284 |

$51,848.61 |

$22,437.24 |

$29,411.37 |

2- Mississippi |

$752,178 |

$52,524.36 |

$22,437.24 |

$30,087.12 |

3- Alabama |

$789,037 |

$53,998.73 |

$22,437.24 |

$31,561.49 |

4- West Virginia |

$792,109 |

$54,121.59 |

$22,437.24 |

$31,684.35 |

5- Kansas |

$804,395 |

$54,613.05 |

$22,437.24 |

$32,175.81 |

6- Missouri |

$805,931 |

$54,674.48 |

$22,437.24 |

$32,237.24 |

7- Arkansas |

$810,358 |

$54,858.78 |

$22,437.24 |

$32,421.54 |

8- Tennessee |

$825,896 |

$55,473.10 |

$22,437.24 |

$33,035.86 |

9- Iowa |

$825,896 |

$55,473.10 |

$22,437.24 |

$33,035.86 |

10- Indiana |

$830,504 |

$55,657.39 |

$22,437.24 |

$33,220.15 |

11- Texas |

$833,575 |

$55,780.26 |

$22,437.24 |

$33,343.02 |

12- North Dakota |

$841,254 |

$56,087.42 |

$22,437.24 |

$33,650.18 |

13- Nebraska |

$845,862 |

$56,271.71 |

$22,437.24 |

$33,834.47 |

14- Georgia |

$848,933 |

$56,394.58 |

$22,437.24 |

$33,957.34 |

15- South Dakota |

$848,933 |

$56,394.58 |

$22,437.24 |

$33,957.34 |

16- Kentucky |

$850,469 |

$56,456.01 |

$22,437.24 |

$34,018.77 |

17- New Mexico |

$859,684 |

$56,824.60 |

$22,437.24 |

$34,387.36 |

18- South Carolina |

$859,684 |

$56,824.60 |

$22,437.24 |

$34,387.36 |

19- Louisiana |

$862,756 |

$56,947.46 |

$22,437.24 |

$34,510.22 |

20- Ohio |

$864,291 |

$57,008.90 |

$22,437.24 |

$34,571.66 |

21- Minnesota |

$885,793 |

$57,868.94 |

$22,437.24 |

$35,431.70 |

22- Michigan |

$893,472 |

$58,176.10 |

$22,437.24 |

$35,783.86 |

23- Wyoming |

$902,686 |

$58,544.70 |

$22,437.24 |

$36,107.46 |

24- Illinois |

$911,901 |

$58,913.29 |

$22,437.24 |

$36,476.05 |

25- Pennsylvania |

$930,331 |

$59,650.47 |

$22,437.24 |

$37,213.23 |

26- North Carolina |

$934,938 |

$59,834.77 |

$22,437.24 |

$37,397.53 |

27- Wisconsin |

$939,546 |

$60,019.06 |

$22,437.24 |

$37,581.82 |

28- Nevada |

$953,368 |

$60,571.95 |

$22,437.24 |

$38,134.71 |

29- Idaho |

$959,511 |

$60,817.68 |

$22,437.24 |

$38,380.44 |

30- Utah |

$961,047 |

$60,879.11 |

$22,437.24 |

$38,441.87 |

The 20 states where you need the highest minimum savings to retire

The states with the highest minimum savings needed to retire are well known for their extraordinary cost of living. These states fill out our rankings and harbor the 15 most expensive cities to live in and the 15 most expensive housing markets in the country.

While it's no surprise that the Polynesian paradise of Hawaii has the highest annual cost of living for retirees, it also boasts the lowest property tax in the country, with an effective rate of 0.32% and an average yearly tax payment of $4,180.

California, Connecticut, Massachusetts, New Jersey, New York, Rhode Island, Montana, and Vermont are among the worst states to retire in for taxes, factoring in tax rates on retirement income and property tax bills. For instance, until recently, California was the only state that fully taxes military retirement pay. Starting with the 2025 tax year, retired military members can claim a tax exclusion of up to $20,000 of military retirement pay. This exclusion is limited to taxpayers with AGI up to $125,000 for single filers and up to $250,000 for joint filers.

Colorado, Connecticut, Rhode Island, Montana, and Vermont make up five of the eight states that still tax Social Security benefits. However, many of these states offer tax breaks on Social Security benefits if retirees meet the income requirements.

The contrast between the places with the lowest minimum savings needs, such as Oklahoma, and those with the highest minimum savings, such as Hawaii, is stark. Retirees in Hawaii require approximately $1.5 million more than in Oklahoma. Housing costs in Oklahoma City, Oklahoma, are 43.1% below average, while costs in Honolulu are 200.4% above average. Utilities are another example of where the states diverge on expenses. West Virginians pay 1% below the national average, and Hawaiians pay 94.4% above the national average.

State |

Savings Needed to Retire: |

Annual Cost of Living: |

Annual Social Security Income: |

Annual Expenditures (After SS): |

1- Hawaii |

$2,198,902 |

$110,393.30 |

$22,437.24 |

$87,956.06 |

2-Massachusetts |

$1,755,055 |

$92,639.46 |

$22,437.24 |

$70,202.22 |

3- California |

$1,538,508 |

$83,997.54 |

$22,437.24 |

$61,540.30 |

4- Alaska |

$1,400,286 |

$78,448.66 |

$22,437.24 |

$56,011.42 |

5- New York |

$1,383,392 |

$77,772.91 |

$22,437.24 |

$55,335.67 |

6- Maryland |

$1,265,135 |

$73,042.65 |

$22,437.24 |

$50,605.41 |

7- New Jersey |

$1,199,096 |

$70,401.07 |

$22,437.24 |

$47,963.83 |

8- Maine |

$1,192,953 |

$70,155.34 |

$22,437.24 |

$47,718.10 |

9- Connecticut |

$1,191,417 |

$70,093.91 |

$22,437.24 |

$47,656.67 |

10- Washington |

$1,188,345 |

$69,971.05 |

$22,437.24 |

$47,533.81 |

11- Vermont |

$1,185,274 |

$69,848.18 |

$22,437.24 |

$47,410.94 |

12- Rhode Island |

$1,180,666 |

$69,663.89 |

$22,437.24 |

$47,226.65 |

13- Oregon |

$1,156,093 |

$68,680.98 |

$22,437.24 |

$46,243.74 |

14- Montana |

$1,125,377 |

$67,452.34 |

$22,437.24 |

$45,015.10 |

15- New Hampshire |

$1,116,163 |

$67,083.74 |

$22,437.24 |

$44,646.50 |

16- Arizona |

$1,110,019 |

$66,838.02 |

$22,437.24 |

$44,400.78 |

17- Delaware |

$1,017,871 |

$63,152.10 |

$22,437.24 |

$40,714.86 |

18- Colorado |

$1,016,336 |

$63,090.66 |

$22,437.24 |

$40,653.42 |

19- Virginia |

$976,405 |

$61,493.43 |

$22,437.24 |

$39,056.19 |

20- Florida |

$967,190 |

$61,124.84 |

$22,437.24 |

$38,687.60 |

Americans are not saving enough

Saving enough for retirement can be a challenge, and many people are falling behind. The median retirement savings for those ages 54-64 is $185,000, and the average balance is $538,000. For those aged 65-74, the median retirement savings is $200,000, and the average is $609,000 according to The Federal Reserve Survey of Consumer Finances 2022.

Age group |

Median savings |

Average savings |

|---|---|---|

Under 35 |

$18,880 |

$49,130 |

35-44 |

$45,000 |

$141,520 |

45-54 |

$115,000 |

$313,220 |

55-64 |

$185,000 |

$537,560 |

65-74 |

$200,000 |

$609,230 |

When you look at all of the numbers, the average retiree will be dependent on Social Security to make ends meet. This is a dicey strategy as the Social Security trust fund will become insolvent in 2033. At that point, the fund's continuing income is expected to fund just 77% of scheduled benefits resulting in your benefits being reduced by 23%.

GOBankingRates Methodology: In order to find out exactly how much you need to retire in your state, GOBankingRates found the annual cost of living for a retired person in each state by multiplying the “65 year and older” expenditure data from the Bureau of Labor Statistics’ 2024 Consumer Expenditure Survey by each state’s cost-of-living index from the Missouri Economic Research and Information Center’s 2025 Q3 cost-of-living series. To find how much money a retired person would need to save, we divided each state’s estimated annual expenditures — minus the annual Social Security income, sourced from the Social Security Administration’s Monthly Statistical Snapshot (November 2025) — by .04, assuming drawing down savings by 4% each year to pay for living expenses. All data was collected on and is up to date as of Jan. 7, 2026.