There’s something about buying high-quality businesses in a tough market and PepsiCo (PEP) fits the bill.

The stock has been trading much better lately and now we’re starting to see further rotations into PepsiCo and its peers.

For instance, Coca-Cola (KO) shares have been trading much better, as both names are now at one-month highs.

At least so far this week, investment funds have been flowing out of tech — the market leader — and into other sectors, namely, energy and consumer staples.

DON'T MISS: Pepsi Has a Bold Plan to Take Down Coca-Cola

Investors could bemoan PepsiCo’s dividend, which pays a yield of just 2.56%. However, it’s hard to complain about its consistency. Last month, the firm gave a 10% boost to its quarterly payout, its 51st consecutive year of raising the dividend.

Analysts expect 4% to 5% annual revenue growth in 2023 and 2024, along with 7% to 9% earnings growth in those years. At a time where volatility is high and worries about the economy persist, a dependable business like PepsiCo’s is clearly in demand.

Now let’s look at the charts.

Trading PepsiCo Stock

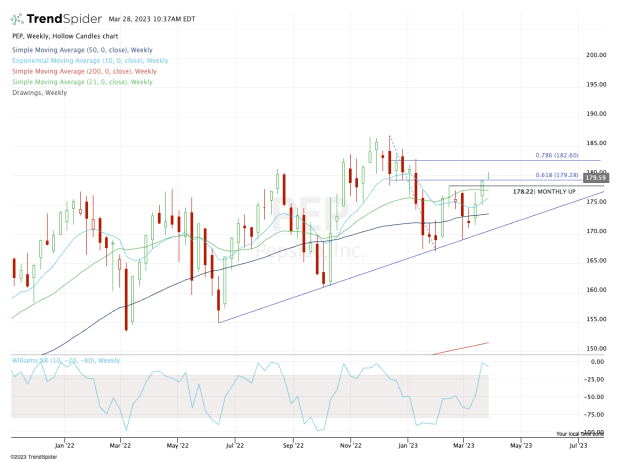

Chart courtesy of TrendSpider.com

As you can see on the weekly chart above, PepsiCo stock has done a good job of putting in a series of higher lows. That’s a bullish observation that allows an uptrend support level to form, which it has — as evidenced by the blue line above.

Also notice how PepsiCo is above all of its weekly moving averages. While not visible, it’s also above all of its daily moving averages as well, indicating strong bullish momentum in recent trading.

Don't Miss: GE Has Surged and Still Holds a Key Breakout Level. Here's the Trade.

From here, I would love to see PepsiCo stock hold up above the $177 to $179 area. That keeps the stock above the February high and a key breakout level, as well as the 61.8% retracement from the 2023 low to the 2022 high.

If that’s the case, it keeps the door open to the $182.50 area, which marks the 78.6% retracement. Above that and the $186 to $187 area is on the table. That’s where the prior high sits, at $186.84.

On the downside, bulls do not want to see PepsiCo stock lose the $177 level. If it does, the 50-day and 200-day moving averages are key to its short term support. Currently, those measures are near $174.