9 analysts have expressed a variety of opinions on Quanta Services (NYSE:PWR) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 2 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 2 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

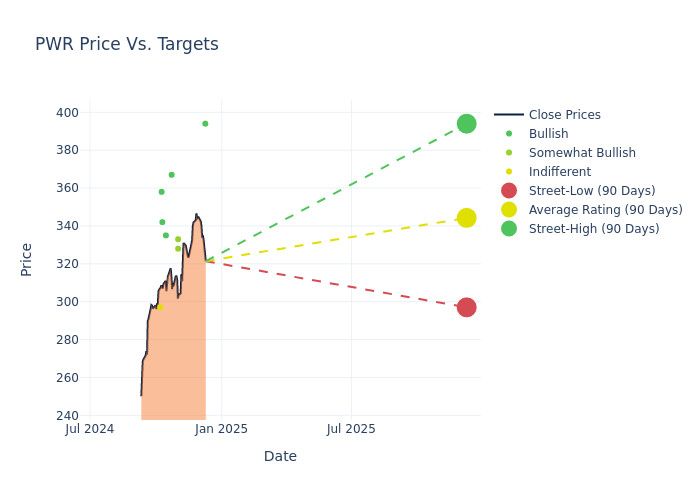

Analysts have recently evaluated Quanta Services and provided 12-month price targets. The average target is $344.67, accompanied by a high estimate of $394.00 and a low estimate of $297.00. Surpassing the previous average price target of $305.62, the current average has increased by 12.78%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A comprehensive examination of how financial experts perceive Quanta Services is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Kaplowitz | Citigroup | Raises | Buy | $394.00 | $348.00 |

| Gus Richard | Northland Capital Markets | Raises | Outperform | $328.00 | $280.00 |

| Andrew Wittmann | Baird | Raises | Outperform | $333.00 | $320.00 |

| Steven Fisher | UBS | Raises | Buy | $367.00 | $313.00 |

| Marc Bianchi | TD Cowen | Raises | Buy | $335.00 | $280.00 |

| Stanley Elliott | Stifel | Raises | Buy | $342.00 | $283.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $358.00 | $319.00 |

| Drew Chamberlain | JP Morgan | Announces | Neutral | $297.00 | - |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $348.00 | $302.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Quanta Services. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Quanta Services compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Quanta Services's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Quanta Services's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Quanta Services analyst ratings.

All You Need to Know About Quanta Services

Quanta Services is a leading provider of specialty contracting services, delivering comprehensive infrastructure solutions for the electric and gas utility, communications, pipeline, and energy industries in the United States, Canada, and Australia. Quanta reports its results under three reportable segments: electric power, renewables infrastructure, and underground utility and infrastructure.

Financial Milestones: Quanta Services's Journey

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Quanta Services's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 15.52% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Quanta Services's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 4.52%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.3%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Quanta Services's ROA stands out, surpassing industry averages. With an impressive ROA of 1.69%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.71.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.