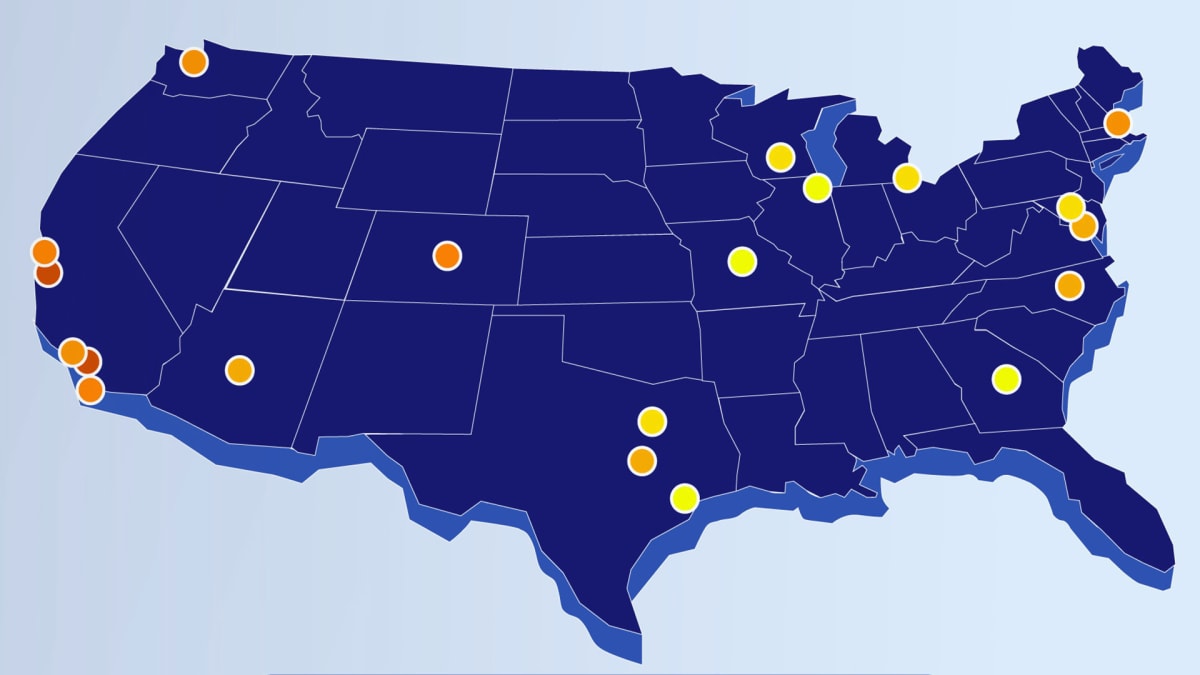

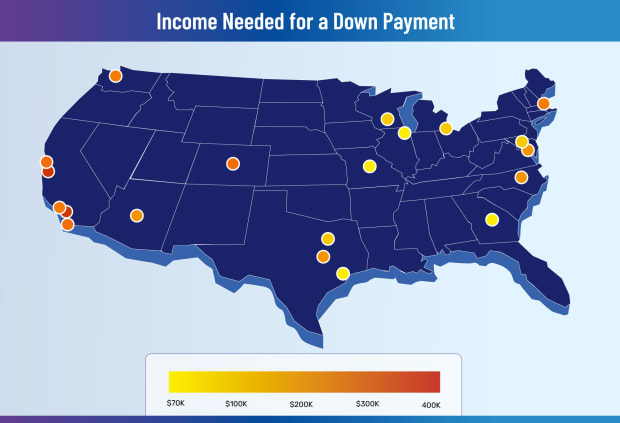

The Takeaway: You need less income to qualify for a mortgage in some places in the Midwest and the South than you do in the West. In general, a smaller down payment means a higher income requirement.

It's been another strange period for the housing market.

In the first quarter of 2023, home prices dropped in many areas but overall mortgage rates ticked up, tightening the financial squeeze on would-be homebuyers. It's not good news for sellers either. Many are feeling "locked in" to their low mortgage rate and have decided to put off listing their home until rates come down, adding salt to the inventory shortage wound.

DON'T MISS: The 10 Best U.S. Cities For High-Paying Jobs

Housing affordability has improved slightly since the end of last year, according to data from the National Association of Realtors (NAR). But the typical monthly payment of $1,859 on a 30-year, fixed-rate mortgage is still much higher than a year ago. In general, families typically spend just under 25% of their income on mortgage payments.

What Should My Income Be Before Buying a House?

Nearly 8 in 10 homebuyers in the U.S. finance their purchase. Lenders pay careful attention to a potential buyer's income when evaluating whether or not to extend a mortgage.

Most lenders prefer that a buyer spend no more than 28% of their monthly gross income on their monthly housing payment, which includes mortgage principal and interest payments, plus other recurring costs like homeowners insurance and mortgage insurance.

Since NAR doesn't track data on non-mortgage payments, like insurance, it assumes a lower debt-to-income ratio of 25% to calculate the minimum income a borrower would need to qualify for a mortgage in metropolitan areas.

NAR's latest report for the first quarter of 2023 revealed that a household would need a qualifying income of at least $100,000 to afford a 10% down payment mortgage in roughly one-third of the 222 U.S. markets it tracks.

National Association of Realtors

For a long time, the standard down payment for a conventional mortgage was assumed to be 20% of a home's purchase price. A down payment of at least that size means a buyer can avoid the added expense of private mortgage insurance. Putting down that much up front can also lead to a lower interest rate.

But the run-up in home prices has made it increasingly difficult for homebuyers to put 20% down, especially first-timers. For those who qualify for non-conventional loans from the Federal Housing Administration or VA, there's no requirement—and little incentive—to put down that much.

Today, the typical down payment among repeat homebuyers and first-time buyers, respectively, is 17% and 6%, according to NAR's annual Home Buyers and Sellers report.

How Much Income You Need to Buy a House, by City and Down Payment

Below, we've highlighted the income it takes to buy a house in some of the most desirable places to live.

The list is adapted from Niche's Best Places to Live in America ranking, which evaluates cities on overall "livability" using statistics related to the quality of local schools, crime rates, housing trends, and the labor market. We pulled NAR data for each city's corresponding metro area.

In the table below, you'll see the annual income you need to finance a typically priced home in each place with different down payments.