KEY POINTS

- The whale wallet first saw $141.2 million worth of $BTC on Sept. 6

- By Tuesday, Sept. 17, the wallet already accumulated over 23,000 Bitcoin

- Sani of TimechainIndex said the wallet may be linked to someone associated with Xapo Bank

Bitcoin whales have long been interesting members of the vast BTC community. Known for their enigmatic nature, the movements of these large Bitcoin holders often inspire discussion among smaller crypto users due to their large transactions.

Late on Tuesday, a new BTC whale was detected by HODL15Capital, a prominent pseudonymous investor whose charts and graphs are often cited by some of the financial industry's influential figures.

From 0 to $1.4B

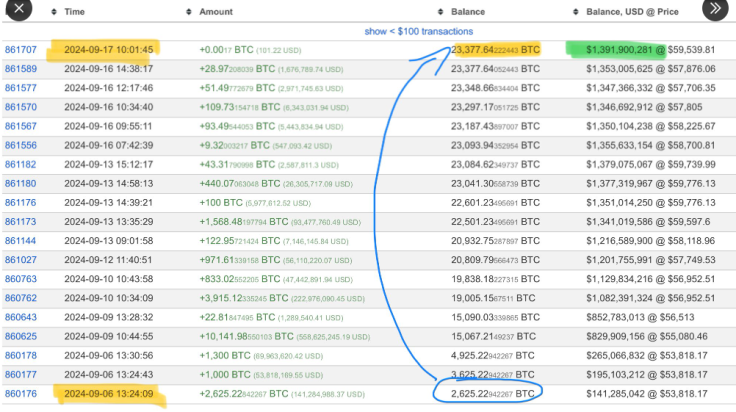

The new whale amassed a staggering $1.4 billion worth of Bitcoins in a matter of 10 days, HODL15Capital said. During the 10-day period, which started on Sept. 6, the whale gradually built momentum from the first purchase of 2,625.22 BTC worth over $141.2 million at the time.

Since then, the whale has been snapping up Bitcoins, on some days more than four times in a day. As of late Tuesday, the whale has accumulated over 23,377 BTC worth $1,391,900,281.

Who is this new whale?

Cryptocurrency users immediately huddled in the comments section of the post, guessing who the new whale could be.

Some users suggested it was Michael Dell, the CEO of tech infrastructure giant Dell Technologies, who has recently been raising speculation that he may have invested in Bitcoin. At least one user believes it is MicroStrategy executive chairman Michael Saylor's personal stash.

Nahuel, a user followed by HODL15Capital, said the Bitcoins were from crypto trust BitGo, Bitcoin private bank Xapo, crypto exchange giant Coinbase, defunct BTC exchange MtGox, and blockchain firm Galaxy Digital.

Sani, the founder of Bitcoin network tracker TimechainIndex, said some $16,000 of the funds "were received from addresses that received funds from Xapo Bank [a] few years ago." Sani also revealed that up to $7,000 on the whale's wallet was received from BitGo.

Around 16k of the funds were received from addresses that received funds from Xapo Bank few years ago, the remaining 6-7k were received from Bitgo.

— Sani | TimechainIndex.com (@SaniExp) September 18, 2024

I believe it is someone connected to Xapo Bank

Notably, Xapo Bank and Hilbert Capital jointly launched a Bitcoin yield hedge fund Monday. The fund was established with an initial investment of 3,000 BTC, worth around $175 million at the time.

Sani later said TimechainIndex was tracking $90,000 that "might belong" to someone "connected to" Xapo Bank. The Gibraltar-based bank has yet to deny or confirm the reports.

In the midst of a whale run?

News of the new whale's rise comes amid continuing BTC and broader crypto market volatility. The world's first decentralized digital asset has been on a wild ride in recent weeks and, as of early Wednesday, is struggling to climb above $60,000.

However, it appears that the whales are taking advantage of the volatile market. Ki Young Ju, the founder and CEO of blockchain analytics firm CryptoQuant, said early Wednesday that there have been "six days of accumulation alerts in a row."

Whales are accumulating #Bitcoin.

— Ki Young Ju (@ki_young_ju) September 18, 2024

Six days of accumulation alerts in a row. Primarily from custody wallet inflows.

Nothing has changed for Bitcoin; we're in the middle of the bull cycle. pic.twitter.com/DE0A1Khhus

He noted that most of the transactions from whales were from custody wallets. "Nothing has changed for Bitcoin; we're in the middle of the bull cycle," he added.

The accumulations also come as spot Bitcoin exchange-traded funds (ETFs) have logged positive inflows over the past four trading days, data from Farside Investors showed. On Tuesday, the funds hauled in $186.8 million, led by Fidelity's FBTC.