Ratings for VSE (NASDAQ:VSEC) were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

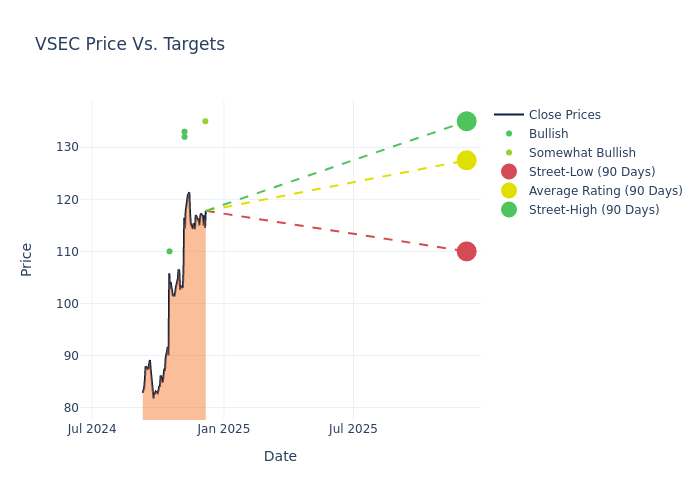

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $124.29, a high estimate of $135.00, and a low estimate of $110.00. Observing a 11.97% increase, the current average has risen from the previous average price target of $111.00.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of VSE by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ken Herbert | RBC Capital | Raises | Outperform | $135.00 | $125.00 |

| Jeff Van Sinderen | B. Riley Securities | Raises | Buy | $132.00 | $120.00 |

| Ken Herbert | RBC Capital | Raises | Outperform | $125.00 | $120.00 |

| Michael Ciarmoli | Truist Securities | Raises | Buy | $133.00 | $115.00 |

| Ken Herbert | RBC Capital | Raises | Outperform | $120.00 | $100.00 |

| Lavina Quadros | Jefferies | Raises | Buy | $110.00 | $100.00 |

| Michael Ciarmoli | Truist Securities | Raises | Buy | $115.00 | $97.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to VSE. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of VSE compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for VSE's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into VSE's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on VSE analyst ratings.

About VSE

VSE Corp is a diversified aftermarket products and services company providing repair services, parts distribution, logistics, supply chain management and consulting services for land, sea and air transportation assets to commercial and government markets. Its operations include supply chain management solutions, parts supply and distribution, and maintenance, repair and overhaul (MRO) services for vehicle fleet, aviation, maritime and other customers. Its reportable segments are; Aviation and Fleet. Majority of the revenue for the company is generated from the Aviation segment which is a provider of aftermarket parts distribution and MRO services for components and engine accessories supporting commercial, business and general aviation operators.

Breaking Down VSE's Financial Performance

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: VSE displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 18.27%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: VSE's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 4.26%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.48%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): VSE's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.79%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.61, VSE adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.