In the preceding three months, 7 analysts have released ratings for GXO Logistics (NYSE:GXO), presenting a wide array of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 1 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

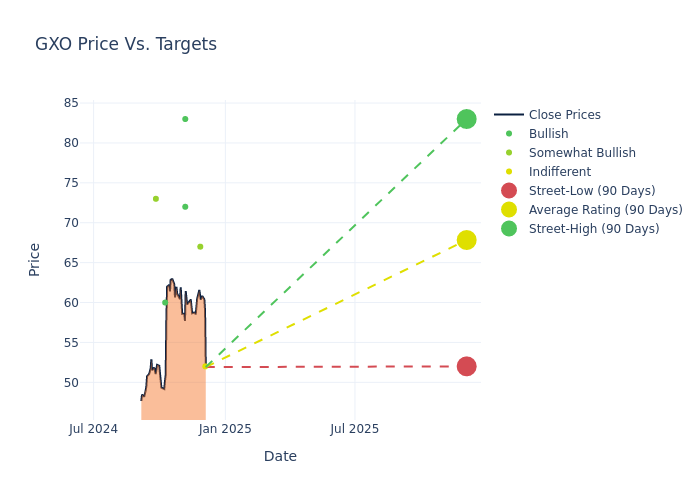

Analysts have recently evaluated GXO Logistics and provided 12-month price targets. The average target is $66.71, accompanied by a high estimate of $83.00 and a low estimate of $52.00. A 0.18% drop is evident in the current average compared to the previous average price target of $66.83.

Understanding Analyst Ratings: A Comprehensive Breakdown

A comprehensive examination of how financial experts perceive GXO Logistics is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon Oglenski | Barclays | Lowers | Equal-Weight | $52.00 | $60.00 |

| Scott Schneeberger | Oppenheimer | Raises | Outperform | $67.00 | $63.00 |

| Brandon Oglenski | Barclays | Raises | Equal-Weight | $60.00 | $55.00 |

| Thomas Wadewitz | UBS | Raises | Buy | $72.00 | $66.00 |

| Jason Seidl | TD Cowen | Raises | Buy | $83.00 | $82.00 |

| Ariel Rosa | Citigroup | Announces | Buy | $60.00 | - |

| Bascome Majors | Susquehanna | Lowers | Positive | $73.00 | $75.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to GXO Logistics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of GXO Logistics compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of GXO Logistics's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of GXO Logistics's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on GXO Logistics analyst ratings.

Discovering GXO Logistics: A Closer Look

GXO Logistics Inc is a contract logistics company. Its revenue is diversified across numerous verticals and customers, including many multinational corporations. It provides warehousing and distribution, order fulfillment, e-commerce, reverse logistics, and other supply chain services differentiated by its ability to deliver technology-enabled, customized solutions at scale. Geographically, it generates revenue from the United Kingdom, the United States, the Netherlands, France, Spain, Italy, and other countries, and derives the majority of its revenue from the United Kingdom.

Financial Insights: GXO Logistics

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: GXO Logistics displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 27.76%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: GXO Logistics's net margin excels beyond industry benchmarks, reaching 1.05%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): GXO Logistics's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.1%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): GXO Logistics's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.28%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: GXO Logistics's debt-to-equity ratio is below the industry average. With a ratio of 1.78, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.