Throughout the last three months, 39 analysts have evaluated Walmart (NYSE:WMT), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 13 | 25 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 8 | 15 | 1 | 0 | 0 |

| 2M Ago | 2 | 7 | 0 | 0 | 0 |

| 3M Ago | 3 | 2 | 0 | 0 | 0 |

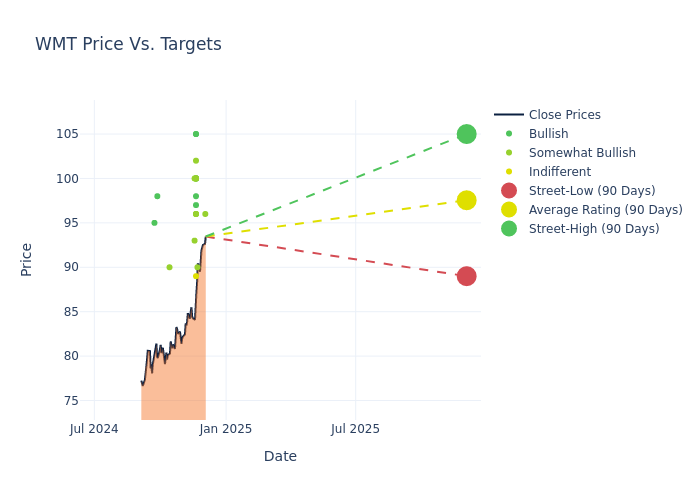

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $94.69, with a high estimate of $105.00 and a low estimate of $85.00. This current average has increased by 9.32% from the previous average price target of $86.62.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive Walmart is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Greg Melich | Evercore ISI Group | Raises | Outperform | $96.00 | $94.00 |

| Seth Sigman | Barclays | Raises | Overweight | $90.00 | $78.00 |

| Mark Astrachan | Stifel | Raises | Hold | $89.00 | $85.00 |

| Bill Kirk | Roth MKM | Raises | Buy | $97.00 | $81.00 |

| Simeon Gutman | Morgan Stanley | Raises | Overweight | $100.00 | $89.00 |

| Robert Ohmes | B of A Securities | Raises | Buy | $105.00 | $95.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $98.00 | $89.00 |

| Edward Kelly | Wells Fargo | Raises | Overweight | $96.00 | $90.00 |

| Greg Melich | Evercore ISI Group | Raises | Outperform | $94.00 | $89.00 |

| Michael Lasser | UBS | Raises | Buy | $100.00 | $92.00 |

| Dean Rosenblum | Bernstein | Raises | Outperform | $102.00 | $98.00 |

| Steven Shemesh | RBC Capital | Raises | Outperform | $96.00 | $92.00 |

| Robert Drbul | Guggenheim | Raises | Buy | $100.00 | $90.00 |

| Corey Tarlowe | Jefferies | Raises | Buy | $105.00 | $100.00 |

| Oliver Chen | TD Cowen | Raises | Buy | $100.00 | $90.00 |

| Bradley Thomas | Keybanc | Raises | Overweight | $96.00 | $88.00 |

| Peter Benedict | Baird | Raises | Outperform | $100.00 | $90.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $100.00 | $92.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $100.00 | $92.00 |

| Peter Keith | Piper Sandler | Raises | Overweight | $93.00 | $83.00 |

| Kelly Bania | BMO Capital | Raises | Outperform | $100.00 | $80.00 |

| Corey Tarlowe | Jefferies | Raises | Buy | $100.00 | $90.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $92.00 | $92.00 |

| Simeon Gutman | Morgan Stanley | Raises | Overweight | $89.00 | $82.00 |

| Bradley Thomas | Keybanc | Raises | Overweight | $88.00 | $87.00 |

| Edward Kelly | Wells Fargo | Raises | Overweight | $90.00 | $88.00 |

| Robert Drbul | Guggenheim | Raises | Buy | $90.00 | $81.00 |

| Bradley Thomas | Keybanc | Raises | Overweight | $87.00 | $86.00 |

| Greg Melich | Evercore ISI Group | Raises | Outperform | $85.00 | $82.00 |

| Dean Rosenblum | Bernstein | Announces | Outperform | $95.00 | - |

| Rupesh Parikh | Oppenheimer | Raises | Outperform | $90.00 | $81.00 |

| Bradley Thomas | Keybanc | Raises | Overweight | $86.00 | $82.00 |

| Michael Lasser | UBS | Raises | Buy | $92.00 | $81.00 |

| Joe Feldman | Telsey Advisory Group | Raises | Outperform | $92.00 | $82.00 |

| Peter Benedict | Baird | Raises | Outperform | $90.00 | $82.00 |

| Paul Lejuez | Citigroup | Raises | Buy | $98.00 | $75.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $89.00 | $76.00 |

| Karen Short | Melius Research | Announces | Buy | $95.00 | - |

| Edward Kelly | Wells Fargo | Raises | Overweight | $88.00 | $81.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Walmart. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Walmart compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Walmart's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Walmart's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Walmart analyst ratings.

Unveiling the Story Behind Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam's Club) and over 10,000 locations globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam's Club contributing another $86 billion to the company's top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Understanding the Numbers: Walmart's Finances

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Walmart's revenue growth over a period of 3 months has been noteworthy. As of 31 October, 2024, the company achieved a revenue growth rate of approximately 0.15%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: Walmart's net margin is impressive, surpassing industry averages. With a net margin of 2.7%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Walmart's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.31%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Walmart's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.77%, the company showcases efficient use of assets and strong financial health.

Debt Management: Walmart's debt-to-equity ratio is below the industry average. With a ratio of 0.7, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

.jpg?w=600)