During the last three months, 10 analysts shared their evaluations of ARM Holdings (NASDAQ:ARM), revealing diverse outlooks from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 1 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 4 | 1 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

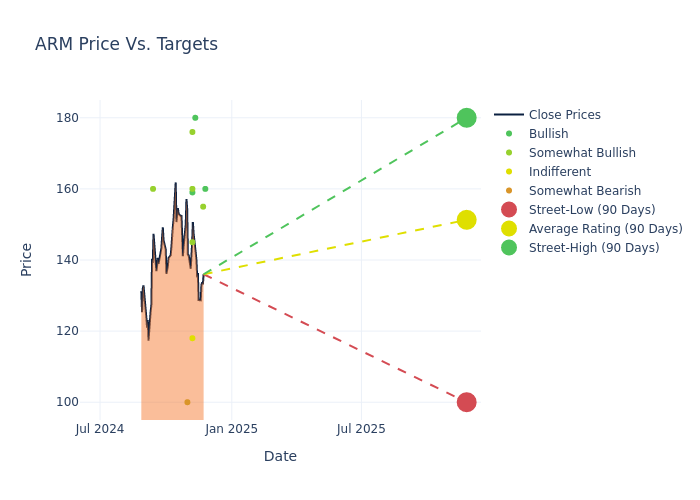

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $151.3, with a high estimate of $180.00 and a low estimate of $100.00. Observing a 14.25% increase, the current average has risen from the previous average price target of $132.43.

Interpreting Analyst Ratings: A Closer Look

A clear picture of ARM Holdings's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Timothy Arcuri | UBS | Announces | Buy | $160.00 | - |

| Joe Quatrochi | Wells Fargo | Announces | Overweight | $155.00 | - |

| Ananda Baruah | Loop Capital | Raises | Buy | $180.00 | $130.00 |

| Harlan Sur | JP Morgan | Raises | Overweight | $160.00 | $140.00 |

| Toshiya Hari | Goldman Sachs | Raises | Buy | $159.00 | $144.00 |

| Chris Rolland | Susquehanna | Raises | Neutral | $118.00 | $115.00 |

| Blayne Curtis | Barclays | Raises | Overweight | $145.00 | $125.00 |

| Mark Lipacis | Evercore ISI Group | Raises | Outperform | $176.00 | $173.00 |

| Sara Russo | Bernstein | Maintains | Underperform | $100.00 | $100.00 |

| Srini Pajjuri | Raymond James | Announces | Outperform | $160.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to ARM Holdings. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of ARM Holdings compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for ARM Holdings's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into ARM Holdings's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on ARM Holdings analyst ratings.

About ARM Holdings

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Financial Insights: ARM Holdings

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, ARM Holdings showcased positive performance, achieving a revenue growth rate of 4.71% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: ARM Holdings's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.68% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): ARM Holdings's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.83%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): ARM Holdings's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.34%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: ARM Holdings's debt-to-equity ratio is below the industry average at 0.04, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.