It’s a simple fact: Opportunities for accredited investors are more robust than those available to most retail investors.

Why? Because if you have the financial experience or the required funds to qualify as an accredited investor, the Securities and Exchange Commission (SEC) believes you’ve got what it takes to explore alternative investments and markets that might be too pricey and/or risky for the typical retail investor.

These accredited investor investments include commercial real estate, farmland, pre-IPO companies, private credit, and more.

The problem? While these accredited investor investment opportunities are exciting, it can be difficult to know where to get started.

If you want to know the best investments for accredited investors, you’re in the right place. Keep reading for a list of the 10 best platforms and opportunities for accredited investors.

At-a-Glance: The Best Accredited Investors Investments

|

Investment |

Accreditation required? |

Minimum to invest |

|

| Equitybee | Pre-IPO companies | Yes | $10,000 |

| Yieldstreet | Real estate + alternative investments | Primarily accredited |

Typically $10,000

(Varies) |

| AcreTrader | Farmland | Yes | $10,000 |

| EquityMultiple | Commercial real estate | Yes | $5,000 |

| CrowdStreet | Commercial real estate | Yes | Varies |

| RealtyMogul | Commercial real estate | Primarily accredited | $5,000 for REITs, varies for direct real estate investments |

| Percent | Private credit | Yes | $500 |

| Masterworks | Art + collectibles | No | $10,000 |

| Vinovest | Wine | No | $1,000 |

| Arrived | Residential real estate | No | $100 |

10 Top Picks: Best Investment Opportunities for Accredited Investors

We’ll get to the list of the best investments for accredited investors in a minute. But first, let’s make sure we’re on the same page about what an accredited investor is.

You can qualify as an accredited investor in one of two ways:

A) You have the right licensure — a Series 7, Series 65, or Series 82 FINRA license.

- B) You meet the financial criteria. Currently, that’s either a net worth of $1 million (excluding the value of your primary residence) or an annual income of $200K or more if filing taxes as a single person, or $300K if filing jointly

Note: These criteria are subject to change. Check out the SEC website for the most current information.

Whether you’re an accredited investor now or just want to be informed for when you are, here are the best accredited investor investments to consider:

1. Equitybee - Invest in Pre-IPO Companies

- Rating: 8/10

- Minimum to get started: $10,000

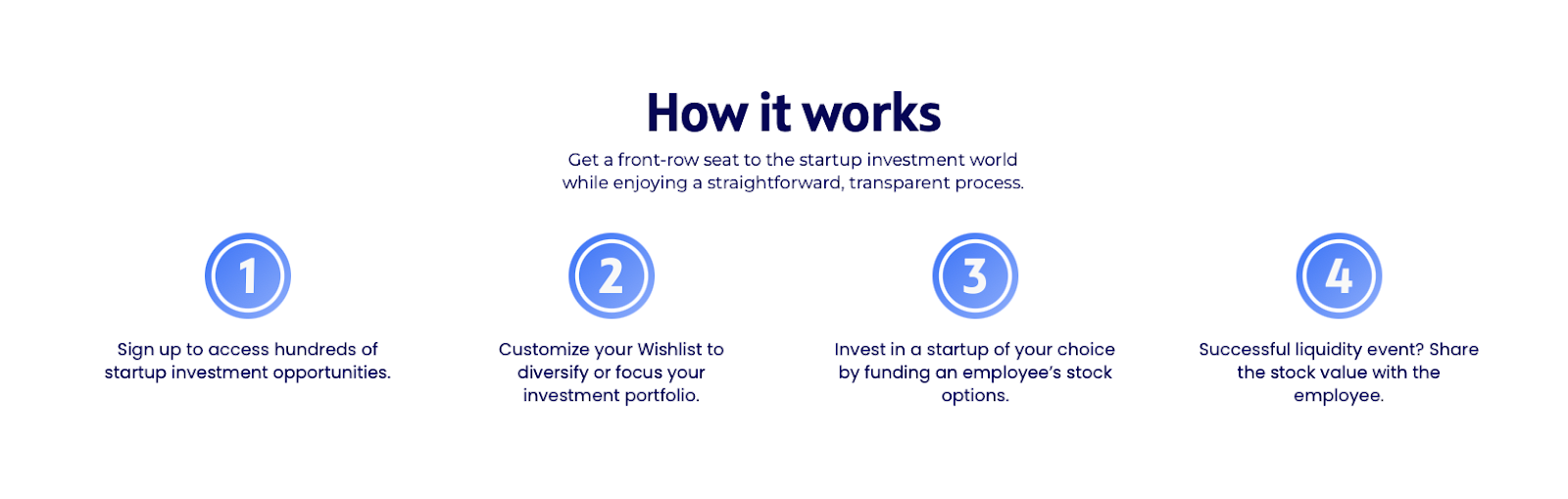

Equitybee offers accredited investors the opportunity to invest in companies before they go public. This means you don’t have to wait for a company to IPO to become a stakeholder. Cool, right? Here’s how it works…

(Source: Equitybee)

Once you’ve created an account, you can create a wishlist to focus on the types of companies you’re interested in. There are plenty of big-name (but still not public) companies currently available on Equitybee: Epic Games, Stripes, and Waymo, to name a few. Once you’ve chosen a company, you can fund an employee’s stock options through the platform.

Just like that, you’re a stakeholder. Now, when a successful liquidity event occurs, you’re entitled to a percentage of the proceeds.

In return for Equitybee’s matchmaking between investors and employees looking to fund their stock options, you’ll pay a platform fee of 5%, plus a small fee following the liquidity event in question. However, the ability to gain access to pre-IPO companies may be worth it for some investors.

2. Yieldstreet - Invest in Real Estate + Other Alternative Assets

- Rating: 8/10

- Minimum to get started: Ranges; typically $10,000

Yieldstreet is a great spot to diversify widely from a single platform. The “one-stop-shop” aspect alone might make it one of the top accredited investors’ investments, but there’s even more to like about the platform.

On Yieldstreet, as an accredited investor, you can invest in alternative investments that until recently were only available to institutional and/or connected investors, including but not limited to:

- Art

- Crypto

- Private credit

- Real estate

- Venture capital

(Yieldstreet also offers select investment funds to non-accredited investors too, including the YieldStreet Prism Fund, a bucket of assets including art, commercial real estate, and more.)

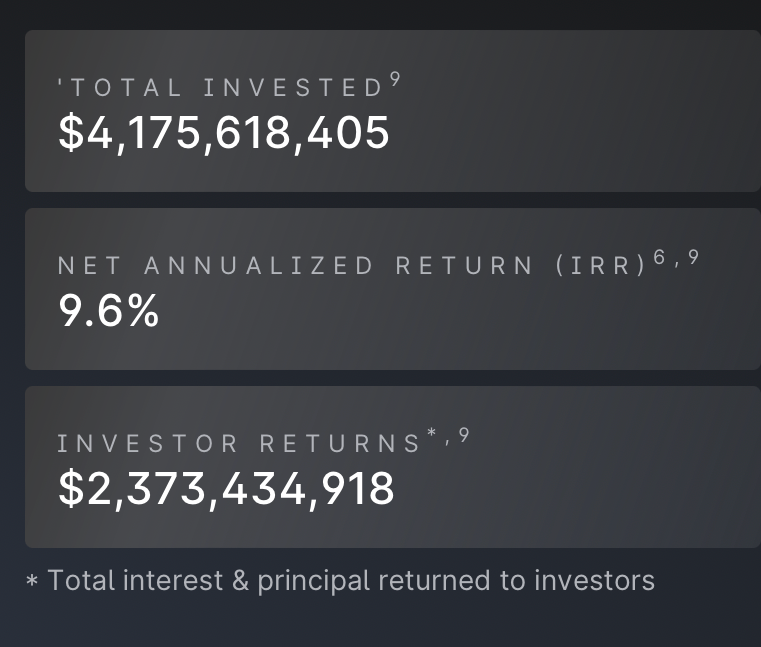

(Source: Yieldstreet)

As of Q1 2024, over $4.1 billion had been invested on Yieldstreet, and since its inception, it has delivered a 9.6% realized net annualized return on matured investments.

(Source: Yieldstreet)

3. AcreTrader - Farmland Investing, Tractor Not Required

- Rating: 8/10

- Minimum to get started: No lower than $10,000; most opportunities range between $15K and $40K

Wealthy investors frequently turn to farmland to diversify and build their portfolios. Why?

Well, consider this: Between 1992-2020, farmland returned 11% annually, and only experienced 6.9% volatility of return. Plus, it has a lower correlation to the stock market than most alternative assets.

You might not have the means (or the desire) to buy and run a full-blown farm. But you can still benefit from farmland’s land appreciation and potential rental income by investing in a platform like AcreTrader.

(Source: AcreTrader)

AcreTrader is only available to accredited investors. The platform offers fractional farmland investing, so you can invest at a lower price than buying the land outright.

Here’s what’s great about the platform: AcreTrader does the heavy lifting for you. They carefully screen potential properties, and only move forward with about 5% of the potential investments they review. That means you can rest easy with the fact that they’ve done their due diligence. Plus, they do all the admin and external management.

In terms of how you get paid, AcreTrader disburses annual income to investors. According to their website, this has historically yielded 3-5% for lower-risk investments. However, there’s a potential for higher returns — over the past 20 years, U.S. farmland has offered over 12% returns on average.

4. EquityMultiple - Choose Your Own Commercial Real Estate Adventure

- Rating: 7/10

- Minimum to get started: $5,000

Until recently, private-market commercial real estate was only the domain of institutional investors. Retail investors (even accredited investors) didn’t have easy access. Thanks to platforms like EquityMultiple, that has changed.

EquityMultiple gives you access to both long-term and short-term real estate investments.

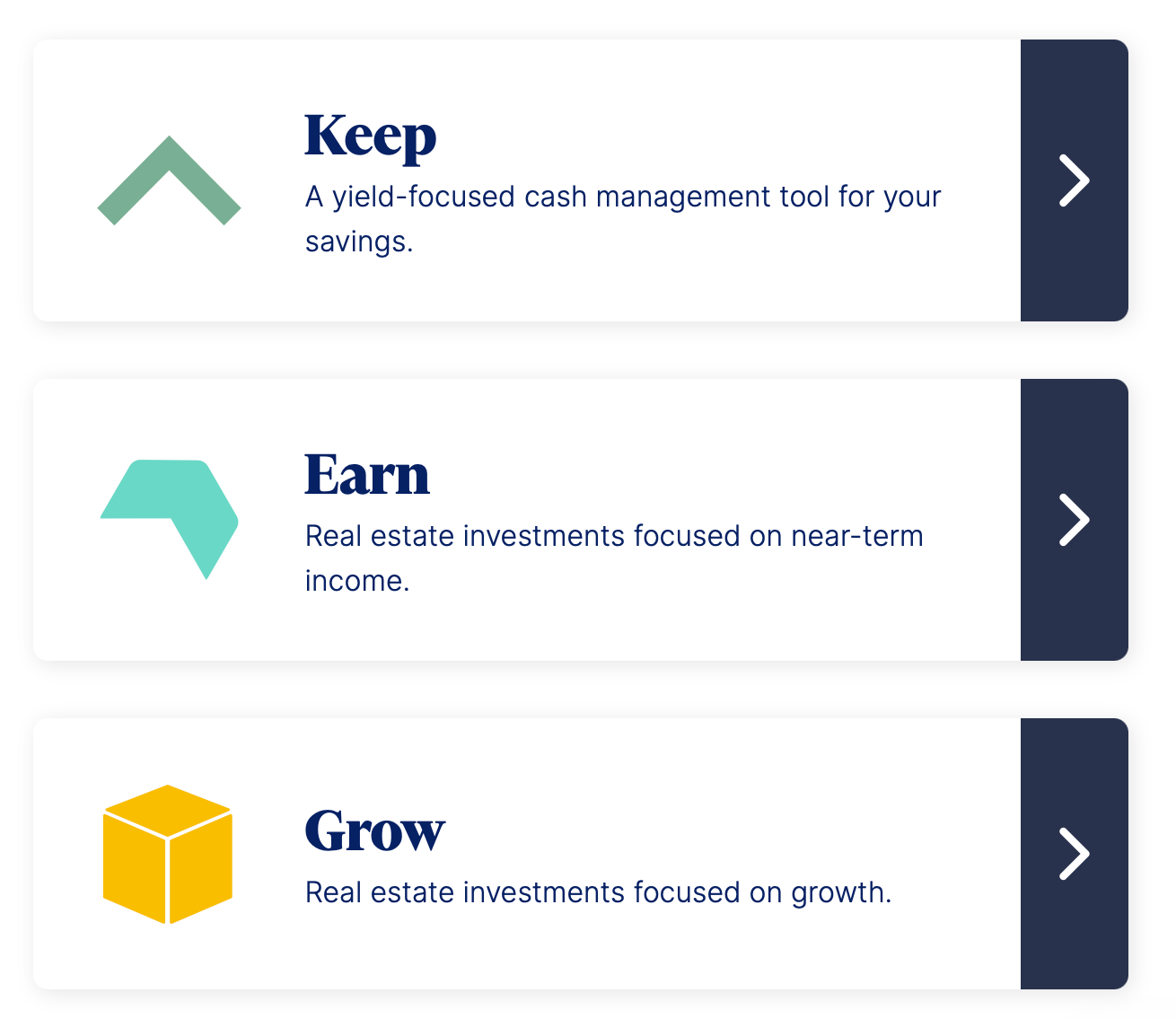

They divide their offerings into three categories:

(Source: EquityMultiple)

The first (“Keep”) is yield-focused cash management tools called “Alpine Notes” that give you access to credit investments.

Both “Earn” and “Grow” are more directly focused on real estate investments. The “Earn” opportunities offer near-term income and EquityMultiple’s site notes that they offer annual rates of return from 8-12%. (Once you’re a member, you can see their specific track record for the types of investments you’re most interested in.)

“Grow” investments give you access to high-upside, private-market real estate investments.

In both respective real estate categories, you’ll gain access to a wide array of property points and different entry points. While minimums start as low as $5k, it can go up from there.

Here’s something cool about EquityMultiple: Their asset managers can work with you to help guide you in the right direction and achieve the best outcomes for your capital.

5. CrowdStreet - Simplified Commercial Real Estate Investing

- Rating: 7/10

- Minimum to get started: $25,000 for most offerings

A veteran in the field (it’s been around since 2014), CrowdStreet is one of the more popular real estate investing sites for accredited investors. It’s constantly featured in “Best Real Estate Investing” roundups. It’s not hard to see why.

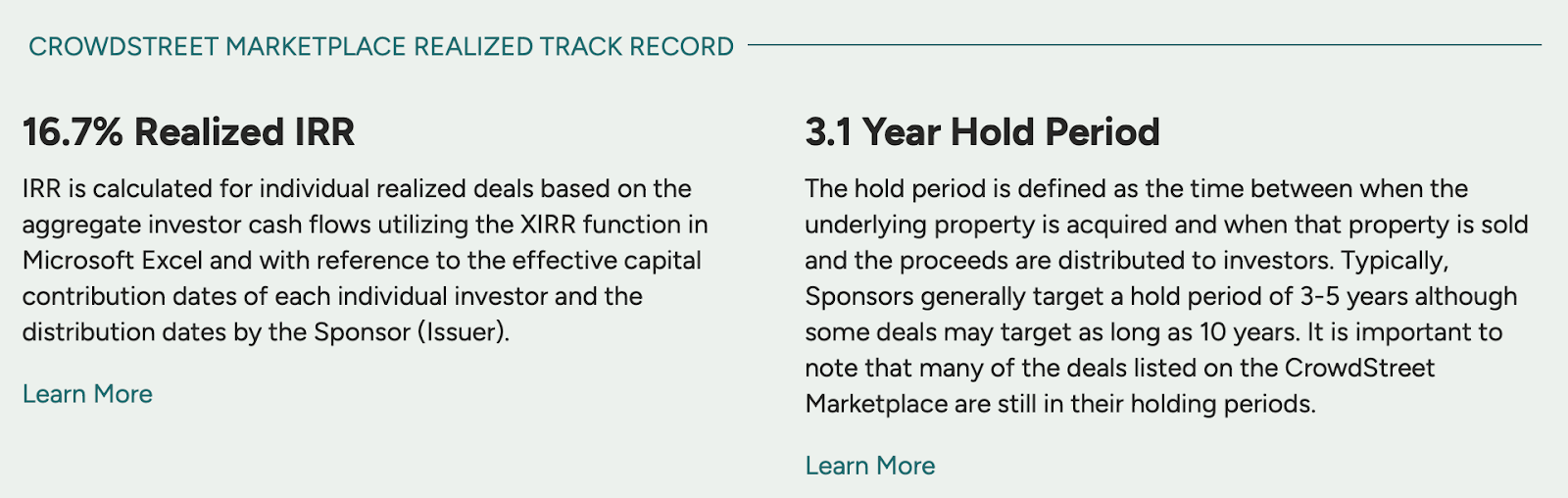

Let’s start with the money. As of February 2024, CrowdStreet has funded over 787 deals, a total of $4.3 billion invested. They boast a 16.7% realized IRR and an average hold period of 3.1 years.

(Source: CrowdStreet)

Next up, the projects. Once you’ve provided proof of accreditation and set up your account, you’ll gain access to the Marketplace, which features both equity and debt investment opportunities which might be multifamily properties or retail, office, or even land opportunities. The geographic regions are just as diverse as the projects.

Worth noting: While you don’t have to pay a fee to set up an account with CrowdStreet, you will have to pay fees to the sponsors for access to investment opportunities.

6. RealtyMogul - Gain Access to Commercial & Residential Real Estate

- Rating: 7/10

- Minimum to get started: $5,000

RealtyMogul allows investors to gain access to commercial and residential real estate properties through fractional real estate investing.

However, they go about it in a slightly different way than some of the platforms featured on this list. There are two roads you can go down…

(Source: RealtyMogul)

First, RealtyMogul has select offerings for accredited and non-accredited investors, namely private REITs (not traded on major exchanges). They operate similarly to REITs that you’d buy on a major exchange in that you receive dividends.

RealtyMogul offers two primary types of REITs for different investing styles — income-focused and growth-focused funds. To invest in these funds, the minimum is $5,000.

But if you’re an accredited investor, you have access to even more opportunities. You can also invest directly in LLCs that own commercial properties. Here, the minimums and time horizons will vary, though the RealtyMogul website quotes 3 to 7 years and $25K to $50K as averages.

The bottom line? The variety of assets and opportunities available on RealtyMogul, combined with the ability to “choose your own adventure,” makes it well worth checking out.

7. Percent - Gain Access to Private Credit Investing

- Rating: 7/10

- Minimum to get started: $500

Here’s an accredited investor investment opportunity you might not have considered: private credit.

Percent’s slogan is “Private credit investing. Simplified.” They deliver on that promise with an easy-to-navigate platform where you can find all sorts of private credit investments, like short-term business loans, cash advances for merchants, and more.

(Source: Percent)

Here’s how it works. Percent locates and does due diligence on loan originators. Then, as an investor, you invest in the portfolio of the loan originator through a special purpose vehicle, or SPV, which permits you to invest in the assets versus the company itself.

On Percent, you can also invest in the Percent Blended Note, or a fund of different credit offerings. It’s an easy way to diversify, but it does have higher minimums than some of the other opportunities on the platform.

By the way, the minimum for most opportunities on Percent is fairly small for this list — just $500. Plus, Percent also offers a sign-up bonus where you can earn up to $500 just for making your first investment. (Terms and conditions apply — see their website for details.)

As of February 2024, Percent has funded $988 million (since 2018) among 527 offerings and has offered a 13.41% weighted average APY. Pretty impressive when you consider investment vehicles like savings accounts are considered “high-yield” at 5% or so.

As for risk? There’s always risk, but Percent’s track record is pretty good — so far, they’ve only experienced a 1.97% default rate.

8. Masterworks - Invest in Art + Collectibles

- Rating: 7/10

- Minimum to get started: N/A

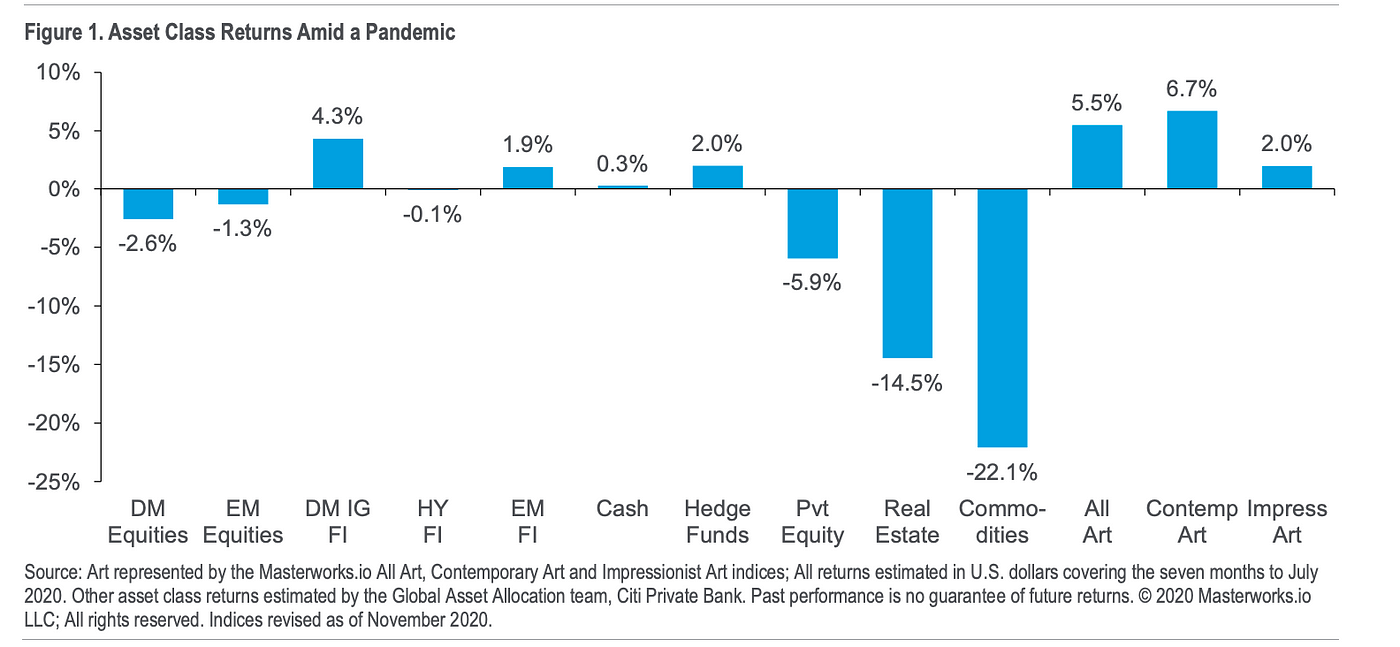

Haven’t considered investing in art and collectibles before? Maybe you should. After all, it’s asset class that tends to perform well, even when other asset classes are not:

(Source: Medium)

Masterworks is a top-rated platform for art investing that allows both accredited and non-accredited investors to invest in masterpieces by the likes of Andy Warhol, Banksy, and more.

As a platform, Masterworks is extremely user-friendly. Once you’re approved for an account, you can start browsing potential investments. You can both invest in the primary market and trade on the secondary market with other art investors.

Plus, Masterworks handles the acquisition, storage, insurance, and sales of the artwork. Then, if it sells for a profit, the proceeds are distributed among investors.

While Masterworks is not just for accredited investors, there is a waitlist — click below to explore more.

9. Vinovest - Become a Fine Wine Investor

- Rating: 7/10

- Minimum to get started: Varying tiers; managed accounts require a minimum deposit of $1,000

Love wine? Want to become a fine wine collector … But don’t have proper storage, or the right knowledge? These things no longer have to be deal breakers. Vinovest can give you entry.

Vinovest allows investors (accredited and non-accredited) to invest in a fine wine portfolio, and they leverage a global network of wine connections to get the best stuff at the best prices.

Typically, when you invest in one of their tiered programs, they’ll put together a portfolio for you within 2 to 3 weeks. Vinovest takes care of the insurance and storage, but the wine is yours.

From there, you can buy, sell, or trade on the secondary market. You can also request that bottles be sent to you if you feel like investing, you know, in your drinking pleasure.

(Source: Vinovest)

It’s pretty cool that Vinovest offers different levels of membership, which makes it accessible to newbie investors just dipping their toes in the world of wine collecting to more serious, high-level collectors and investors.

10. Arrived - Invest in Single-Family Homes

- Rating: 7/10

- Minimum to get started: $100

Even though Arrived is open to both accredited and non-accredited investors, it’s worth adding to the list because they offer something a little different than anything else we’ve featured so far.

Unlike the commercial-heavy real estate platforms featured earlier in this post, this platform gives you access to single-family properties. AKA, rentals. That is to say — you get the perks of being a landlord without the headaches.

While the platform is relatively new (debuted in 2021), it’s got some serious star power behind it — investors include Jeff Bezos of Amazon fame.

The process is pretty simple. Once you’ve created an account, you can browse and select properties, decide how much you’d like to invest, buy shares, and fund your investment. Then, you’ll receive quarterly dividends from rental income and appreciation If a property is sold after the investment hold period, investors can earn appreciation if the property value goes up.

So far, the returns look good for Arrived. As of February 2024, since its inception, it has attracted 572K investors, owns $128 million in property owned by investors, and has paid out $4.5 million in dividends.

Plus, Arrived has a stringent vetting process for choosing properties — they estimate that less than 0.2% of homes they review will pass their due diligence process. So you can rest assured that every property has been carefully reviewed.

Get Started With Arrived Homes

Conclusion: The Best Investments for Accredited Investors

Accredited investors’ investments have the potential for superior returns than most investment opportunities available to non-accredited retail investors.

But with these perks comes responsibility. It’s up to you to choose intelligent ways to diversify and invest intelligently so you can grow your money.

The platforms we’ve discussed are all well-reviewed and have solid track records. While it’s up to you to do your due diligence and decide the investing approach that will work best for you, this list of the best investments for accredited investors is a solid starting point on your accredited investor journey.

shares were trading at $506.19 per share on Tuesday afternoon, up $0.20 (+0.04%). Year-to-date, has gained 6.50%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Ryan Taylor

Ryan is a Property Financial Analyst and active real estate agent in Michigan. He has worked in the retirement industry for Voya Financial and Alerus Financial as a Retirement Analyst. Ryan holds a bachelor's degree in business from Ferris State University.

The 10 Best Investments for Accredited Investors: Opportunities + Platforms To Try StockNews.com