Investors in Tesla (TSLA) have quietly enjoyed recent trading, including Friday’s action with the shares up 3% on the day.

The Austin electric-car titan's shares are now up in four of the past five sessions and three of the past four. In that stretch we’ve seen a total rally of almost 18%.

And the shares now are testing into several key measures.

This week has been a decisive win for the bulls, after the shares gapped down on Tuesday following the company’s second-quarter delivery results.

That actually set up the bulls for a pretty good trade as Tesla held a key support level. What they really needed was a move back up through $700 -- and they got that on Thursday.

Tesla stock has continued to power higher all week, even though it’s no longer the world’s largest EV producer.

The move also comes as Ark Innovation Fund (ARKK) has continued to trade quite well over the past few sessions. Tesla is one of the largest components of ARKK.

Let’s look at the charts to see the new developments.

Trading Tesla Stock

Chart courtesy of TrendSpider.com

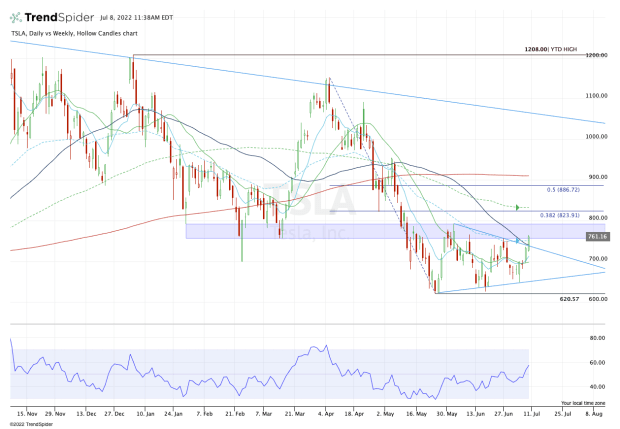

Once Tesla shares burst through $700, they also reclaimed the 10-day and 21-day moving averages. For short- and intermediate-term traders, this was an important development.

The move sent the shares to the 50-day and 10-week moving averages, as well as wedge resistance. Now it's pushing through them, and it's critical for Tesla to hold above these key measures.

Why? Because for a stock to reverse course, it needs to first reclaim a resistance measure and then use that measure as support.

It works for short-sellers, too, who look for a stock to first break below support, then find resistance at that level.

Tesla has now reclaimed these levels. So if it can go a step further and find the 10-week and the 50-day moving averages as support, the bulls can gain more momentum.

If the shares can close above $750, let’s see if they can push to the June high at $792.63. On a monthly-up rotation, it could put the 38.2% retracement in play near $825, along with the declining 21-week moving average.

On the downside, the bulls want to see Tesla stock hold the 50-day and 10-week moving averages as support. But they need $700 to hold, along with the 10-day and 21-day moving averages.

A break of all these measures will put uptrend support back in play (blue line).

The bottom line: Tesla stock can be a big driver, not just for ARKK but for sentiment as a whole.

If it can continue higher, it may bode well for stock-market bulls. But a breakdown would have the bears looking to regain momentum.