Tesla (TSLA) shares have been making waves as the company shakes up the electric-vehicle space.

Investors have been bidding up the stock as the leading EV company inked deals enabling owners of Ford (F) and General Motors (GM) vehicles to use the group's supercharger network.

That network has long been considered a major advantage for Tesla, and investors over the years had wondered whether the Austin EV maker would open it up to other automakers. That question has now been answered.

Don't Miss: Are Growth Stocks Back? Trading Cathie Wood's ARKK

Tesla shares climbed more than 4% on Friday and more than 14% last week. The move marked the stock’s fourth straight weekly gain and fifth weekly gain in the past six weeks.

Further, Tesla stock has finished higher in 16 of the past 18 sessions. And measured from the April low to the recent high, the shares have rallied more than 65%.

With that runup in mind, how should traders approach the stock?

Trading Tesla Stock

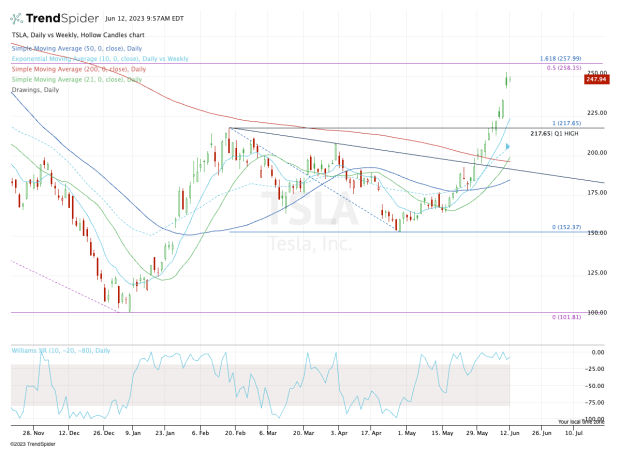

Chart courtesy of TrendSpider.com

The stock’s two down days in the past 18 trading sessions were declines of just 1.5% and 1.6%, respectively.

At a minimum, the bulls need to wait for some sort of pullback and/or consolidation.

Ideally, the bulls will see the stock find support at the rising 10-day moving average (or even sooner on a short-term time frame like the four-hour chart).

If the bulls are in active control of Tesla stock, they will defend short-term support levels such as the 10-day.

Given the potential for elevated volatility this week — with the CPI inflation report on Tuesday, the PPI inflation report and the Fed’s rate-hike decision on Wednesday, and the quarterly options expiration on Friday — we could see a deeper dip in Tesla stock.

With that perspective, the $210 to $217.50 area is one level that may not be hit soon but should be on investors’ radar.

This area marks the first-quarter high, while the 21-day and 10-week moving averages are near this zone, too.

It would mark a decline of about 15% from the recent high and mark a solid buying opportunity for the bulls.

Don't Miss: Small Caps Are Breaking Out. How Long Can Investors Ride the Wave?

On the upside, keep an eye on the $250 level. This level held Tesla stock in check on Friday and is doing so again on Monday.

But if the stock pushes through this level, the $258 mark is vital. Not only is that the 161.8% extension of the recent range, but it’s the 50% retracement of Tesla’s bear-market correction.

Long story short: Exercise a bit of caution with Tesla stock in the short term, while looking to buy the dip.