Electric vehicle stocks closed the week ending Sept. 17 on a mixed note, as investors reacted to the macroeconomic uncertainty that dragged the broader market lower, analysts’ actions, and a positive policy move.

Now, here are the key events that happened in the EV space during the week:

Tesla's Company Updates & Analysts' Actions: The cost of making a Tesla, Inc. (NASDAQ:TSLA) car has come down by about 57% between 2017 and now, with the improvement coming primarily from better vehicle design and new factory design, Martin Viecha, vice president of investor relations at Tesla, said in a tech conference, according to reports. The executive also confirmed that Tesla for the first time has access to all the battery cells it requires.

On the prospect of a cheaper EV down the line, he reportedly said one could be in the pipeline, although the focus is currently on the Model Y and Model X vehicles, which are seeing stronger-than-expected demand.

Tesla shares benefited this week from multiple positive analysts’ actions. Earlier this week, Needham analyst Vikram Bagri upgraded the shares from Underperform to Hold, citing a lack of any catalysts that could lead to underperformance in the near term. The analyst, however, remained wary of valuation.

Morgan Stanley’s Adam Jonas said the “Inflation Reduction Act” could provide a $10,000/unit boost, and therefore could be worth over $30 billion to the company, according to Investing.com. Deutsche Bank analyst Emmanuel Rosner raised his Tesla price target from $375 to $400, while maintaining a Buy rating, StreetInsider reported.

In another positive development, Tesla reduced the lead times for the delivery of its Model Y and Model 3 units in China to a minimum of a week, according to information on the company’s Chinese website. This apparently suggests the Giga Shanghai factory is up and running after the COVID-19 shutdowns in April and the renovation-related shutdown in July.

See also: Is Tesla The New Apple? Fund Manager Says Elon Musk's Company Will Be 'Much, Much Bigger’

Fisker A Buy At Needham: Fisker, Inc. (NYSE:FSR) received a bullish recommendation from Needham’s Vikram Bagri. The analyst appreciated the company’s asset-light manufacturing model and also pointed out that the stock trades at a discount.

Ford Asks Dealers To Upgrades To Sell EVs: Ford Motor Company’s (NYSE:F) CEO Jim Farley has asked the company’s dealers numbering about 3,000 to invest over $1 million for upgrades that would facilitate sales of EVs. The company is offering its dealers the option to become EV-certified, with investments of $500,000 or $1.2 million. Only those dealers which give a commitment toward the investment by Oct. 31 will be allowed to sell EVs, beginning in January 2024.

Nio Rolls Off Power Swap Station In Europe, XPeng G9 To Debut Next Week: Nio, Inc. (NYSE:NIO) announced that the first power swap station manufactured in Europe rolled of the production line in Hungary. The swap station would be shipped to Germany, it said.

Nio’s peer XPeng, Inc. (NYSE:XPEV) confirmed the schedule for the online event to launch its flagship G9 SUV.

Join XPENG G9 Launch Event!

— XPENG (@XPengMotors) September 17, 2022

We will be live from 7p.m. GMT+8 on September 21, 2022! 🎥 Save the date. https://t.co/d8Cvhvdyxz

Biden Kick-starts Charging Infrastructure Investment: The Biden administration announced this week a $900 million grant for building EV charging stations in 35 states, marking the first tranche of the funding approved under the “Inflation Reduction Act of 2022.”

“A nationwide charging network is a 'key missing piece in the puzzle' around longer-term EV initiatives within the U.S. for the Detroit 3,” said Wedbush analyst Daniel Ives in a note.

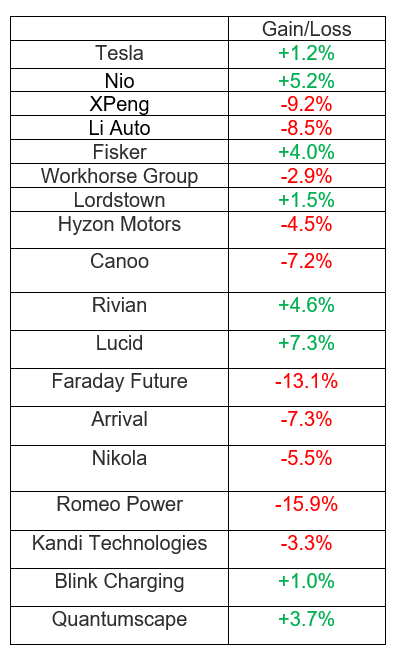

EV Stock Performances for The Week:

Photo: Created with an image from TED Conference on Flickr