Most electric vehicle stocks finished the week ending Aug. 5 higher, with the exception of industry giant Tesla, Inc. (NASDAQ:TSLA) and a handful of other companies. Stocks were reacting mostly to earnings news flow, tax credit proposals that are being discussed as part of a broader bill, and M&A news flow.

Here are the key events that happened in the EV space during the week:

Tesla’s Shareholder Meeting: Tesla conducted its annual shareholder meeting this week at its Giga Austin facility, which was held as a hybrid event. As expected, shareholders approved splitting the shares in the ratio of 3:1. The company later confirmed that the split will be implemented in the form of a stock dividend, payable on Aug. 24, to shareholders on record as of Aug. 17.

And there was no revolt, with shareholders voting mostly in line with the company’s recommendations.

Tesla CEO Elon Musk turned up and offered his thoughts and predictions on a host of topics, ranging from the company’s own product roadmap to inflation and recession. He continues to emphasize that the U.S. will undergo a shallow but prolonged recession that could last for 18 months.

He suggested that the company's full-self-driving software should be available by the end of the year to anyone who requests it in North America. Tesla’s production capacity will expand to 2 million units by the end of 2022, he added. He also hinted at the commencement of the production of the much-anticipated Cybertruck by the end of 2023. Volume production of the 4680 battery will likely start by the end of 2022, he added.

Separately, Tesla began deliveries of its Model Y SUV in Australia and New Zealand this week.

Related Link: Do Institutional Investors Love Tesla? Gary Black Weighs In

Toyota’s To Repurchase bZ4X EVs: Japanese auto giant Toyota Motor Corporation (NYSE:TM) is taking a step to please aggrieved customers affected by the June recall of its bZ4X EVs due to the likelihood of wheels falling off. The company’s U.S. unit is reportedly repurchasing the affected SUV, with the terms of purchase depending on the buyer’s state and particular circumstances.

Romeo In M&A Mix: Romeo Power, Inc. (NYSE:RMO) shares were on a tear after the embattled battery manufacturer announced a deal to be bought by heavy-duty, commercial EV maker Nikola Corporation (NASDAQ:NKLA) for 74 cents per share in stock. The penny stock rallied sharply to end the week over 60% higher.

Earnings Bring Down Lucid: Luxury EV maker Lucid Group, Inc. (NASDAQ:LCID), which was once touted as the “next Tesla” came up short in its second quarter, delivering merely 679 vehicles in the quarter and producing about 1,400 vehicles for the first half. More importantly, the company cut its forecast for 2022 in half. It now expects to produce 6,000 to 7,000 vehicles, down from 12,000 to 14,000 units it envisaged earlier. The company blamed it on “extraordinary supply chain and logistics challenges.”

Fisker Touts Strong Reservations: Fisker, Inc. (NYSE:FSR) investors heaved a sigh of relief as the company stuck with its timeline for the start of the production of its Ocean One SUV. Production will start as planned on Nov.18, the company confirmed. The company also said reservation numbers were buoyant at 56,000 units.

Related Link: Tesla Dominance Put To The Test: How EV Upstarts Lucid, Rivian, Fisker Stack Up In Q2 Results

Lordstown Sticks With Production Timeline: Lordstown Motors Corp. (NASDAQ:RIDE) reported its first-ever operating profit in the second quarter despite a lack of revenue. The company benefited from the gains on the sale of its Ohio facility to partner and Taiwanese contract manufacturer Hon Hai Precision Manufacturing Co. Ltd. (OTC:HNHPF). The company confirmed it would begin production of its Endurance pickup truck in the third quarter and begin deliveries by the end of the year.

EV Tax Credit Deal Could Go Through Senate: The Joe Biden administration’s ambitious Climate and Energy tax bill could be passed by the Senate as early as Sunday after Sen. Kyrsten Sinema (D-AZ), who was holding out, agreed to vote for the proposals, with some modifications. Proposals on clean energy are part of the bill.

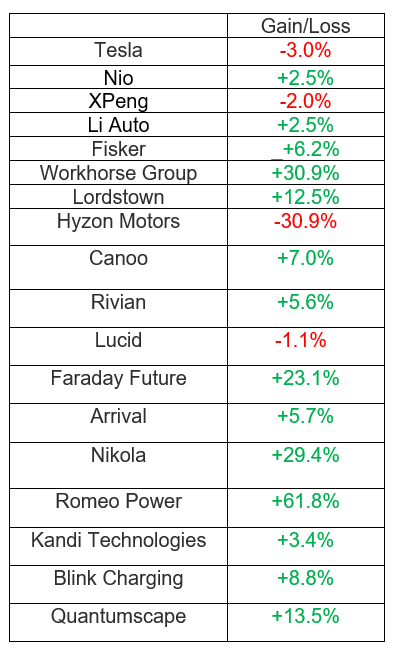

EV Stock Performances for The Week: