The good news is piling up for Tesla (TSLA) and its charismatic chief executive officer, Elon Musk. With few complaints from customers, the electric vehicle maker recently raised prices on its Model S sedans, Model X luxury SUVs, Model Y SUVs and Model 3 entry-level sedans to avoid eroding its margins in the face of soaring raw-materials prices.

The group has also officially opened its giant European factory near Berlin, where its production capacity should reach 500,000 vehicles a year.

And more is coming, industry sources say. Tesla is expected to open its second vehicle production gigafactory in the U.S. in April. This Austin factory could officially start manufacturing cars on April 7, TheStreet has reported.

If nothing changes, Tesla will have four gigafactories of EV development, enabling it to substantially increase production and meet demand. Its rivals, both legacy automakers (GM (GM), Ford, (F), Volkswagen (VLKAF) ) and newer players like Lucid (LCID), Rivian, Nikola (NKLA) or Fisker (FSR), are still groping in terms of production.

Tesla Again Is Valued at $1 Trillion

After producing nearly a million vehicles in 2021, Tesla is expected to produce around 1.42 million units in 2022, according to industry analysts. At this level, Musk's group should be consolidating its lead in what is considered the long-term future of the automotive industry. Political pressure to reduce CO2 emissions has never been so intense.

It is therefore no surprise that the group, founded in 2003 and listed on the stock market for the first time in 2011, has seen its share price surge in recent days.

The automaker's market capitalization has once again surged past $1 trillion.

On Wednesday, Tesla stock gained 0.5% and closed at $999.11, giving it a market capitalization of $1.03 trillion. Tesla therefore returns to the elite circle of companies that investors value at more than $1 trillion. This club has only six members, five of which are technology groups.

Apple (AAPL) ($2.77 trillion) retains the world's largest stock market capitalization, but its throne is threatened by the Saudi state oil group Saudi Aramco ($2.27 trillion), according to companiesmarketcap.com.

Microsoft (MSFT) ($2.24 trillion) is No. 3, followed by Alphabet (GOOGL) ($1.77 trillion) and Amazon (AMZN) ($1.66 trillion).

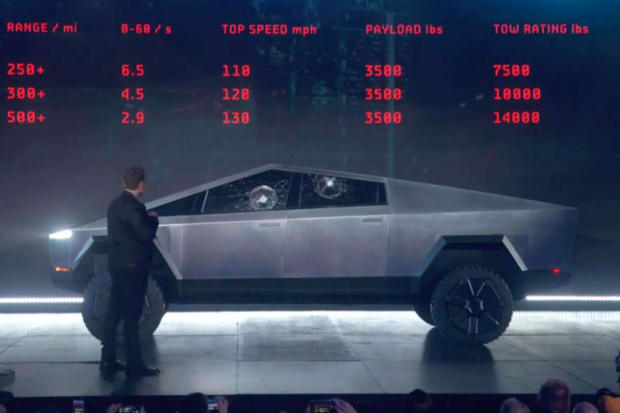

This isn't the first time Tesla has surpassed $1 trillion in market cap; it had happened last October and December. The valuation then took a hit, with investors disappointed that Tesla did not announce the launch of a low-end electric vehicle at $25,000 and that it postponed the production of its long-awaited futuristic cybertruck.

Tesla

On The Way to $2 Trillion?

A number of analysts have raised their outlooks on the company.

Goldman Sachs analyst Mark Delaney says investors must take into account the recent increase in the price of Tesla vehicles and the expected increase in production and sales volumes, a consequence of its "ability to navigate the supply chain, recent government approval for the new Berlin factory, and potentially higher demand for EVs following the rise in oil prices."

Wedbush analyst Dan Ives calls the opening of the Berlin plant a game-changer for Tesla.

"We view the opening of Giga Berlin as one of the biggest strategic endeavors for Tesla over the last decade and should further vault its market share within Europe over the coming years as more consumers aggressively head down the EV path," he wrote in a recent note.

He added that: " We cannot stress the production importance of Giga Berlin to the overall success of Tesla's footprint in Europe and globally, as the current Rubik's Cube logistics of producing cars in China at Giga Shanghai and delivering to customers throughout Europe was not a sustainable trend."

Tesla currently has four production sites: Fremont, Calif., Shanghai, Austin and Berlin. Until the opening of Berlin last Tuesday, only the first two were producing the cars the company currently sells.

Fremont hosts assembly lines for the Model S, Model X, Model Y and Model 3, while Shanghai produces only the Model 3 and Model Y.

The company also has a gigafactory in Nevada, which produces electric motors and lithium-ion battery packs for the Model 3 sedan, and a gigafactory in Buffalo, N.Y., focused on solar energy rather than EVs.