Electric vehicle stocks mostly declined in the week ending Nov. 4, as another big rate hike delivered by the Federal Reserve weighed on risk appetite. Market leader Tesla, Inc. (NASDAQ:TSLA) remained under pressure amid investor worry over Elon Musk’s divided attention following his Twitter buy.

Now, here are the key events that happened in the EV space during the week:

Tesla China Sales Slow: Data released by the China Passenger Car Association showed that Tesla’s China sales fell from 83,135 units in September to 71,704 units in October. This is despite the company slashing vehicle prices by 5% in late October. The company’s sales also paled before Warren Buffett-backed BYD Manufacturing Company Limited (OTC:BYDDY) (OTC:BYDDF), which reported battery EV sales of 103,157 units in October.

Among Chinese startups, Nio, Inc. (NYSE:NIO) and Li Auto, Inc. (NASDAQ:LI) reported year-over-year growth, although sequentially sales dropped. XPeng, Inc.’s (NYSE:XPEV) sales, meanwhile, were cut almost in half from a year ago. Nio said supply chain challenges in the wake of COVID-19 restrictions impacted production and the supply chain.

Saudi Arabia, Foxconn Partner: Saudi Arabia’s sovereign wealth fund has set up a joint venture with Hon Hai Precision Manufacturing Company Limited (OTC:HNHPF) to manufacture and sell EVs as part of its Vision 2030 goal of reducing its reliance on oil and diversifying its economy. The joint venture company, christened Ceer, plans to design, manufacture and sell a portfolio of EVs using BMW AG’s (OTC:BMWYY) component technology.

Nikola Reports Mixed Q3: Nikola Corporation (NASDAQ:NKLA) reported a narrower-than-expected third-quarter loss and above-consensus revenue. The company said it produced 75 Nikola Tre BEVs at its Coolidge, Arizona, plant and delivered 63 trucks to its dealers. The company, however, reduced its production outlook for 2022 from 300-500 trucks to 255-305 units, and did not give guidance for 2023, citing uncertainties.

Lucid To Unveil New Air Trims: Lucid Group, Inc. (NASDAQ:LCID) said it would unveil the Lucid Air Pure and Air Touring during an online global launch event on Nov. 15, at 1 p.m. EST. The unveiling will be preceded by the first Air Touring delivery that would happen at the company’s Beverly Hills Studio. The Air Pure and the Air Touring have starting prices of $87,400 and $107,400, respectively.

Fisker On Track: Fisker, Inc. (NYSE:FSR) confirmed that it would start production of its first EV model – the Ocean SUV, later this month. The vehicle has raked in reservations of over 62,000, the company said, adding it is targeting production of 42,400 units by the end of 2023. While the EV is being made in Austria by a unit of Magna International, Inc. (NYSE:MGA), the company is mulling plans to move manufacturing to the U.S. by 2025. The company, meanwhile, reported a wider loss for its third quarter.

Canoo Forays Into Battery Manufacturing: Cash-strapped Canoo Inc. (NASDAQ:GOEV) announced that it would set up a battery module manufacturing facility at MidAmerica Industrial Park in Pryor, Oklahoma. Once fully ramped up, the facility will be capable of producing about 3200 MWhs of battery module manufacturing capacity, it added.

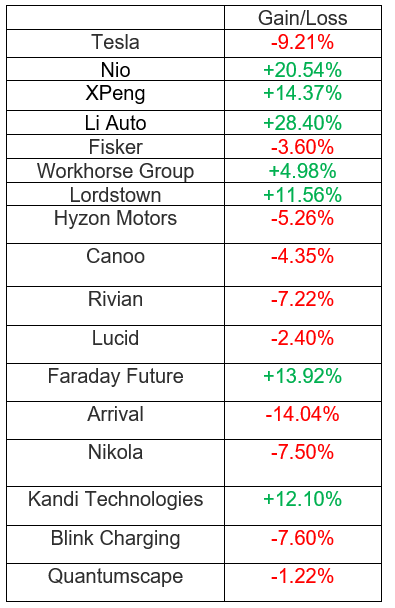

EV Stock Performances for The Week:

Read Next: : Best Electric Vehicle Stocks