Electric vehicle stocks came under selling pressure in the week ended Oct. 15, dragged by the broader market weakness. Market leader Tesla Inc. (NASDAQ:TSLA) continued to be punished by traders and has now lost about half of its market capitalization relative to the time the stock hit its record high in November.

Here are the key events that happened in the EV space during the week:

Tesla Stock Weakness Triggers Conversations: Tesla hit a split-adjusted historical high of $414.50 on Nov. 4 and has since then given back half of its gains.

Apart from the market-wide factors, the stock is also pressured by company-specific issues such as intensifying competition and CEO Elon Musk’s interest in Twitter Inc. (NYSE:TWTR). Investors are worried that a Twitter buy would need Musk to offload some of his stake in the company, potentially creating downward pressure on the stock. There are also worries that the billionaire’s focus on Tesla will be diluted if the deal goes through.

With the sell-off seen in the stock this year, analysts believe Tesla shares are trading at extremely oversold levels and tout an attractive valuation. The clamor for Tesla to initiate a buyback is growing louder, with Future Fund’s Gary Black urging the board in an open letter to go in for a $10 billion-plus buyback.

Tesla bull and Ark Invest founder Cathie Wood said in an interview this week that Tesla is a solution to the economy, adding that innovation will help solve problems with supply chain issues as well as food and energy crises.

Musk announced Tesla’s full-self-driving beta 10.69.3 would be released next week, with a previous communication from the CEO suggesting that the version will introduce major upgrades to Tesla’s autonomous software.

Tesla’s China sales steamrolled to a record high in September, according to data released by the industry body China Passenger Car Association. The company sold 83,1335 cars in the month, beating the previous record of 78,906 in August. The September tally comprised exports of 5,522 units and domestic sales of 77,938 vehicles.

Lucid Delivers In Q3: Luxury EV maker Lucid Group Inc. (NASDAQ:LCID) reported this week third-quarter production of 2,282 vehicles, keeping it on track to hit the year’s guidance of 6,000 and 7,000 units. The company had halved its 2022 production forecast in August, when it released its second-quarter results, citing supply chain constraints.

The company began delivering vehicles only a year back.

Canoo Bags Orders: Canoo Inc. (NASDAQ:GOEV) announced an agreement with fleet management company Zeeba to supply 5,450 of its EVs, with an initial commitment of 3,000 units through 2024. Zeeba is looking to buy Canoo’s Lifestyle delivery vehicles and lifestyle vehicles.

Nikola’s Trevor Found Guilty: Nikola Corporation (NASDAQ:NKLA) founder Trevor Milton was found guilty of two counts of wire fraud and one count of securities fraud. Although Milton was acquitted of a more serious securities fraud, he could still face a prison sentence that could run up to 20 years. He is due to be sentenced on Jan. 27.

Federal prosecutors had charged him with defrauding investors by lying about the capabilities of the company’s trucks and fueling infrastructure, in a bid to drive up the stock price.

GM Dips Toes Into Energy Storage Market: General Motors Company (NYSE:GM), which is striving to topple Tesla as the EV leader, said it is launching a new line-up of energy storage products for homeowners, businesses and utilities. These products will be manufactured under a new business unit called GM Energy and include stationary energy storage, solar through a partnership with SunPower Corporation (NYSE:SPWR) and bi-directional charging technology to deliver power from the vehicle to their home or to grid.

Read Next: Best Electric Vehicle Stocks

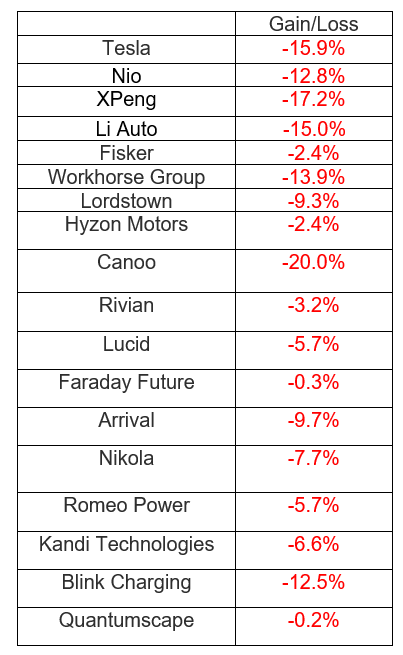

EV Stock Performances for The Week:

Photo: Clockwise from left: Courtesy Tesla; Nikola founder Trevor Milton, Miljøstiftelsen ZERO / Flickr Creative Commons; Courtesy Lucid