The Terra blockchain was halted for almost two hours today amid widespread turmoil in the cryptocurrency market, with investors challenging the presumed 1-to-1 pegs that underpin stablecoins.

- Driving the news: The blockchain runs the algorithmic stablecoin Terra USD, alongside its partner Luna, the governance token. Both coins have crashed in a dramatic fashion in the last few days, while another called Tether has also come under pressure.

Why it matters: Blockchains are intended to be decentralized, meaning that lots of people run them. It means that with many people across multiple locations, it's hard for those running them to even communicate. The chain stopping this suddenly, and without warning, suggests a high level of coordination.

- Underpinning blockchains is a notion of "trustlessness" enabled by decentralization. Bitcoin was built so people could transact without ever worrying about trusting anyone, even knowing that there are many sketchy actors on the network.

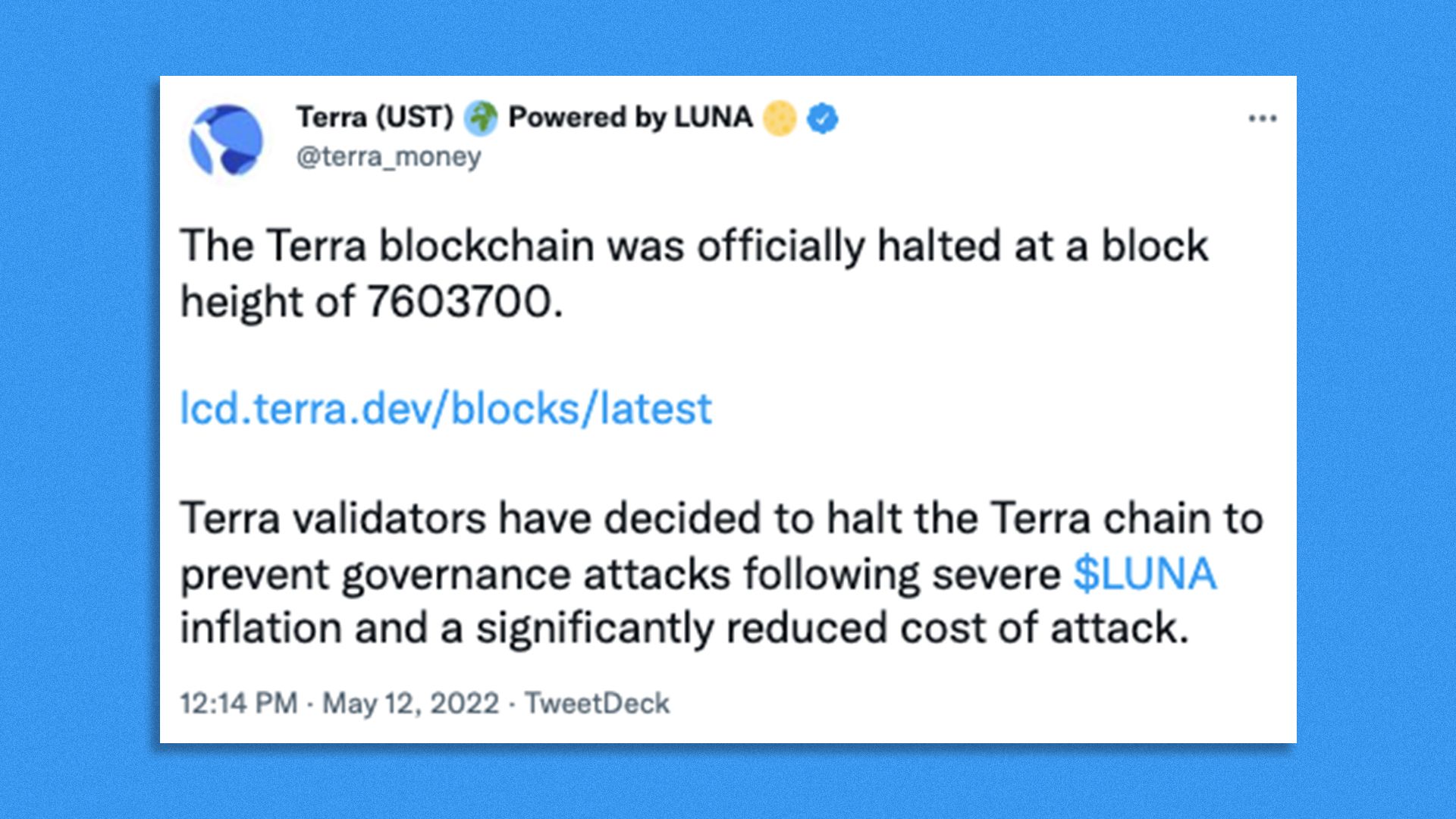

The latest: The official Terra Twitter account said that stoppage was opted for to prevent "governance attacks."

- Terra is governed by those who hold the Luna token.

- As of this writing, Luna is trading at around one penny, which puts the overall market cap at just under $60 million. That's down from around $30 billion at the start of May (yes, billion — not a typo).

- In other words, it's theoretically quite cheap to buy up lots of Luna, and then influence decisions on the platform.

- If someone really tried to buy half the supply of Luna, it would drive the price way up. Still, with the price that low, it's much easier to get a meaningful position.

Once the chain fully restarts, Luna holders will no longer be able to make new delegations of their coins. This means that the validators who were running the blockchain before it was halted should remain in that position, until delegations are reenabled.

- It essentially locks in the people that are in charge.

What they're saying: "Not sure it matters at this point either way," Michael Arrington of Arrington Capital, a fund that has both backed Terra and multiple applications built on the blockchain, told Axios via text message.

Of note: Staying live is crucial for decentralized finance applications. Most of them stay solvent by liquidating bad debt as soon as collateral loses value. With the blockchain shut down, it can't do that.

Our thought bubble: Such a chain stoppage will be hard to justify in the minds of most people in crypto. It is likely to be a cure much, much worse than the disease.

- That said, it probably won't be the end of Terra. EOS, an older blockchain that went live in 2018, has always been controlled by a small and well coordinated set of validators, and it has persisted.

What we're watching: Tokens on an exchange from a halted blockchain are sort of like a man in an international airport terminal whose country just evaporated.

- Even with the chain restarted, users might not have much faith in the coins any longer.

Terraform Labs, the company that built the Terra blockchain, was not immediately available for comment.