TelevisaUnivision reported a $52 million loss in the first quarter, up from $3 million a year ago, as the Spanish-language giant invested in its ViX streaming service and its third-party ad-sales business in Mexico.

Adjusted operating income before depreciation and amortization was $328.5 million, down 9%. Excluding a bad debt reversal from a year ago, operating income before depreciation and amortization (OIBDA) would have been down 5%, the company said.

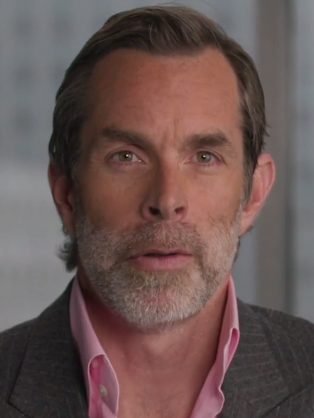

CEO Wade Davis said the company’s direct-to-consumer businesses, including ViX, is on track to turn profitable “in a few short months” and contribute to earnings in the second half of the year.

The company is planning to launch an ad-supported version of its premium ViX tier.

Revenue rose 7% to $1.1 billion, with growth coming from the company’s direct-to-consumer business globally and its linear networks in Mexico.

In the U.S. advertising revenue edged up to $399.4 million, with growth in streaming offsetting linear weakness. Subscription and licensing revenue was flat at $326.5 million.

“2024 started strong with great revenue growth and continued progress across our most important strategic initiatives,“ Davis said. “Our DTC business is performing extremely well and is on track to be profitable in a few short months.

“The U.S. and Mexico corridor, which is at the center of our massive global opportunity, continues to show remarkable strength with our Mexico business posting an exceptionally strong quarter, led by the advertising business,” he said. “Although we are only one quarter into the year, 2024 is shaping up to be a historic year for us as our audience is likely to be the deciding factor in the upcoming U.S. elections and we expect that to drive commensurate political ad revenue.”

The company also said it refinanced $340 million of its debt, which means none of its debt will mature until 2026.