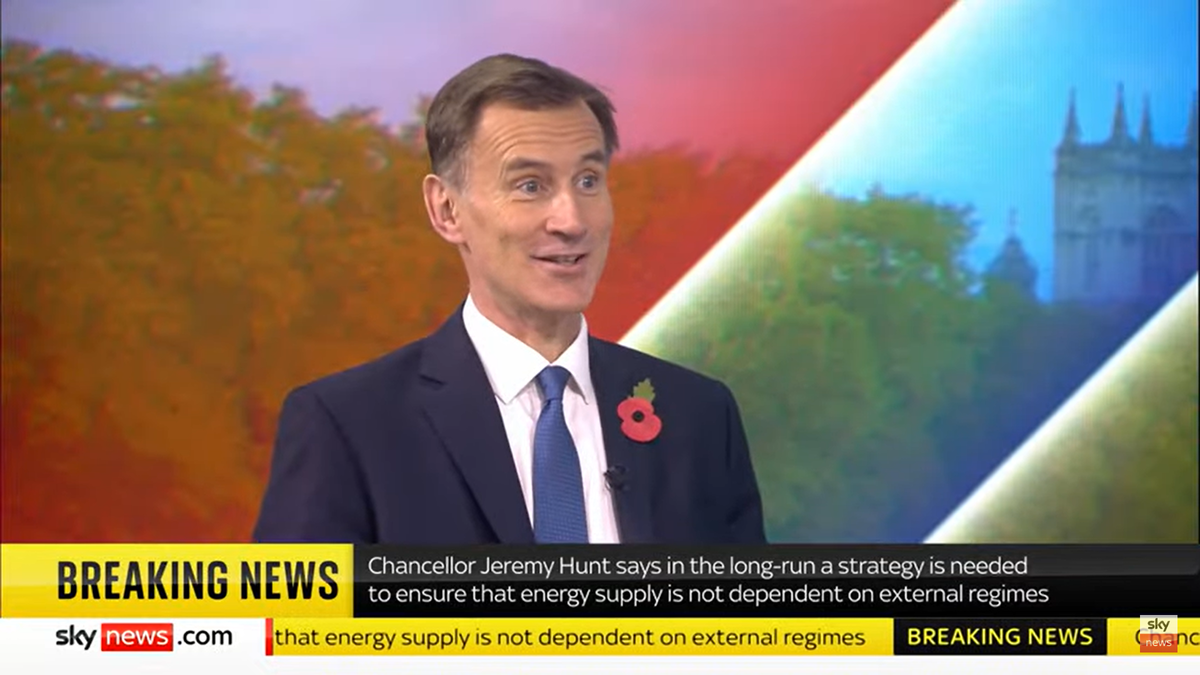

Chancellor Jeremy Hunt has confirmed that government support for energy bills will be targeted at the most vulnerable after April, in a move expected to cost millions of households hundreds of pounds.

And he said that “we are all going to be paying a bit more tax” after he sets out his tax and spend plans in Thursday’s Autumn Statement

Speaking days ahead of the crucial mini-Budget , Mr Hunt confirmed he expects the UK to plunge into recession and said his goal was to make it “as short and shallow as possible” by bearing down on inflation.

The chancellor confirmed his statement will include both tax rises and spending cuts to deal with the additional cost of energy, which he said was the equivalent of funding a second NHS each year.

And he said it will also feature “a long-term plan for clean energy, green energy and cheap energy” to ensure that the UK is never again at the mercy of international events like Russia’s war in Ukraine.

Speaking to Sky News’s Sunday with Sophy Ridge, Mr Hunt signalled that the government’s energy support plan – holding all households’ gas and electricity bills to an annual average of £2,500 for the six months to April at a cost of £60bn – is to be slashed back once the winter is over.

The statement will set out plans for “short-term support for people who need it, but also a long-term plan to really change our approach to energy”, he said.

Documents submitted to the Office for Budget Responsibility indicate that Mr Hunt intends to extend the scheme for a further six months at a considerably reduced cost of £20bn, according to The Sunday Times.

This could see the guarantee rising as high as £3,100, costing the average household an additional £600.

Mr Hunt said that his Autumn Statement package would mean everyone paying more tax, but pledged to ensure that the most vulnerable are protected.

“We will be asking everyone for sacrifices,” he told Sky News. “But in a fair society – as we are in the UK – there is only so much you can ask from people on the lowest incomes.”

He said his statement would show “compassion and support for the most vulnerable people”.

Mr Hunt insisted that Britain would get through the difficult period ahead, telling Sky: “There are going to be very difficult decisions, but we are a resilient country and we have faced much bigger challenges in our history.”

The chancellor is understood to be considering a package of £25bn worth of tax rises and £35bn of cuts to public spending to fill a gap of up to £60bn in the government’s finances.

He has indicated that this will mean tight settlements for unprotected Whitehall departments, and today said that NHS too will have to find “efficiencies”.

While acknowledging that NHS doctors and nurses are coming under “unbearable pressure”, he added: “There is a lot of money going into the NHS and ... in the context where funding for the NHS is going up, we need to do everything we can to find efficiencies”.

Mr Hunt told BBC1’s Laura Kuenssberg: “Schools, hospitals, all our public services are having to deal with the cost of inflation. What (they) will see is a govenremnt that has a plan to tackle the root cause of those pressures... which are the bills going up, the electricity bill going up, the gas bill going up.

“Whate we need to do is a combination of short-term support for people who are struggling - and absolutely schools and public services are in that category - but also a plan which says ‘This is how we are going to get through this’.”

The chancellor is also expected to extend a four-year freeze on income tax thresholds by two years, dragging millions more workers into higher rates. Similar freezes will increase bills for national insurance and inheritance tax.

And reports suggest he may reduce the threshold for the highest 45p rate from £150,000 to £125,000 and halve the tax-free allowance for capital gains tax in order to target some of the pain onto the wealthiest Britons.

The chancellor is expected to extend the windfall tax on North Sea oil and gas companies by two years to 2028.

He told Kuenssberg that a failure to take action to get the books into balance would mean soaring mortgages.

“If we do nothing, the Bank of England will then increase interest rates,” said Mr Hunt. “They have to do that constitutionally. It’s their job to bring down inflation.

“If we don’t help them with what we do as a government, they’ll have to take that pressure and we’ll see mortgage rates go up, interest rates go up and that will be damaging for families up and down the country.

“A dynamic economy needs low taxes and sound money. But sound money has to come first, because inflation eats away at the pound in your pocket and the pound in your bank account every bit as insidiously as taxes.”