/T_%20Rowe%20Price%20Group%20Inc_%20logo%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $20.3 billion, T. Rowe Price Group, Inc. (TROW) is a publicly owned global investment manager, serving individuals, institutions, retirement plans, and financial intermediaries worldwide. The firm manages equity and fixed-income mutual funds using fundamental and quantitative, bottom-up research approaches, with a strong focus on ESG investing and selective late-stage venture capital investments.

Shares of the Baltimore, Maryland-based company have underperformed the broader market over the past 52 weeks. TROW stock has decreased 12.6% over this time frame, while the broader S&P 500 Index ($SPX) has returned 12.5%. Moreover, shares of the company are down 8.5% on a YTD basis, compared to SPX’s marginal gain.

Focusing more closely, shares of the company have lagged behind the State Street Financial Select Sector SPDR ETF’s (XLF) slight rise over the past 52 weeks.

Shares of T. Rowe Price Group fell 5.5% on Feb. 4 after the company posted Q4 2025 results, with weaker-than-expected adjusted EPS of $2.44 and revenue of $1.93 billion. Investor sentiment was further pressured by net client outflows of $25.5 billion, including $23.2 billion in equity outflows. The selloff also reflected higher adjusted operating expenses of $1.25 billion, up from $1.13 billionB in Q3.

For the fiscal year ending in December 2026, analysts expect T. Rowe Price Group’s adjusted EPS to grow 3.8% year-over-year to $10.09. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

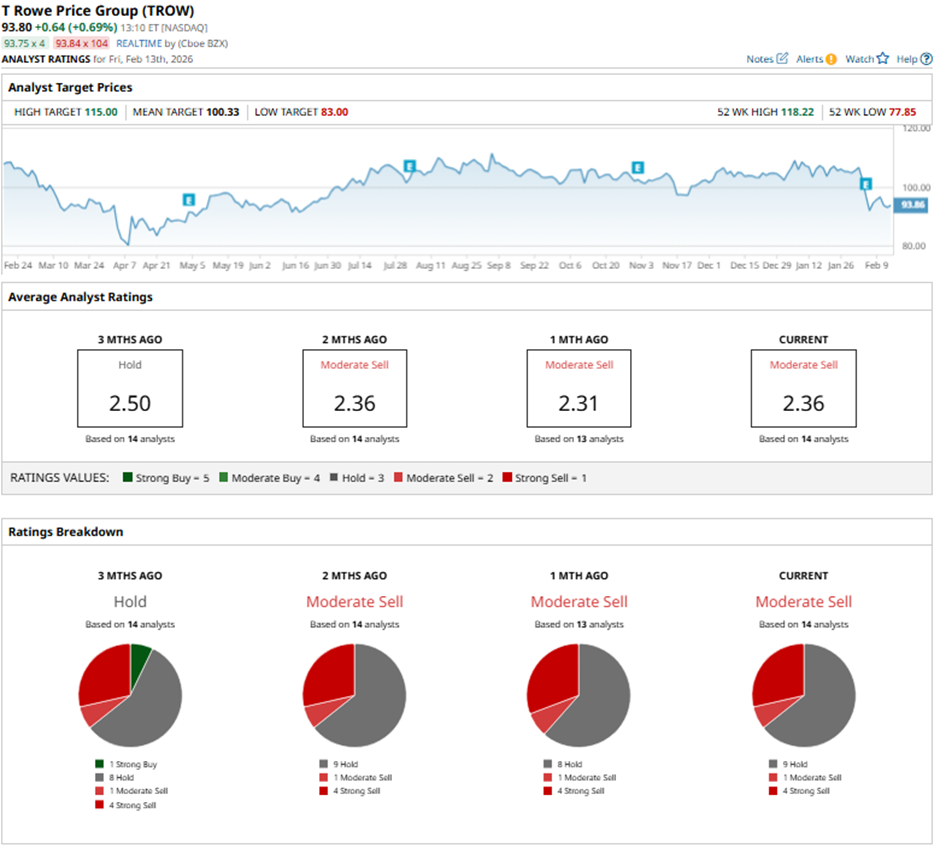

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Sell.” That’s based on nine “Hold” ratings, one “Moderate Sell,” and four “Strong Sells.”

On Feb. 10, Morgan Stanley cut its price target on T. Rowe Price Group to $115 while maintaining an “Equal Weight” rating.

The mean price target of $100.33 represents a nearly 7% premium to TROW’s current price levels. The Street-high price target of $115 suggests a 22.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.