Nearly 50 months after T-Mobile's controversial $26 billion acquisition of rival U.S. mobile network operator Sprint closed, the worst fears of critics have been realized -- American consumers are paying significantly more each month for wireless service.

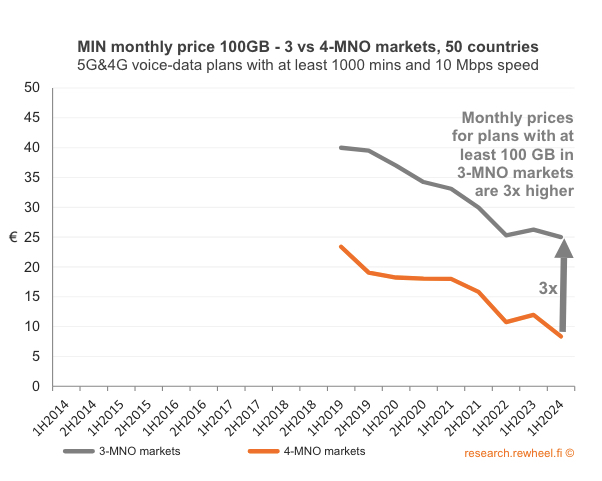

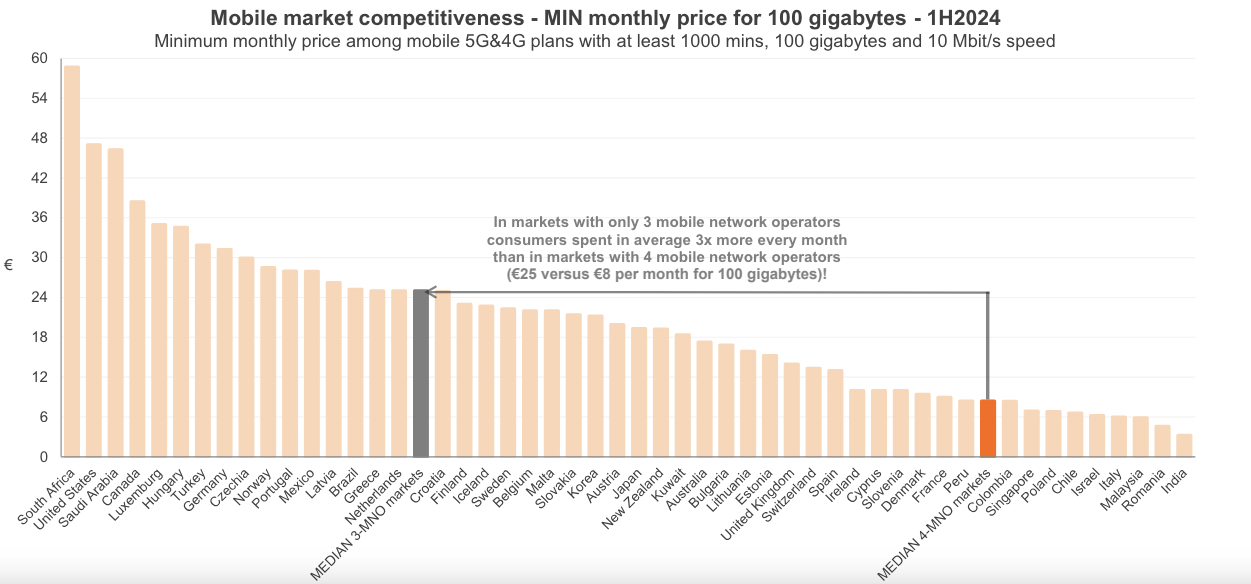

In a new report (first reported on in the U.S. by Light Reading), Finland's Rewheel Research claims that wireless markets with only three mobile network operators (MNOs) pay a lot more for wireless service vs. markets with four MNOs, as the U.S. once stood before T-Mobile gobbled up its No. 4 ranked rival.

For certain plans, Rewheel said that consumers in three-MNO markets pay as much as three times more each month.

"Five years on, the Sprint/T-Mobile 4-to-3 mobile merger made the U.S. one of the most expensive mobile markets in the world," Rewheel stated. "... After the merger prices in the U.S. either stopped falling altogether or fell at a much slower rate. The 4-to-3 mobile merger in the US led to higher prices and consumer harm."

Part of the Democratic minority on the FCC commission at the time regulators were reviewing T-Mobile's proposed M&A, current chair Jessica Rosenworcel argued to the Justice Department in 2019, "We've all seen what happens when markets become more concentrated after a merger like this one. In the airline industry, it brought us baggage fees and smaller seats. In the pharmaceutical industry, it led to a handful of drug companies raising the prices of lifesaving medications. There's no reason to think this time will be different."

For its part, the DOJ responded by engineering a provision ... that simply hasn't worked out.

In July 2019, the Justice Department agreed to settle a lawsuit over the merger by requiring T-Mobile and Sprint to divest certain assets, including the Boost Mobile and Virgin Mobile prepaid businesses, that would enable Dish Network to replace Sprint as America's fourth MNO.

These days, however, Dish and its parent company, EchoStar, appear significantly closer to entering bankruptcy court than they are finishing completion of a nationwide 5G wireless network and operating a full-fledged post-paid wireless business.