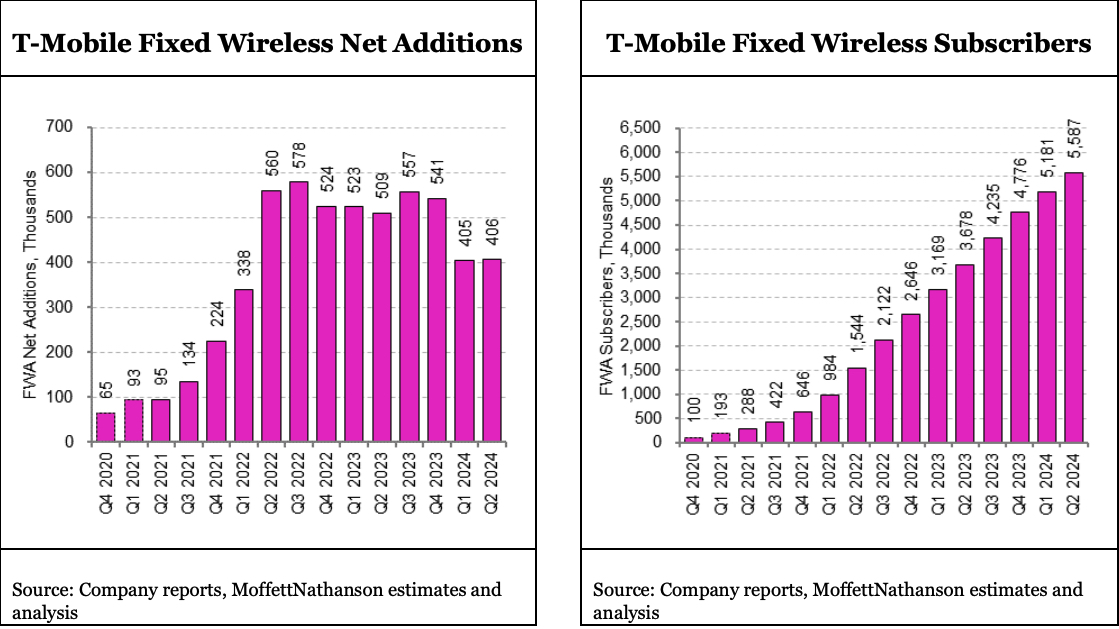

T-Mobile reported expansion of 406,000 fixed wireless access users in the second quarter, a 27% growth deceleration from the same April to June period of last year.

The result didn't surprise the investment community, with the wireless company, dating back to its launch of FWA service in 2021, predicting that it will only have network capacity to support 7 million to 8 million 5G Home Internet subscribers through 2025.

T-Mobile shares were up more than 3% as of this sentence typing.

Currently, T-Mobile’s FWA base stands at 5.587 million customers, which is well past the halfway point of its self-imposed ceiling.

The rapid proliferation of low-priced fixed wireless access (FWA) services has been a thorn in the side of cable operators, the biggest of which, Comcast and Charter Communications, both lost record numbers of cable broadband customers in Q2.

Also read: Charter Follows Comcast With Worst-Ever Broadband Quarter, Loses 149,000 Subscribers in Q2

But T-Mobile seems to view the FWA business as merely a transition tool, a gateway into the fiber-based home internet business and more broadly, a convergent future of packaging mobile and wireline internet service, just like the rest of its cable and wireless competitors.

Last week, T-Mobile announced it had entered into a joint venture with global investment firm KKR to buy residential fiber infrastructure company Metronet. This followed T-Mobile's investment of $950 million in April in another joint venture, this one with Swedish investment firm EQT, to buy 50% of fiber network provider Lumos.

The two investments will result in T-Mobile reaching around 10 million homes with fiber by 2030, T-Mobile said Wednesday.

Responding to a question about the company’s “convergence strategy” from analyst Craig Moffett, T-Mobile CEO Mike Sievert said he and his teammates are “not believers” in the phrase “convergence” per se, but he seems to like where the basic concept is headed.

“That being said, convergence is real in that the customers that buy both buy them together, and we have bundles today,” he added. “Many of our 5.6 million broadband customers today purchase that in a bundle and realize discounts by doing so.”

Also read: Dumb in Dallas? AT&T Keeps Pushing a ‘Convergence’ Advantage It Simply Does Not Have

For his part, Moffett has been critical of AT&T's convergence strategy, noting that since the telecom only has fiber in 12% of U.S. homes, it can’t effectively market a combined offering.

For the “mathematically inclined,” Moffett noted in a Wednesday morning investor note, 10 million homes passed translates only to around 6% of the U.S.

“The situation for T-Mobile is worse still. And yet they are plowing ahead undaunted,” he wrote. “Like AT&T, T-Mobile has neither a wireline answer in the vast majority of the country nor a viable path to get one. If the world moves in the direction of convergence — or worse, if they, along with AT&T, help move it there themselves — then T-Mobile will lose everywhere they don’t have a wireline network. Right now, that’s 98% of the country. The muddled strategy around convergence is a pity, because T-Mobile is actually doing very well in mobile, thank you very much.”

T-Mobile reported a 3% year-over-year gain in Q2 total revenue to $19.772 billion.

“We’ve already made abundantly clear how much we dislike T-Mobile’s quixotic mission to cobble together what is destined to be a costly and, ultimately, a largely irrelevant wireline footprint,” Moffett added. “It’s a pity that it distracts from real momentum in their core mobility business, which yet again posted strong results.”

Here’s T-Mobile’s full Q2 earnings release.