/Synchrony%20Financial%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Headquartered in Stamford, Connecticut, Synchrony Financial (SYF) offers digitally driven consumer financial services, including private-label and co-brand credit cards, installment loans, and savings products through Synchrony Bank.

Boasting a market cap of approximately $30.5 billion, the company comfortably surpasses the $10 billion threshold that defines “large-cap” status and leverages its scale to support wide-ranging credit programs across major retailers and service providers.

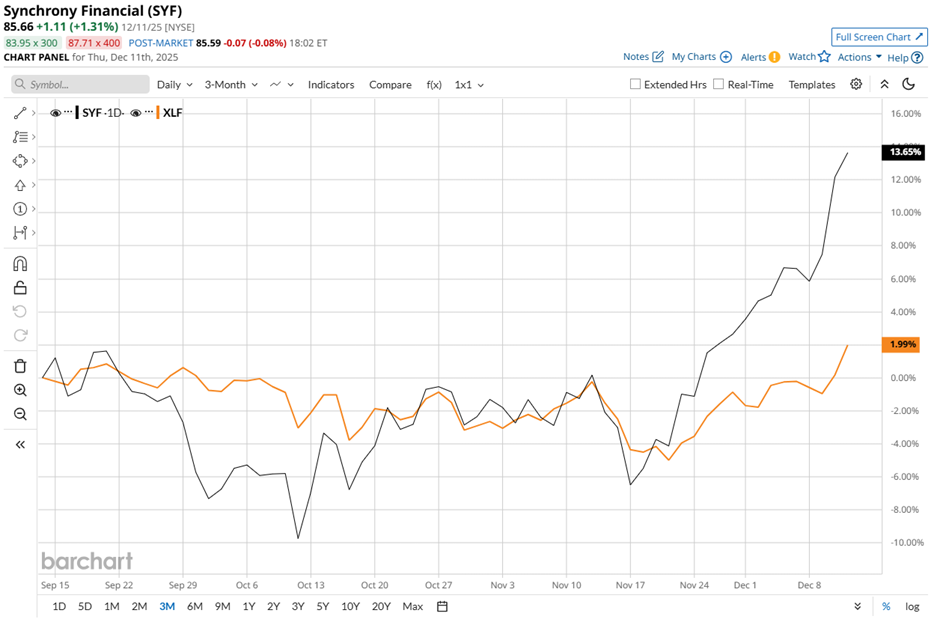

Currently, SYF stock trades just slightly below its 52-week high of $86.22 made in Dec, underscoring persistent investor confidence. Plus, its 12.7% gain in the past three months easily beats the State Street Financial Select Sector SPDR ETF’s (XLF) 1.6% rise during the same stretch.

Longer-term performance sharpens the contrast. SYF stock has climbed 25% over the past 52 weeks and 31.8% year-to-date (YTD), whereas XLF gained 10.2% across 52 weeks and 13.5% YTD, signaling that shares of Synchrony continue to outperform.

SYF stock has shown strong technical resilience, trading above its 50-day moving average of $74.46 and 200-day moving average of $65.77 since mid-June, although it did see a dip in October. However, its return above both averages by late Nov. signals renewed buyer confidence and strengthens trend support.

A notable intra-day jump occurred on Dec. 4, when SYF stock rose almost 1.6% after Synchrony and Mitsubishi Electric Trane HVAC US LLC (METUS) renewed their strategic residential-financing partnership. With already in effect since Oct 1, the multi-year renewal extends a decade-long collaboration and reinforces Synchrony’s position in a rapidly expanding, energy-efficient HVAC market.

For context, SYF’s rival SLM Corporation (SLM) has gained 3.4% over the past 52 weeks and declined marginally YTD, underscoring SYF’s stronger momentum and more convincing market traction.

24 analysts are backing SYF’s fundamental strength with a “Moderate Buy” consensus rating, while the stock is already trading above its mean price target of $82.58.