Financial giants have made a conspicuous bullish move on Symbotic. Our analysis of options history for Symbotic (NASDAQ:SYM) revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $210,224, and 4 were calls, valued at $196,187.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $22.0 to $37.5 for Symbotic over the recent three months.

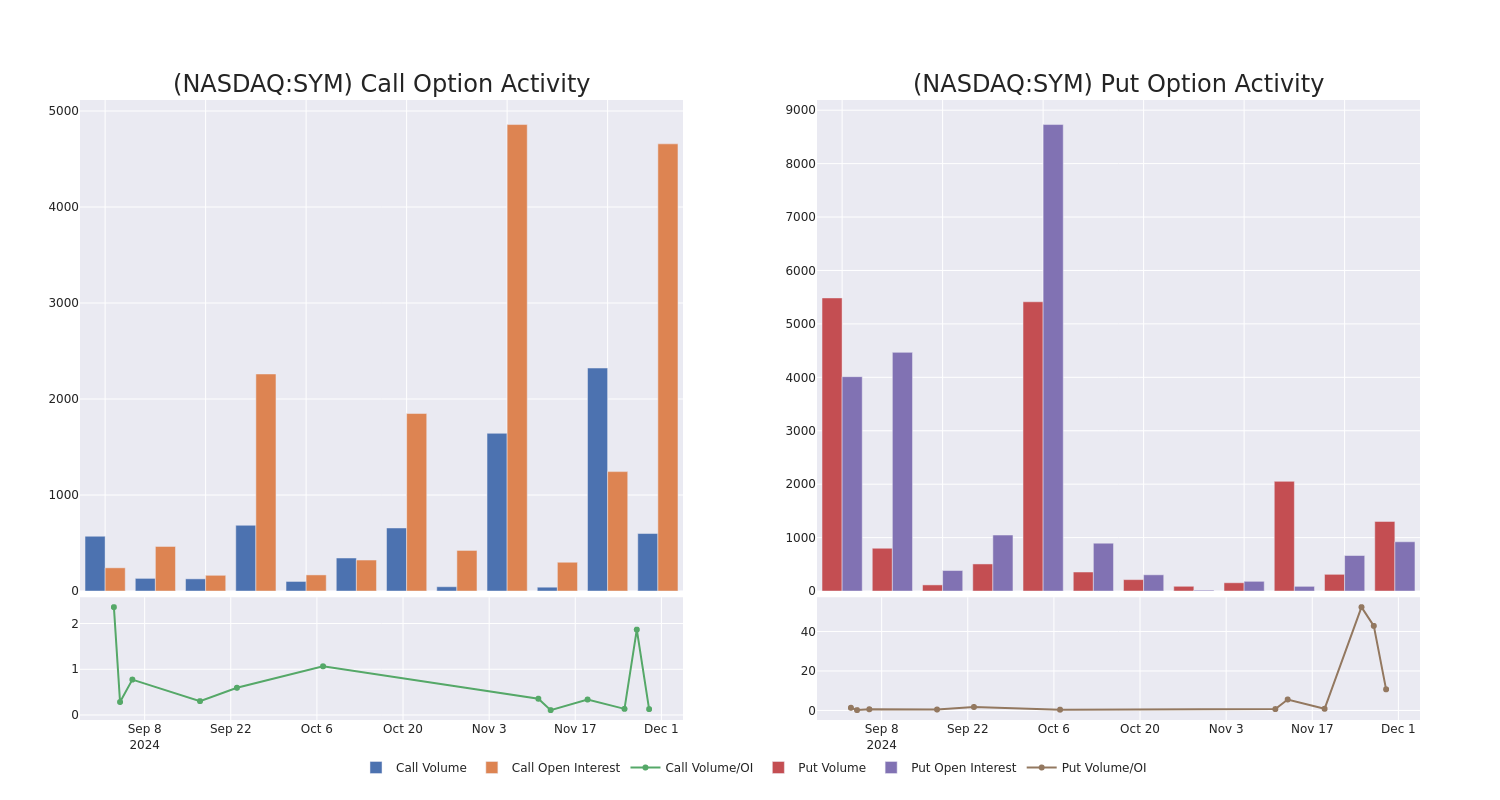

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Symbotic's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Symbotic's whale activity within a strike price range from $22.0 to $37.5 in the last 30 days.

Symbotic Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SYM | PUT | SWEEP | BULLISH | 12/06/24 | $0.95 | $0.9 | $0.95 | $22.00 | $101.3K | 108 | 1.0K |

| SYM | CALL | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.1 | $3.0 | $25.00 | $61.5K | 1.3K | 243 |

| SYM | CALL | SWEEP | BEARISH | 05/16/25 | $7.6 | $7.1 | $7.25 | $22.50 | $53.6K | 463 | 12 |

| SYM | CALL | SWEEP | BEARISH | 01/17/25 | $1.75 | $1.5 | $1.5 | $30.00 | $45.0K | 2.4K | 294 |

| SYM | PUT | SWEEP | NEUTRAL | 02/21/25 | $5.5 | $5.3 | $5.4 | $27.50 | $41.0K | 365 | 115 |

About Symbotic

Symbotic Inc is an automation technology company that develops technologies to improve operating efficiencies in modern warehouses. The group develops, commercializes, and deploys innovative, end-to-end technology solutions that dramatically improve supply chain operations. Symbotic also automates the processing of pallets and cases in large warehouses or distribution centers for some of the retail and wholesale companies in the world. The company operates in two geographical regions the United States and Canada. Key revenue is generated from the United States.

Having examined the options trading patterns of Symbotic, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Symbotic

- With a trading volume of 3,288,012, the price of SYM is up by 6.44%, reaching $25.54.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 66 days from now.

Professional Analyst Ratings for Symbotic

In the last month, 5 experts released ratings on this stock with an average target price of $43.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Symbotic, targeting a price of $46. * An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $60. * Consistent in their evaluation, an analyst from BWS Financial keeps a Sell rating on Symbotic with a target price of $10. * Consistent in their evaluation, an analyst from Northland Capital Markets keeps a Outperform rating on Symbotic with a target price of $53. * Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Symbotic with a target price of $48.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Symbotic, Benzinga Pro gives you real-time options trades alerts.