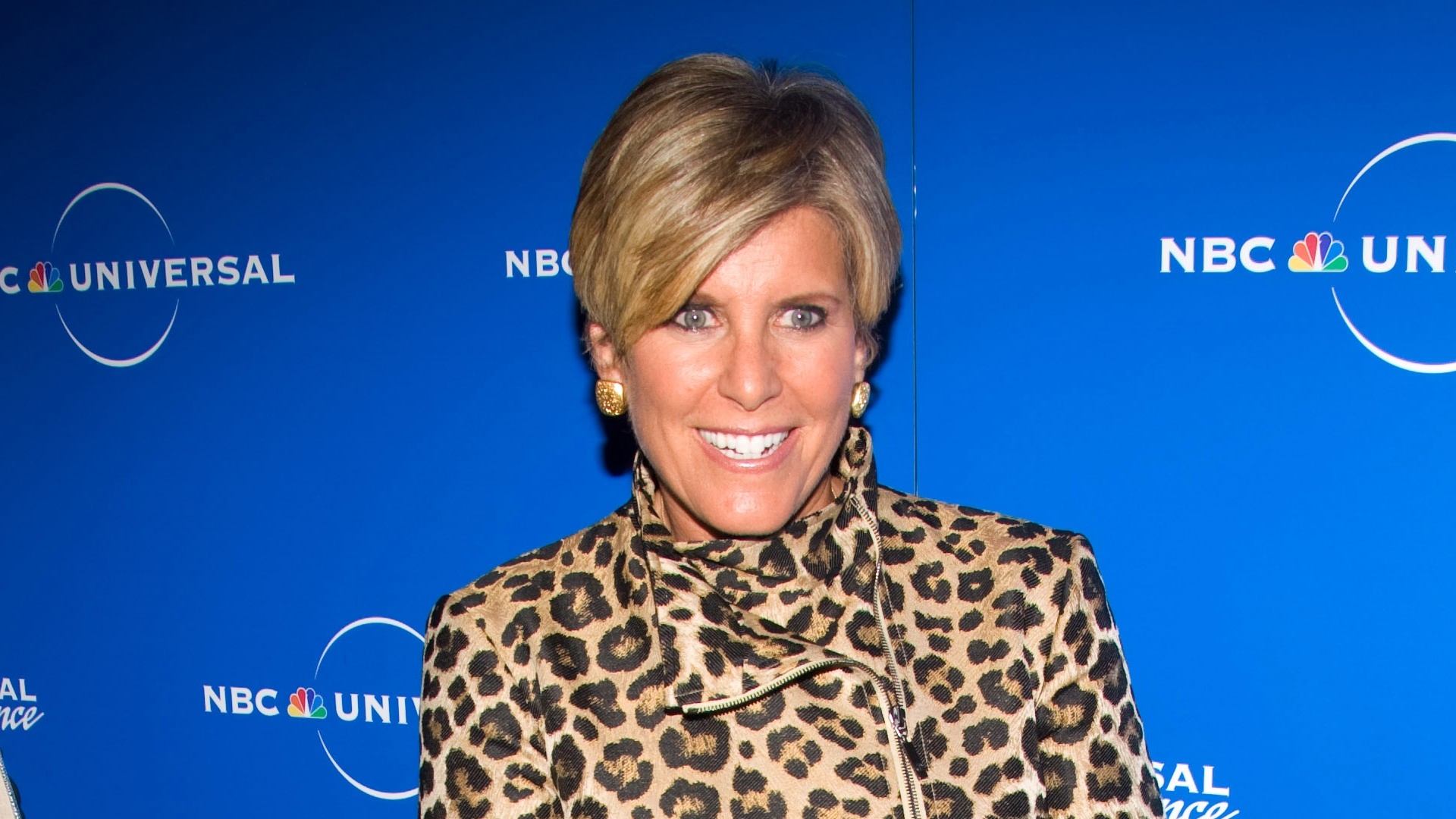

Covering small expenses like a phone bill for your adult children might seem harmless, but according to personal finance expert Suze Orman, it can actually prevent them from achieving any long-term financial goal, or worst case, turn them into lazy, entitled monsters. Many parents continue paying for their grown kids’ bills out of love or habit, but Orman warns that this practice can lead to long-term money problems for both parents and children.

In a LinkedIn post, Orman emphasized how important it is for parents to stop paying for even seemingly small expenses, like phone bills, to help their children become more financially independent.

Paying Their Own Bills Can Build Financial Independence

In one of the most famous — and funniest — scenes from the 2010s-era HBO comedy series “Girls,” perpetually petulant slacker and aspiring “voice of a generation” Hannah Horvath (Lena Dunham) sits across from her parents as they cut her off financially. While Hannah has spent hours at an unpaid internship, bopping around Brooklyn and discovering herself, Mom and Dad have been footing the bill for everything — including her phone.

“We can’t keep bankrolling your groovy lifestyle,” Mom says, prompting Hannah to insist that she’s so close to the life she wants, her parents shouldn’t end it now. The scene resonates because it has played out thousands of times in households around the country.

Orman would likely support Hannah’s parents in their choice to make her stand on her own two feet, but she also understands why parents are so tempted to help young adults. After all, cell phone bills and streaming services seem like relatively minor expenses — so why not make your kids’ lives easier by covering them?

However, Orman urges parents to flip their perspective: If the amount is truly small, that’s exactly why young adults should be paying it themselves. Learning to manage even modest bills helps build a strong financial foundation.

“If it’s a manageable amount, it won’t be hard for them to take on. And that’s a key step toward financial independence,” Orman wrote. “Maybe it’s the first bill they put on auto-pay — helping them build responsible habits and a strong credit score. Every step counts on the road to financial freedom!”

Read Next: 9 Things the Middle Class Should Consider Downsizing To Save on Monthly Expenses

For You: 6 Things You Must Do When Your Savings Reach $50,000

Help Should Be Oriented Toward Goals

Hannah’s parents may have had the right idea, but forcing her into total financial independence without helping her establish a financial safety net first might not be the wisest approach. Orman isn’t against parents offering some financial help to their adult children, but she believes it should be structured to help young adults develop financial skills.

In addition to having young adults pay for their own phone bills, streaming services and car insurance, Orman says that adult children who move back home should chip in toward household expenses. Parents don’t need to charge their twentysomethings the equivalent of a full market-rate mortgage or rent payment — after all, if they could afford rent, they wouldn’t be living at home — but getting them in the habit of budgeting a certain amount to make “rent” each month helps instill financial discipline.

If parents genuinely don’t need the extra money, they can always set aside their child’s “rent payments” and later return the funds as the foundation for an emergency savings account.

Parents Need To Prioritize Their Own Retirement

As your children become adults, not only are you wondering where the time went, but you’re also nearing the age where retirement planning becomes even more critical. To ensure your own future, you simply can’t remain open as the Bank of Mom and Dad.

Orman stresses that while parents should encourage their kids to build financial independence, they must also stay focused on their own financial goals — especially retirement. Think of it this way: You’ve worked hard to build your financial security, and just as your adult children are in their own self-discovery periods, you have the right to start one of your own.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- Nearly 1 in 3 Americans Hit by a Costly Holiday Scam, Norton Survey Shows -- How To Avoid This

- Here's What the Average Social Security Payment Will Be in Winter 2025

- How Middle-Class Earners Are Quietly Becoming Millionaires -- and How You Can, Too

- The Easiest Way to Score $250 for Things You Already Do

This article originally appeared on GOBankingRates.com: Suze Orman: 3 Reasons Parents Should Stop Paying Their Adult Kids’ Phone Bills