PORTSMOUTH, N.H.—New research from Hub finds that consumers are worrying as much about the complexity of the streaming experience as they are about the cost of subscriptions; only half of the services they use are considered "must have."

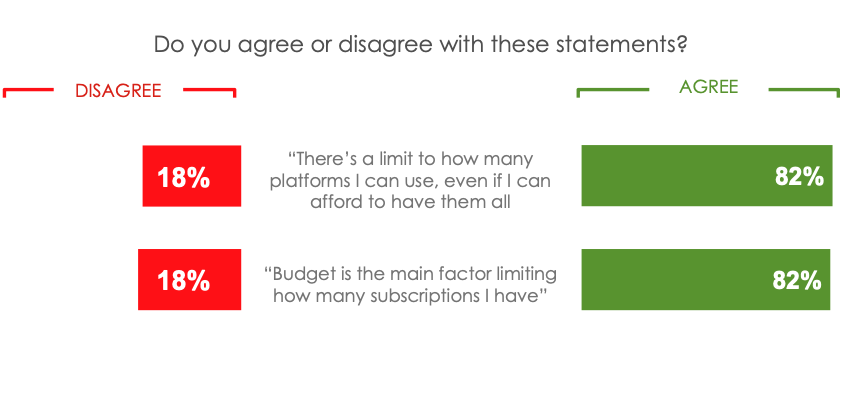

While many consumers continue to complain about cost (82% of all respondents say budget is a main factor limiting their subscriptions), just as many (82%) say there’s a limit to how many platforms they can use, even if they could afford to have them all, indicating that consumers have more sources of entertainment than they can easily use and are eager for solutions that allow them to simplify, the report found.

“This research underscores the threat churn represents to entertainment providers”, said Jon Giegengack, principal at Hub and one of the study authors. “Consumers are using many sources, but only half of them are considered essential: the others are at risk of being cut. But the data also show the opportunity for companies that can simplify the user experience. Complexity is as big an impediment as cost – and for companies trying to maximize their bottom line, creating a simpler experience should be more palatable than cutting their price.”

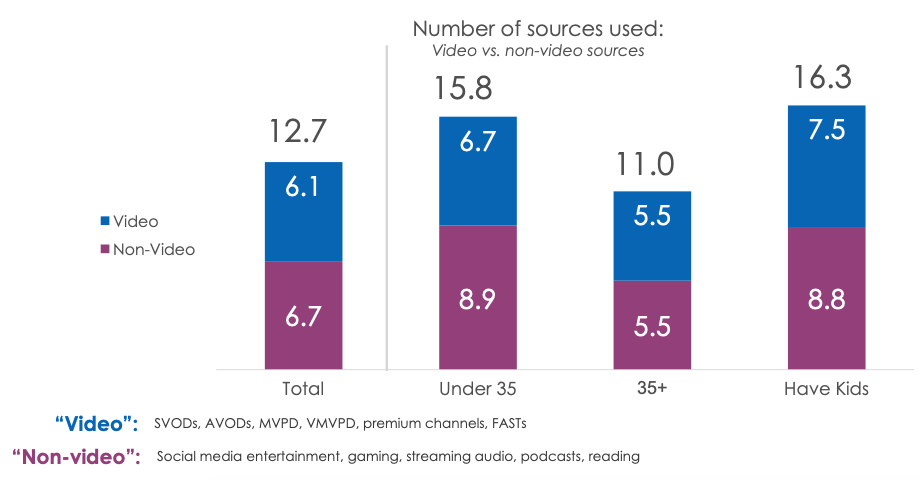

The findings from the latest wave of Hub’s “Battle Royale” study also found that “premium” video represents only about half of consumers’ total entertainment ecosystem and that formats like gaming and social media are taking a greater share of disposable time and money.

More specifically, the survey found that the average household uses roughly the same number of premium video sources (6.1) and non-video (6.7). And in key segments, like young people or households with kids, use significantly more non-video than video sources of entertainment.

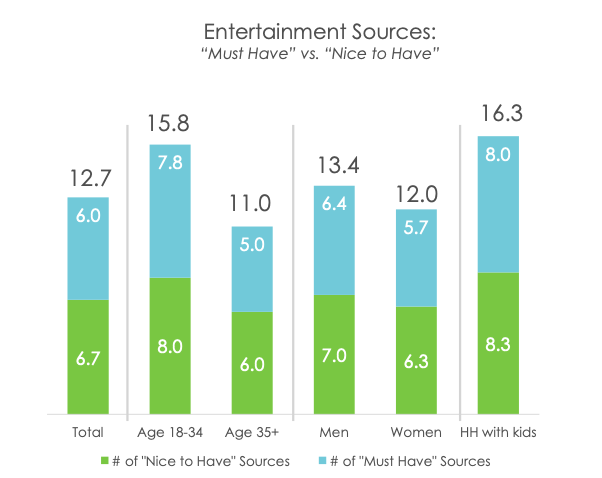

The Hub research also found that only about half of entertainment sources are considered “must haves” (“something my household can’t do without”). Across categories - video, audio, gaming, social media, podcasts, reading, etc. – the average respondent said their household uses 12.7 different sources (the same as in 2022). Younger consumers use more (15.8) and households with kids use the most (16.3), the Hub researchers reported.

But regardless of segment, consumers only consider about half their sources to be “must haves” (“something my household can’t do without”). All the others are classified as “nice to have” – something they might miss if it were gone, but not essential. The 50-50 ratio of “must haves” vs. “nice to haves” is consistent across segments, the researchers wrote.

These findings are from Hub’s 2023 “Battle Royale - Wave 3” report, based on a survey conducted among 3,000 US entertainment decision-makers with broadband, age 18-74. Interviews were conducted in March 2023 and explored consumer attitudes towards bundling subscription services.