/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

San Jose, California-based Super Micro Computer, Inc. (SMCI) develops and manufactures high-performance server and storage solutions based on modular and open architecture. With a market cap of $19.9 billion, Super Micro’s operations span the United States, Europe, Asia, and internationally.

Companies worth $10 billion or more are generally described as "large-cap stocks." Super Micro fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the digital infrastructure industry. Its solutions include a range of rack-mount and blade server systems, as well as components.

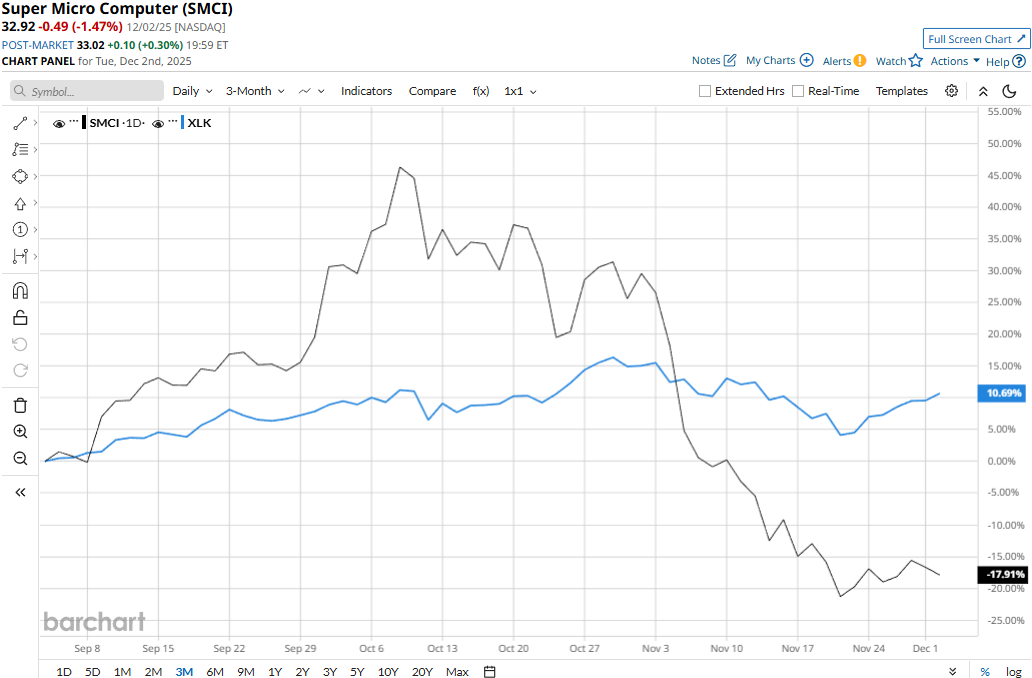

However, it's not all rainbows and sunshine. SMCI stock has tanked 63.3% from its 52-week high of $66.44 touched on Feb. 19. Meanwhile, SMCI stock prices have declined 19.3% over the past three months, lagging behind the Technology Select Sector SPDR Fund’s (XLK) 11.4% gains during the same time frame.

SMCI has underperformed the broader tech space over the longer term as well. Its stock prices have gained 8% on a YTD basis and plunged 21.6% over the past 52 weeks, compared to XLK’s 24.4% surge in 2025 and 22.6% gains over the past year.

SMCI stock dropped below its 50-day and 200-day moving averages in the last month, underscoring its bearish movement.

Super Micro Computer’s stock prices plunged 11.3% in the trading session following the release of its Q1 results on Nov. 4. The company observed a notable drop in sales, declining 13.8% quarter-on-quarter and 15.5% year-on-year to $5 billion, missing the consensus estimates by 56 bps. Further, due to margin contraction, its adjusted EPS observed an even sharper decline, dropping 52.1% year-over-year to $0.35, but surpassed the consensus estimates by 25%.

Meanwhile, SMCI has also underperformed its peer, Arista Networks, Inc.’s (ANET) 15.1% gains in 2025 and 24.1% surge over the past year.

Among the 19 analysts covering the SMCI stock, the consensus rating is a “Hold.” Its mean price target of $46.70 suggests a 41.9% upside potential from current price levels.