Experts changed their tune markedly on Federal Reserve interest-rate policy after Friday’s stronger-than-expected jobs report.

Nonfarm payrolls rose 254,000 in September, up from 159,000 in August. The unemployment rate dipped to 4.1% from 4.2%. And average hourly wages climbed 4% year-on-year from 3.9% in August.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

“The data hit a grand slam with payrolls coming in strong, positive revisions, and unemployment falling,” Lindsay Rosner, head of multisector investing within Goldman Sachs Asset Management, wrote in a commentary.

“The economy is heading into the post-season [a reference to the baseball playoffs] solidly,”

The Fed cut interest rates by 0.5 percentage points in September, its first reduction in four years. Before the employment data, experts were fairly split on whether the central bank would cut 0.25 points or another half-point at its meeting in November.

The jobs report changed all that. Now interest-rate futures imply an 84.6% probability of a quarter-point cut and a 15.4% chance of the Fed standing pat, according to CME FedWatch.

What’s ahead for the Fed

The Fed’s Federal Funds Rate target currently stands at 4.75%- 5%. The rate applies to overnight interbank loans, which banks borrow from each other to keep their reserve levels stable.

The jobs and inflation numbers ahead of the Nov. 6-7 Fed policy meeting will likely dictate the central bank's next move. Strong data could lead the Fed to keep rates steady, while weak data could mean a rate reduction.

Related: Goldman Sachs' S&P 500 targets after Fed interest rate cut

As for how rate changes affect you, falling rates lower payments for your home, auto, credit card, and bank loans. But they also reduce the income you get from your savings accounts, certificates of deposit and money-market accounts.

After the jobs data, some experts said the Fed will have to rethink its rate-easing program.

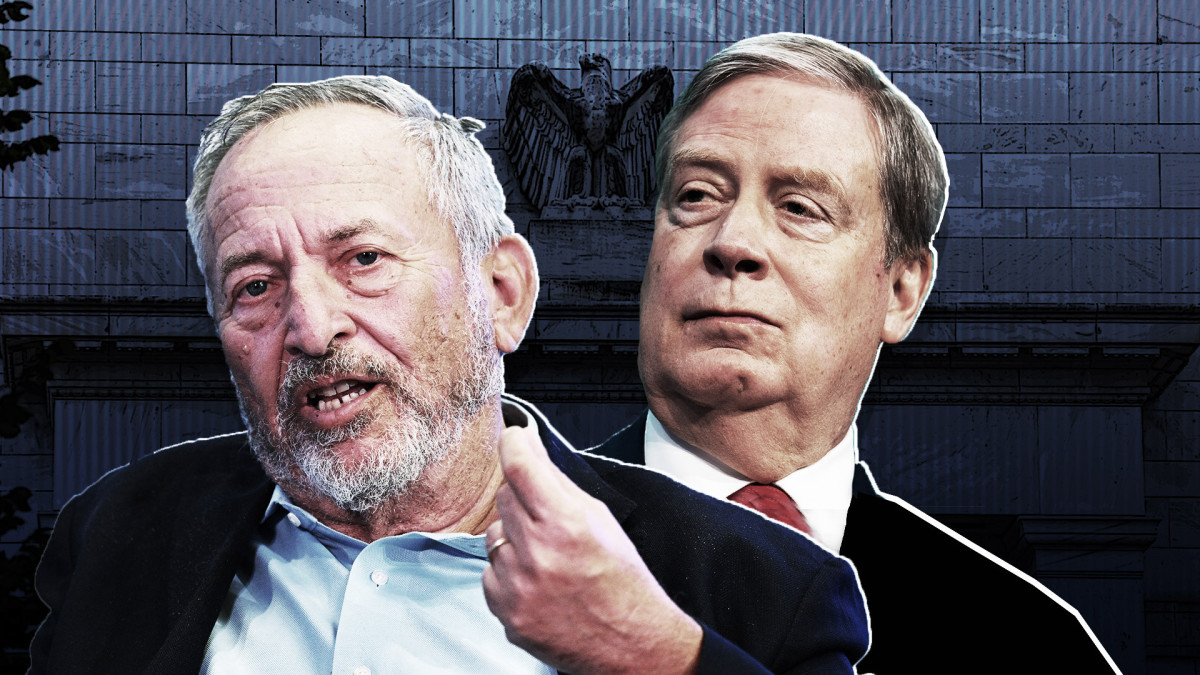

Larry Summers: The Fed made a mistake

“Today’s employment report confirms suspicions that we are in a high neutral-rate environment where responsible monetary policy requires caution in rate cutting,” the Harvard economist Larry Summers wrote on X.

Today’s employment report confirms suspicions that we are in a high neutral rate environment where responsible monetary policy requires caution in rate cutting. With the benefit of hindsight, the 50 basis point cut in September was a mistake, though not one of great consequence.…

— Lawrence H. Summers (@LHSummers) October 4, 2024

The neutral rate is the Federal Funds Rate at which inflation is stable around the Fed’s target of 2% and the economy is at full employment.

“With the benefit of hindsight, the 50-basis-point [0.5-percentage-point] cut in September was a mistake, though not one of great consequence,” the former treasury secretary and Harvard president said.

“With this data, ‘no landing’ as well as ‘hard landing’ is a risk the Fed has to reckon with. Wage growth remains well above pre-Covid levels and it does not appear to be decelerating.”

The Fed seeks a soft landing in which inflation falls to its target (it registered 2.2% in August) without sparking an economic downturn. A no-landing means inflation rebounds and a hard landing means recession.

Related: Veteran analyst spotlights crucial Fed interest-rate battle everybody is ignoring

Stanley Druckenmiller, Torsten Slok also hawkish

Another financial luminary, the investor Stanley Druckenmiller, is wary of the Fed overdoing its rate cuts. He was a colleague of hedge-fund legend George Soros.

“I hope the Fed is not trapped by forward guidance the way they were in 2021,” he wrote in an email to Bloomberg after the jobs report. He’s referring to the Fed’s reluctance to raise rates after inflation started taking off in 2021. Now, the reluctance would be to refrain from rate cuts.

“GDP above trend, corporate profits strong, equities at an all-time high, credit very tight, gold new high. Where’s the restriction?” said Druckenmiller, who oversees his own family office, Duquesne Family Office.

Fund manager buys and sells:

- Experts cite stocks to buy after Fed rate cut

- Cathie Wood divests $23 million of surging tech stocks

- Top value fund manager says Alphabet is deep-value stock

He means that given those financial trends, Fed policy isn’t too tight now. So, the central bank doesn’t need to cut rates much. (Perhaps he means it doesn’t need to cut rates.)

Druckenmiller said last week before the jobs report that he’s shorting U.S. bonds, according to MarketWatch. Shorting securities is a bet that their price will decline.

Torsten Slok, chief economist at Apollo Global Management, appears to agree with Summers and Druckenmiller. “Data continues to remain robust,” he wrote in a report titled “No Need For Fed Cuts,” as cited by Barron’s.

High corporate spending on artificial intelligence and fiscal stimulus, including defense spending, could keep rates “higher for longer,” Slok said.

Related: The 10 best investing books, according to our stock market pros