In a new analysis of what services might make up a good bundle and what services might benefit the most from bundling, Antenna has released new data that highlights some of the companies that have the least committed customers and those services that might benefit the most from bundling as a way to attract new customers and reduce churn.

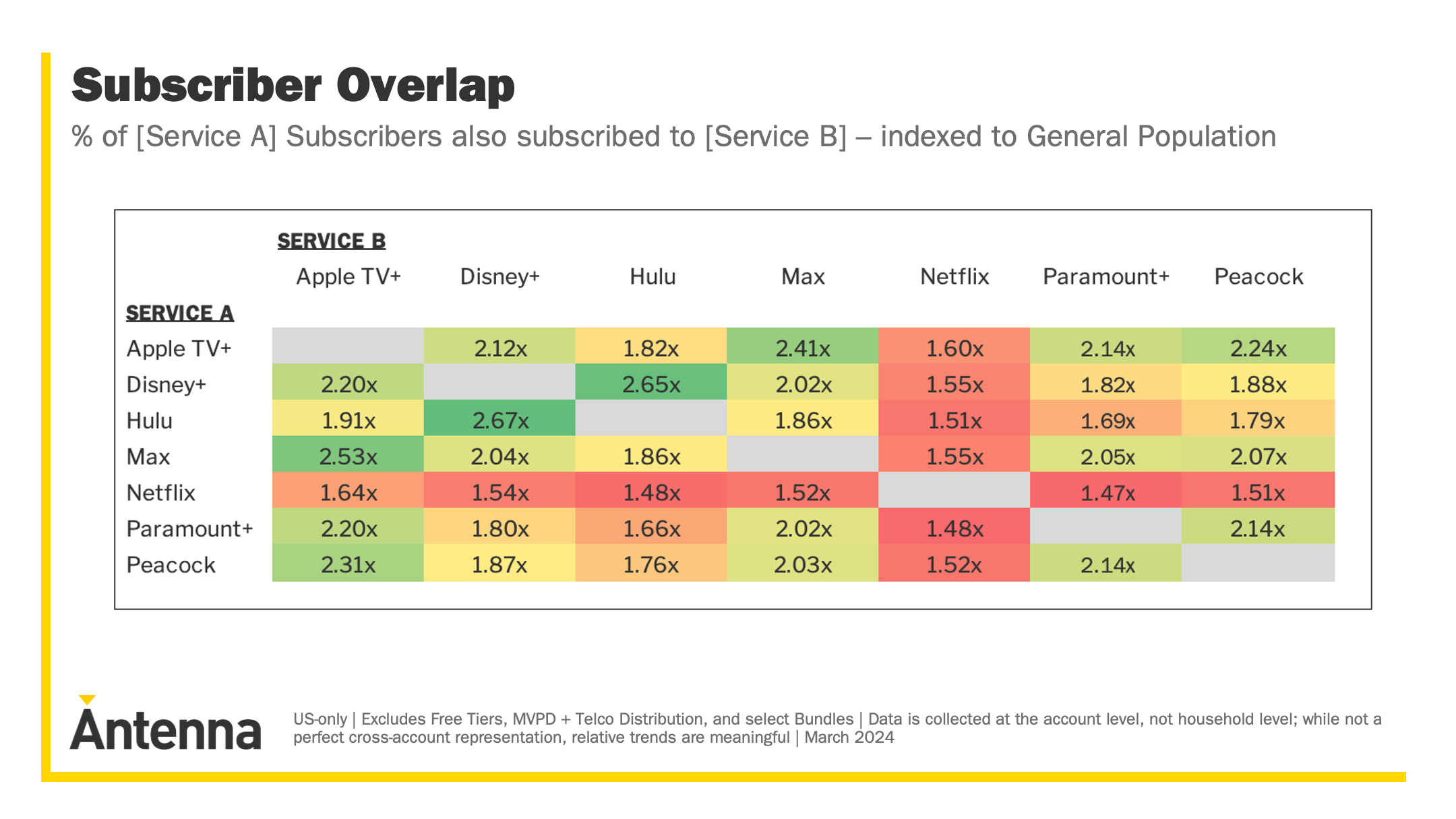

To analyze those questions, Antenna started by estimating the number of individuals who subscribe to multiple services. For instance, Antenna finds that Max Subscribers are 2.53x more likely to be subscribed to Apple TV+ compared to the General Population.

The researchers noted that a high rate of overlap could indicate that particular services are strong candidates to be bundled together because consumers have shown interest in each. But, while high overlap indicates an affinity between the two services, it also could indicate that a discounted bundled offering might be cannibalistic because many consumers already are willing to pay full price to each service, the company explained.

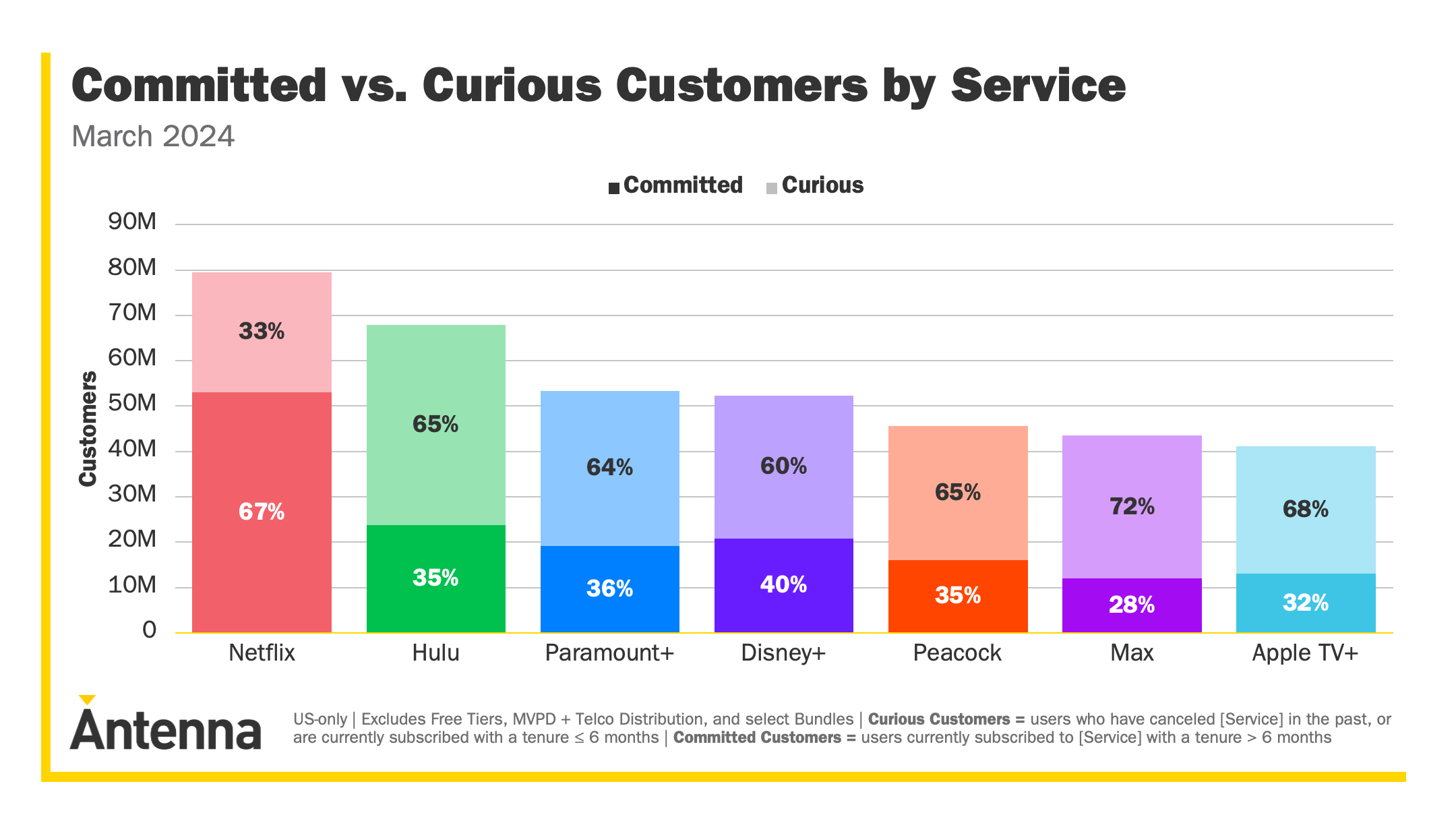

To differentiate between a cannibalistic bundle versus one which would add economic value, Antenna used the idea of “Curious Customers”, which were defined individuals who have canceled a service in the past, or are currently subscribed with a tenure of six months or less.

At the end of Q1’24, Antenna data indicated that Hulu had the largest numbers of Curious Customers at just under 45M. Those are individuals who have shown enough interest in Hulu to try it, but have not committed to long-term loyalty. Netflix had the fewest Curious Customers.

Antenna calls subscribers who had access to the service longer than six months "Committed Customers".

It analyzed a services’ Curious Customers relative to their Committed Customers as an interesting way to think about the potential upside or cannibalization which bundling could provide to the service in general.

Most Premium SVOD services have more Curious Customers than Committed Customers, the data indicated. The ratio is highest for Max; of all the people who Antenna has ever observed subscribing to Max, 28% of them are currently subscribed with a tenure longer than six months.

“This suggests that Max has significant potential upside from using bundles to motivate Curious Customers to subscribe more loyally, with less risk of losing revenue from existing loyal subscribers `trading down’ to a lower cost bundle”, the Antenna analysis found. “For Netflix, on the other hand, two out of every three individuals who have ever subscribed to the service are currently subscribed with a tenure over six months. Bundles represent more cannibalization risk, with less upside potential.”

The researchers also argued that "the most productive bundles will pair services with a strong overlap between Curious Customers. These Curious Customers have displayed a willingness to pay for each service, but not a high level of loyalty to them. As such, the discounted bundled offering has a large base of individuals who may be prompted to engage more loyally with both services together than they were with either service on a standalone basis. This represents strong upside potential for both participating services. The least productive bundles maximize Committed Customer overlap. These Committed Customers have shown a willingness to pay for a given service, and a higher level of loyalty. As such, offering them a discounted bundle could be value-destructive."

For more detailed information on Antenna’s methodology and definitions of core metrics, please visit http://www.antenna.live/methodology.