/Stryker%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Portage, Michigan-based Stryker Corporation (SYK) is a leading global medical technology company specializing in orthopaedics, MedSurg, and neurotechnology solutions, serving hospitals and healthcare providers worldwide. Valued at $135.7 billion by market cap, the company is best known for its joint-replacement implants, surgical equipment, and advanced technologies, including the Mako robotic-assisted surgery platform, which enhances procedural precision and efficiency.

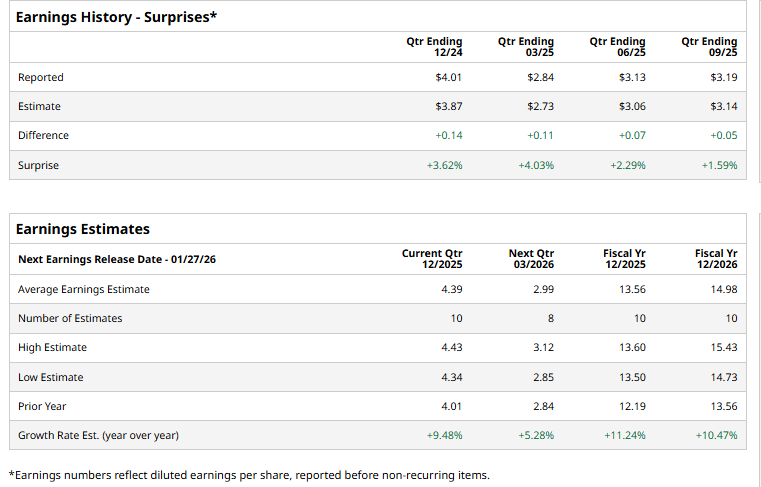

The Medtech giant is expected to announce its fiscal fourth-quarter earnings soon. Ahead of the event, analysts expect SYK to report a profit of $4.39 per share on a diluted basis, up 9.5% from $4.01 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect SYK to report EPS of $13.56, up 11.2% from $12.19 in fiscal 2024. Its EPS is expected to rise 10.5% year over year to $14.98 in fiscal 2026.

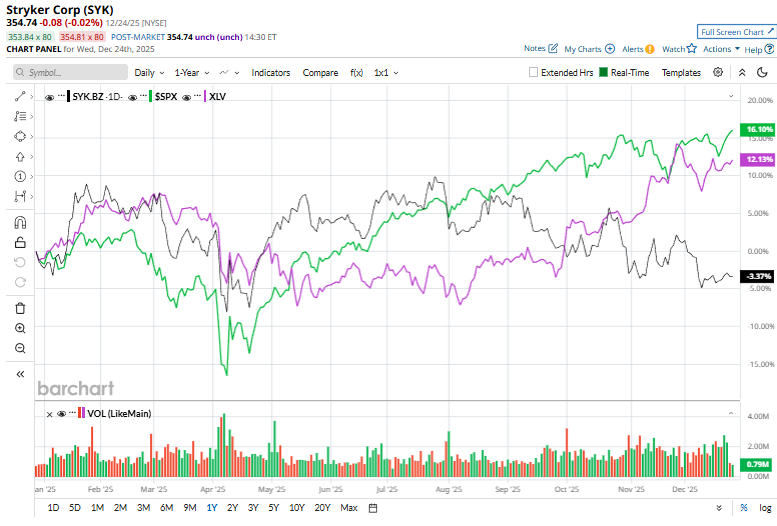

SYK stock has declined 4.3% over the past year, underperforming the S&P 500 Index’s ($SPX) 14.8% gains and the Health Care Select Sector SPDR Fund’s (XLV) 11.8% rise over the same time frame.

On Dec. 19, shares of Stryker rose more than 1% after Citizens JMP Securities upgraded the stock to “Outperform” from “Market Perform” and set a $440 price target. The upgrade reflects growing confidence in Stryker’s long-term growth outlook, supported by strong demand for its orthopaedics and MedSurg products, continued momentum in robotic-assisted surgery, and improving operating leverage.

Analysts’ consensus opinion on SYK stock is reasonably bullish, with a “Strong Buy” rating overall. Out of 27 analysts covering the stock, 18 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and seven give a “Hold.” SYK’s average analyst price target is $432.88, indicating a potential upside of 22% from the current levels.