If there were any doubts that streaming TV has finally hit its stride in 2024, NBC was ready to knock them down this month.

Although the network didn’t break out the share of 2024 Olympics viewing split between its three platforms—Peacock streaming, broadcast TV (NBC, Telemundo) and its cable channels (such as USA Network, E! and NBCSports)—the company’s enthusiasm about Peacock’s performance from Paris underscored the growing perceived value of streaming video in the media mix. NBC crowed that the 23.5 billion minutes of Paris Olympics coverage streamed via Peacock during the games, July 19-Aug. 11, was up “40% from all prior Summer and Winter Olympics combined.”

(Read: Peacock Signed-Up 2.8M Subs During Olympics)

NBCUniversal Media Group Chairman Mark Lazarus said the streaming usage “marked a groundbreaking moment for Peacock, which delivered …cutting-edge innovation while shattering all-time Olympics streaming records.”

The Olympics streaming victory lap surfaced amidst a marathon of other developments that illustrate the hurdles and leaps that face the industry. Days after NBC’s declaration of streaming success, a Federal court in New York issued a preliminary injunction to stop Venu Sports, the joint venture streaming service from Disney, Fox and Warner Bros. Discovery, which had planned to launch in time for the NFL season.

‘Wait and See’

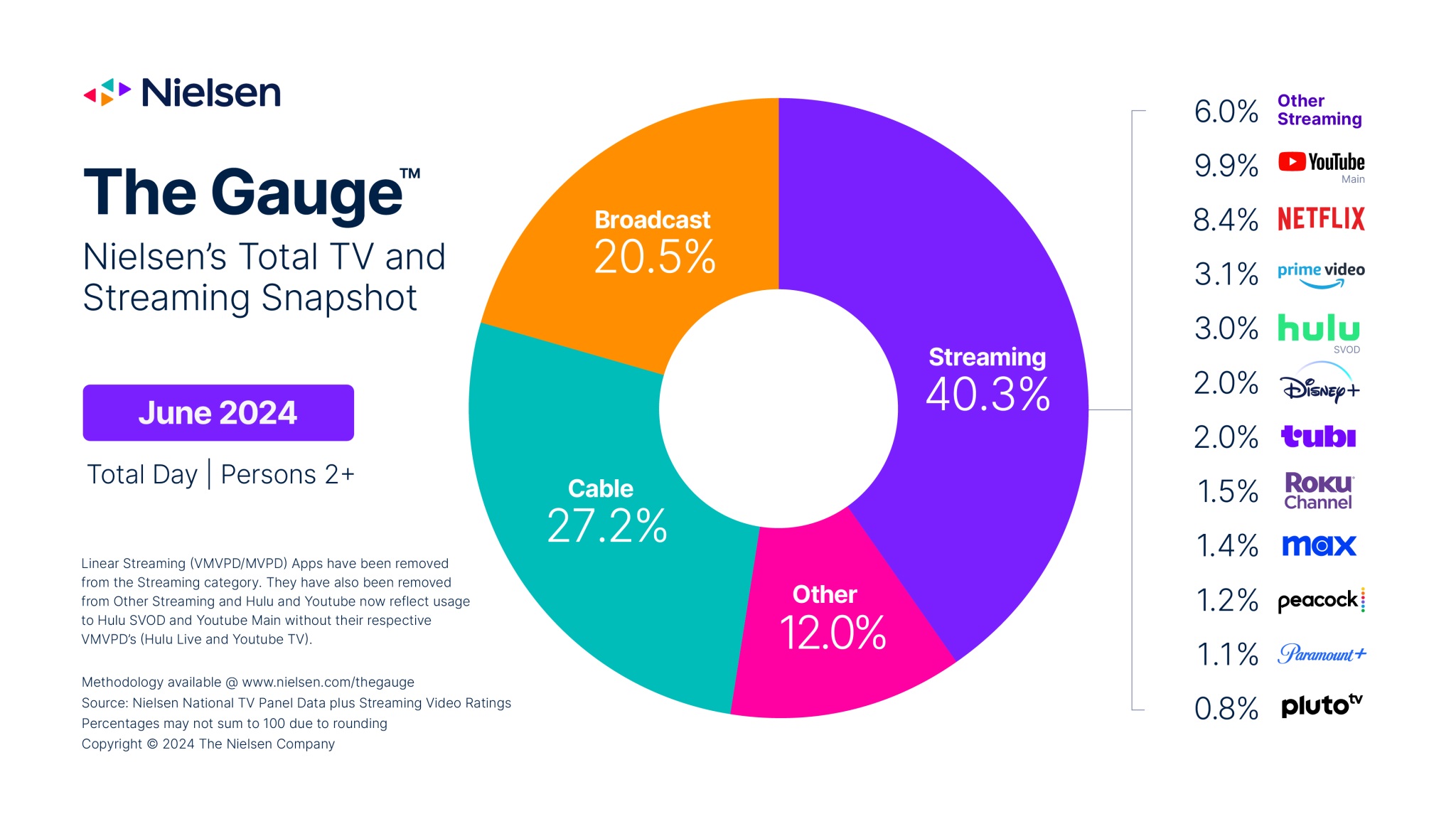

These developments emerged just after Nielsen’s latest “The Gauge” report, which calculated that 40.3% of TV viewing is now watched on streaming platforms, followed by cable (27.2.1%) and over-the-air broadcast (25.5%). The streaming share was up from 37.7% a year earlier in Nielsen’s analysis of how Americans watch TV across platforms.

Collectively, this summer’s avalanche of streaming exuberance (and stumbles) mirrors the ways that the buzzy business of video streaming is taking off in countless directions. At the same time, dozens of challenges are becoming apparent in this latest competitor to (or collaborator with?) broadcast TV. They encompass technology, economics, legal/regulatory issues and consumer preferences for ad-supported programming vs. paid content.

The emergence of Venu, the proposed $42.99/month bundle of streaming content has been a major source of enthusiasm. Its program package is intended to include ABC, Fox, ESPN, TNT, TBS programs and by extension a slew of major football, baseball, basketball and hockey league games. Analysts are waiting to see how it will fare against alternatives such as the Xfinity StreamSaver bundle that Comcast is assembling by bringing Peacock, Netflix and Apple TV+ into one $15 per month package.

Rick Ducey, managing director of BIA Advisory Services, who analyzes the migration of media platforms, characterizes the current situation as “a very complicated environment for everyone to navigate.” He cites “nearly 2,000 streaming services available to consumers configured, bundled and sold across various platforms, publishers, and content aggregators.”

Ducey observed that industry providers and consumers are evaluating the very different business models that are available.

Other analysts offer similar perceptions of the cloudy near-term outlook. “This environment makes it challenging for consumers to keep track of what they are spending, which causes a great deal of frustration,” says Adriana Waterston, executive vice president and insights and strategy lead at the Horowitz Research Division of M/A/R/C Research. “This is why churn has been such a big issue.” She points to data showing that “consumers navigate these costs by timing which services they pay for when.”

Waterston sees the decision-making process about streaming tied to viewers’ “increased expectation for content that reflects [their] identities and views on the world,” and said she expects an even “bigger impact” if and when Venu debuts as “sports fans get a sense of the breadth of content this service could offer.”

In her firm’s recent research, 42% of sports fans said they would subscribe [to Venu], and among those who were likely to sign up, 38% said they would likely make a change to the other services they get because of it.

NBC, in its post-Olympics victory lap, pointed to streaming video’s ability to give viewers what they want to see. Peacock’s “Gold Zone,” a compendium of whip-around coverage of each day’s Olympic highlights, consistently ranked among Peacock’s top five most-watched Olympics segments and nearly quadrupled its viewership during the two weeks in Paris, according to NBC’s analysis.

One in five Olympics viewers tuned into “Gold Zone” and more than a quarter of Olympics viewers on Peacock watched via “Multiview,” with half of their time spent on featured live events, and half watching the “quad box” view of multiple events.

Churn Concerns

Yet in the deluge of viewer research, an unsettling picture emerges. In Xperi’s latest TiVo Video Trends Report, 20% of consumers said they believed “they have too many services.” The study found that at the end of 2023, the average home used 11.1 services (down slightly from 11.5 a year earlier)—but that the number of free services increased while paid services declined year over year.

Parks Associates also identified a 30% decline in spending on streaming services since 2021. Current spending is about $64 per month compared to $90 monthly three years ago, according to Sarah Lee, a Parks research analyst. “Consumers are spending less, but rather than go without, many are using ad-based alternatives to save on costs,” Lee said. “A service needs to provide unique and ongoing value if it is to charge a premium.”

Separate research by LG Ads indicates that 80% of viewers watch Free Ad-supported Streaming TV (FAST) channels and 63% prefer this format to other on-demand formats.

And that leads to questions about what viewers want to see on streaming channels.

MoffettNathanson media analyst Michael Nathanson, in a mid-summer evaluation, examined a shift away from original content, which had established Netflix in its early years. Now, Nathanson said that Netflix, along with Paramount+ and Warner Bros. Discovery’s (WBD) Max, are showing streaming gains even “as they released less content.”

We already see a significant decline in new show production, smaller deals, and only with established showrunners and stars. Buckle your pants, we are all going on a diet.”

Seth Skolnik, Vivid Labs

“The market has shifted to allow the company to drive an increasingly large share of its viewership with its competitors’ content,” Nathanson said. “This is reflected in acquired titles’ (and especially nonexclusive acquired titles) rapidly increasing share of the list of top streamed titles.” He pointed out that only two of the top 20 most-streamed shows on Netflix in Spring were originals.

Seth Skolnik, chief operating officer of Vivid Labs, draws on his experiences at Paramount, Technicolor and new media start-ups to conclude that the bubble has burst. “We already see a significant decline in new show production, smaller deals, and only with established showrunners and stars,” he said. Buckle your pants, we are all going on a diet.”

BIA’s Ducey is also trying to interpret how streaming customers’ viewing preferences will affect future production and distribution. “Content investment strategy has shifted towards more focused content offerings such as TV shows and films in genres like action, medical or police dramas, international series and films, live sports [and]… science fiction,” he said. “The total investment in content and number of titles produced may have reached a limit for now as streaming businesses rationalize” growth and profitability metrics.

“Cross-platform (linear TV plus streaming) campaign planning, activation, optimization and improved measurement and ROI using relevant Key Performance Indicators will provide a lot of lift to streaming’s role in the local media ecosystem,” he added.

Caution: Lawyers at Work

As the content and marketing landscape takes shape, streaming is already facing increased legal scrutiny. Congressional forces are urging the Justice Department and the Federal Communications Commission to probe the Venu alliance with an emphasis on a potential antitrust violation in pooling sports league contracts of the several networks.

In the current legal challenge to Venu, plaintiff streamer Fubo claims it is being forced to carry dozens of channels in order to get licensing rights to the sports events.

Most streaming services seem content trading the need to obtain copyrights for less regulation.”

Ari Melzer, Wiley Rein

“The FCC hasn’t regulated streaming services to date, other than in very discrete areas such as closed captioning,” explains Ari Meltzer, a communications attorney at the Wiley Rein law firm in Washington. He points out that there are already disputes about whether the FCC has authority over streaming video—an issue that is being bruited around quietly on Capitol Hill. For now, oversight comes under other legal umbrellas, such as antitrust, contracts, copyright, and unfair and deceptive trade practices, Meltzer adds.

“There are tradeoffs: while streaming services don’t have to comply with the same regulations as broadcast and cable/satellite, they also aren’t entitled to certain benefits, such as statutory copyrights,” he added. “Most streaming services seem content trading the need to obtain copyrights for less regulation.”

Last week’s ruling on Venu from the U.S. District Court, Southern District of New York, has changed the momentum. There is no indication about how long the court’s temporary restraining order will stay in effect. Fubo, a nine-year old streaming service that concentrates on live sports (including NFL, MLB, NBA, NHL, MLS and international football), filed the lawsuit in February, claiming that Venu would control up to 80% of live broadcast sports content.

Venu’s owners said they plan to appeal the Court ruling.

Fubu co-founder/CEO David Gandler welcomed the ruling, saying “We seek equal treatment from these media giants, and a level playing field in our industry.” He cited the network and league that “monopolize the market, stifle competition and cheat consumers from deserved choice.”

Determining the Venu legal status “introduces a bit of a wild card” to the landscape, Ducey added. “If Venu does move forward and survives these threats, it certainly could [prove] how to bring some collaborative innovation to the market by trying to offer a ‘best-in-class’ sports experience to streaming viewers.” But he acknowledged that the high-value sports licensing rights could “challenge the viability” of Venu.

“Something has to give. Consolidation may help share costs but then partners stand to lose some competitive differentiation with their other direct-to-consumer and distribution platform strategies,” Ducey added. “It’s not clear how this nets out at this point.”

Meanwhile, Advertisers are Standing By

Central to many streaming providers’ programming and pricing decisions is the flavor of streaming video that appeals to viewers.

Among the options:

- AVOD (Ad-Supported Video on Demand)

- FAST (Free Ad-Supported Streaming TV)

- SVOD with ad-supported discount tiers

- TVOD (Transactional VOD, i.e., one-time rentals of a movie or show from Prime Video)

- PVOD (Premium VOD, additional fee for access to exclusive content such as major event or early-access viewing)

Add to that acronym jumble the emerging options for commercial operations, such as:

- CSAI (client-side ad insertion): ads aimed direct to customers

- SSAI (server-side ad insertion): ads put into video streams

Advertisers are evaluating the comparative values of CSAI, which enables more individual personalization to viewers vs. SSAI, which are less prone to disruptions or latency issues.

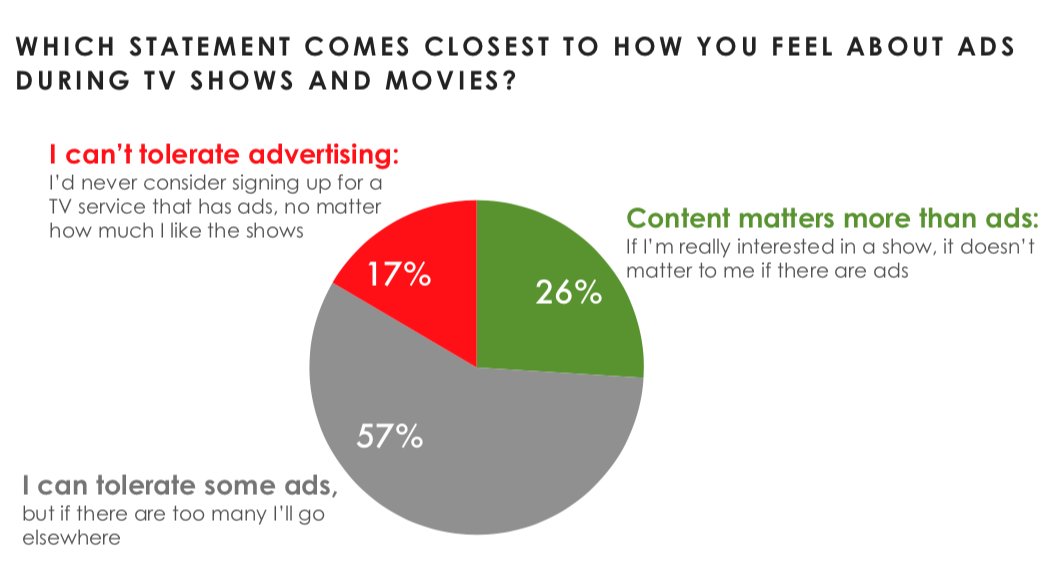

In its latest survey of viewer acceptance of ad-supported streaming, Hub Entertainment Research found that “an increasing number of TV viewers are accepting advertising in streaming video and they are readily able to discern the differences in how various services deliver the ad experience.” Hub said that “two-thirds of TV viewers would prefer watching ads if it saves on subscription costs” and the level of total ad intolerance has dropped from 17% in 2021 to 12% in June 2024.

Along with the ad-structure decisions comes a confrontation with a question that many media veterans fear: “Are we reinventing cable TV?” For example, the SVOD vs. FAST deliberation revives memories of the 1970s and ’80s introductions of ad-supported cable networks along with HBO, Showtime and other extra-fee “paid” channels.

Adriana Waterston of M/A/R/C calls content consolidation (such as Venu) into à la carte packages “the beginning of the new cable TV/multichannel bundle,” adding “I believe that at least from a value standpoint, this is what consumers really need, even if it’s not what they think they want.”

We’ve Seen This Show Before

In his 2024 memoir “Hits, Flops, and Other Illusions,” TV and film producer/director/writer Ed Zwick mused about Hollywood’s shift toward the economics of streaming.

The celebrated creator (“thirtysomething,” “Glory,” “The Last Samurai,”), laments that, “storytelling in this new age of streaming platforms seems deliberately crafted to create a new kind of anxiety designed to induce gorging rather than fulfillment, conversation rather than catharsis, consumption instead of closure.”

“The thoughtful has given way to marketable, and the complex idea replaced by the 15-second TikTok,” Zwick contends as he dissects Hollywood’s current “pressure to hold to …commercial viability” and the preference for “pre-sold IP [intellectual property] [that] can be marketed in a single sentence.”

After expressing his frustrations, Zwick kvetches that the modern Hollywood approach is “to aim low and hit the target.”