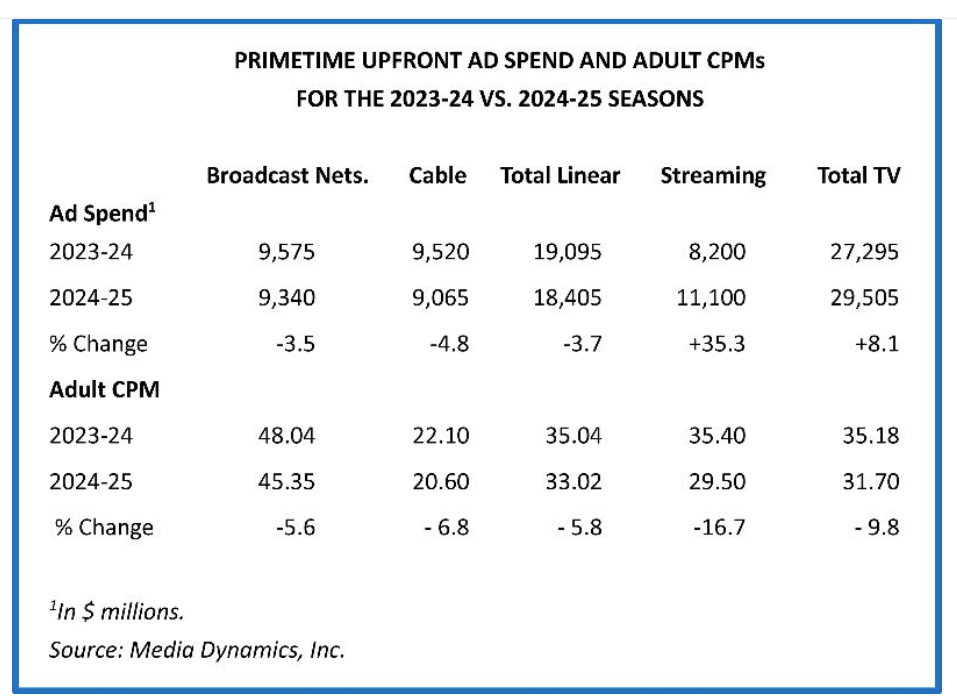

The television industry’s shift to streaming could be seen in the upfront advertising market, where gains in streaming were enough to more than offset declines in traditional broadcasting and cable.

Bottom line: Commitments to buy primetime advertising in the 2024-25 TV season rose 8% to $29.5 billion, according to a preliminary estimate by Media Dynamics. That figure includes the relatively new entrants into the TV market, such as Netflix and Amazon.

The increases came as media buyers were able to wrest lower prices on a cost-per-thousand viewers (CPM) basis.

As expected, linear ad commitments were down 3.7% to $18.4 billion.

For the broadcast networks, volume fell 3.5% to $9.3 billion.

For the cable networks, volume dropped 4.8% to $9.1 billion, a smaller drop than one might have expected considering that Warner Bros. Discovery just took a $9 billion writedown on its cable networks business.

Strong demand for sports kept linear ad volume from falling more, Media Dynamics said.

Streaming volume jumped 35% to $11.1 billion, topping either broadcasting or cable for the first time.

Pricing fell across the board. For primetime on broadcast, CPMs dropped 5.6% to $45.35. On cable, the decline was 6.8% to $20.60.

It was the second year in a role that upfront prices fell, the first time that’s happened.

Streaming CPMs dropped 16.7% to $29.50.

Media Dynamics said that with streaming replacing traditional TV, advertisers were determined to reduce pricing for streaming to levels more comparable to TV. The were helped by a big increase in supply of streaming inventory with Amazon Prime Video entering the ad market in a big way and the proliferation of free ad-supported streaming television (FAST) channels.

The upfront includes more than just primetime, Media Dynamics noted. Adding in the other dayparts, advertisers are expected to spend $45 billion to $50 billion in the upfront, leaving $10 billion to $12 billion for the scatter market, in which advertising time is bought just before it is expected to air, usually without ratings guarantees.

As most of the major media companies declared that they were done with their upfront sales, they cited increases in streaming and digital and strong demand for sports.