Stocks gapped higher at the opening bell Tuesday as Americans headed to the polls to decide another closely contested presidential election.

The long run-up to the election had traders and tacticians attempting to discount the outcome's potential impact on the prices of various asset classes as well as the future health of the economy. The so-called Trump trade is just one example of this activity.

Happily, retail investors are better served by not participating in this arguably neurotic behavior. That's because, when it comes to long-term investing, it doesn't matter which party holds the White House.

But let's get back to Tuesday's action, which took place perhaps days before the winner of the election will be confirmed. Markets are thought to provide a real-time indicator of the candidates' perceived chances of winning the Electoral College.

Although it's wise to heed market signals, this does not make them crystal balls.

At mid-session, the blue chip Dow Jones Industrial Average was up more than 400 points, or 1%, at 42,199. The broader S&P 500 gained 1.1%, while the tech-heavy Nasdaq Composite rose 1.4%.

All 11 sectors of the S&P 500 were higher, led by consumer discretionary, industrials and tech. As per usual, the tech sector was driven by Magnificent 7 stocks, most notably Nvidia (NVDA) and Tesla (TSLA).

In case anyone missed it, Nvidia was added to the Dow Jones Industrial Average on Monday, effective November 8. Tesla, helmed by noted Trump advocate Elon Musk, has always been a volatile stock. TSLA's five year-beta stands at 2.3, and its all-time maximum drawdown is 73%.

It's not unreasonable to be skeptical of TSLA stock's predictive value on a day like today.

The bottom line

"There is no clear consensus around the important questions of 'who will be President' and/or 'which party will control the House and Senate,'" write Nicholas Colas and Jessica Rabe, co-founders of DataTrek Research. "No matter the outcomes, therefore, they will be a surprise to many market participants."

What does that mean? For retail investors, there is no trade here. And while today's market action will offer some signal, it will also put out a lot of noise. So sit tight. It has long been established that time in the market is far more important than timing the market.

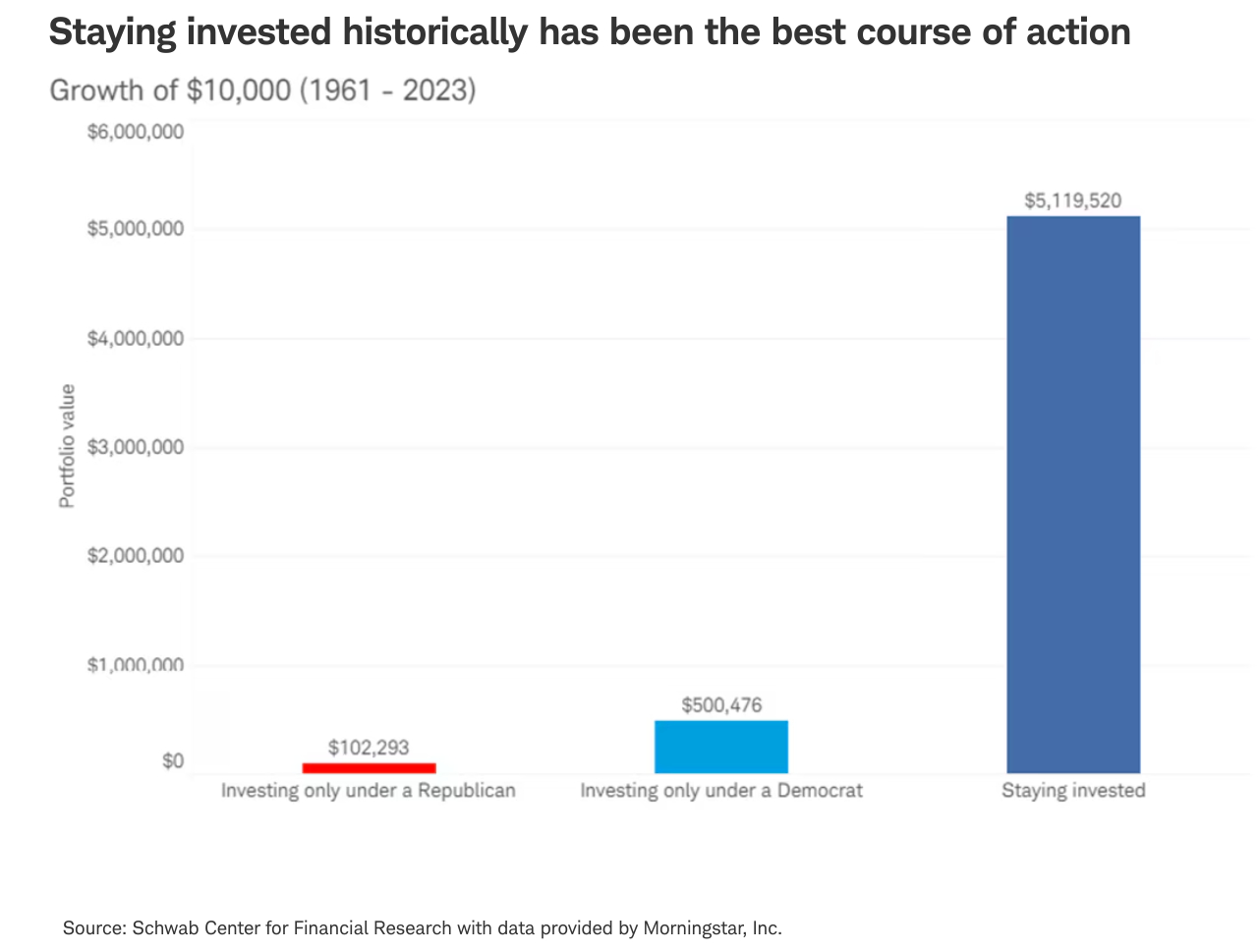

Have a look at the below chart, courtesy of the Schwab Center for Financial Research. Staying invested no matter which party runs Washington has proven to be a superior method for creating wealth.

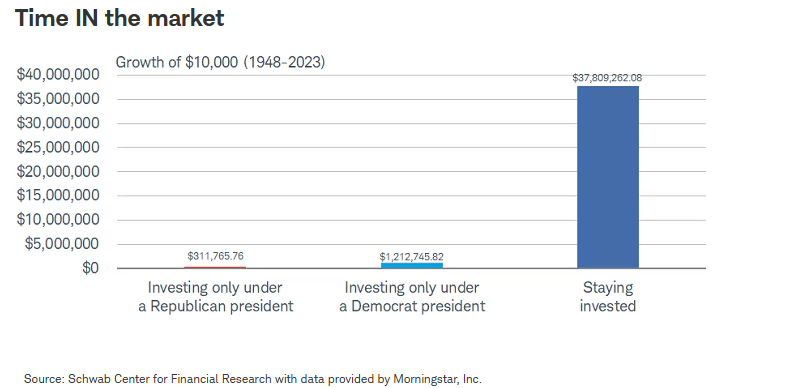

But wait, there's more. Here's another chart from Schwab illustrating the same point going all the way back to 1948.

As for where the market goes from here?

Let's hear from DataTrek again: "The market setup going into Election Day 2024 is one where 1.) Tech drives the S&P much more than in 2016 and 2020; 2.) stocks are evaluating a significant acceleration in earnings growth in the next three to four quarters; and 3.) expected volatility is unusually elevated relative to prior bull market elections."

The real kicker, however, is that the market setup would arguably be the same even if it weren't an election year, DataTrek says.

Markets might prefer some outcomes to others, but they more or less accept reality and then try to figure out how that reality will change in the future. Good luck with that. Happily, the long-term trend for U.S. equities has always been up and to the right.

In the meantime, traders and tacticians will just have to wait like the rest of us normies. Retail investors, as always, would do well to stay frosty.