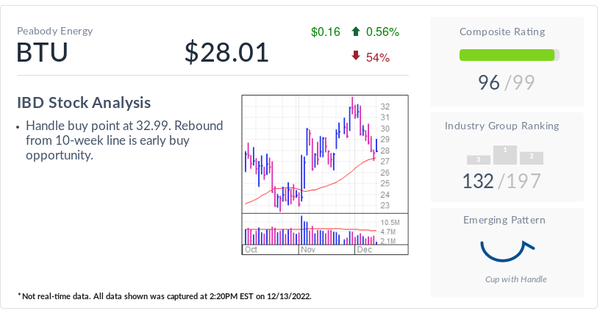

Fortified with 960% earnings growth last quarter and Wall Street forecasts of a 1,431% EPS spike this year, steel producer ATI has forged a spot on the IBD Breakout Stocks Index. ATI stock now aims to fire up a breakout past a handle buy point at 31.84.

ATI is a leading producer of high-performance materials for the global aerospace and defense markets. The Pittsburgh, Pa.-based firm also provides products for the electronics, medical and specialty energy markets.

Working with clients such as Boeing, Lockheed Martin, Northrop Grumman and NASA, ATI helps engineer solutions that fly higher and faster, burn hotter, dive deeper, stand stronger and last longer.

With a 94 Composite Rating, ATI holds the top ranking within the Steel-Specialty Alloys industry group.

See Who Joins ATI On The IBD Breakout Stocks Index

Specialty Steel Leader In Demand Among Top Funds

Attracted by a sharp turnaround in earnings in recent quarters, 42 funds with an A+ rating from IBD have a position in ATI stock.

Prior to posting the 960% spike in earnings growth in Q3, ATI generated four quarters of triple-digit EPS increases. While those gains were based on prior-year quarters that showed a loss, ATI confirmed its rebounding strength with a 960% earnings gain last quarter to 53 cents a share, from 5 cents a year earlier.

Sales growth has also been solid, ranging from 16% to 56% over the last five quarters.

Still in turnaround mode following the rough patch it encountered before its rebound in the second half of 2021, ATI holds a lackluster C SMR Rating, which tracks sales growth, profit margins and return on equity.

ATI Stock Holds Support Near New Buy Point

Mirroring volatility in the market indexes, ATI has battled resistance while forming multiple chart patterns since breaking out of cup with handle in February.

Since retaking its 50-day moving average once again in November, the aerospace and defense industry leader has generally held support at that benchmark line. While forming its current handle, the stock has also found support at its 21-day exponential moving average.

Watch now if ATI can take flight and clear its 31.84 buy point in volume at least 40% higher than normal.

Follow Matthew Galgani on Twitter at @IBD_MGalgani.