Stocks ended mixed Thursday trading as investors parsed a key series of labor market data releases that are likely to define the Federal Reserve's autumn rate path.

The Dow Jones Industrial Average lost 219.22 points, or 0.54%, to finish the session at 40,755.75, while the S&P 500 slipped 0.3% to 5,503.41, while the tech-heavy Nasdaq advanced 0.25% to end the day at 17,127.66.

"September is off to a weak start as the recovery on the S&P 500 stalled near resistance from the July highs," said Adam Turnquist, chief technical strategist for LPL Financial. "Momentum indicators have turned bearish, and signs of defensive leadership have begun to emerge, pointing to more volatility ahead."

Turnquist said that breakdowns in longer-duration Treasury yields, crude oil, and copper, along with a simultaneous breakout in gold, "provide a warning sign of rising risks to an economic soft landing."

Wall Street will be focused on Friday's August non-farm payroll report, which is expected to show 164,000 new hires last month and a headline unemployment rate of 4.2%.

Jeffrey Roach, LPL Financial’s chief economist, said investors should keep an eye on labor force flows.

“The inflow of individuals re-entering the labor force will increase the unemployment rate,” he said. “These flows reveal underlying sentiment about the job market.”

Roach said that the labor market reveals the immigration problem in the U.S., citing the elevated ratio of foreign-born individuals not in the labor force.

“Fewer temporary help jobs could be a sign of caution,” he added.

Updated at 2:24 PM EDT

Friday focus

Stocks are mixed heading into the final hours of trading, with the S&P 500 down 6 points, or 0.1% and the Nasdaq up 74 points, 0.43%, paced by gains for Amazon and Tesla.

The market's larger focus, however, rests on tomorrows' August non-farm payroll report, which is expected to show 164,000 new hires last month and a headline unemployment rate of 4.2%.

The overall reading, however, is likely to cement bets on both the size of the Fed's September rate cut and the path and pace of policy easing over the final three months of the year.

Related: Jobs report to signal timing and size of autumn Fed interest rate cuts

Updated at 11:25 AM EDT

Tesla boost

Tesla (TSLA) shares are moving firmly higher in early trading following an update on the carmaker's FSD 'roadmap' that suggests it could be ready for rollout in Europe and China early next year.

Elon Musk has pinned his hopes for the company on both AI technologies and their ability to deliver autonomous driving on a global scale, with a focus on both traditional EVs and the upcoming fleet of robotaxis.

Tesla shares were last marked 4.3% higher in early trading and changing hands at $228.82 each.

Related: Tesla stock reacts to FSD roadmap ahead of robotaxi hype

Updated at 9:47 AM EDT

Mixed open

The S&P 500 was marked 9 points, or 0.14% higher in the opening minutes of trading, with the Nasdaq up 103 points, or 0.61%, following a modestly positive reading for weekly jobless claims.

The Dow, meanwhile, was down 92 points while the small cap Russel 2000 index was largely unchanged from last night's 2,146 point close.

S&P 500 Opening Bell Heatmap (Sept. 05, 2024)$SPY +0.08%🟩$QQQ -0.10%🟥$DJI +0.02%🟩$IWM +0.01%🟩 pic.twitter.com/FUlP3BHtiy

— Wall St Engine (@wallstengine) September 5, 2024

Updated at 8:35 AM EDT

Solid claims reading

Around 227,000 Americans filed for jobless benefits last week, the Labor Department said, a modestly smaller-than-expected tally that was down 5,000 from the prior reporting period.

Continuing claims, which track those who have already filed and are still receiving benefits, were also lower, falling by 22,000 to 1.838 million.

Stock futures pared earlier declines following the Labor Department release, with the S&P 500 called 6 points lower and the Nasdaq priced for a 60 point decline.

Unit Labor Costs very tame last four quarters pic.twitter.com/Y2Bpgur2K0

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) September 5, 2024

Updated at 8:23 AM EDT

Jobs slump

Payroll processing group ADP's National Employment report for the month of August was notably weaker than forecasts, with just 99,000 private sector hires.

The group's July tally was revised lower, as well, to 111,000 from 122,000, while wage gains for job changers in August eased to a gain of 7.8%.

“The job market's downward drift brought us to slower-than-normal hiring after two years of outsized growth,” said chief economist Nela Richardson. “The next indicator to watch is wage growth, which is stabilizing after a dramatic post-pandemic slowdown.”

Challenger Gray's August layoffs report, meanwhile, showed a 193% surge from July levels to 78,891, a tally that is also 1% higher from the same period last year.

“Cuts are following a very similar trend from last year as ongoing pressures have challenged labor decisions,” said senior vice president Andrew Challenger.

August @ChallengerGray Job Cuts +1% year/year vs. +9.2% prior … tech sector saw largest increase in cut announcements while food industry saw largest decrease pic.twitter.com/jycl5svIXk

— Liz Ann Sonders (@LizAnnSonders) September 5, 2024

Updated at 6:25 AM EDT

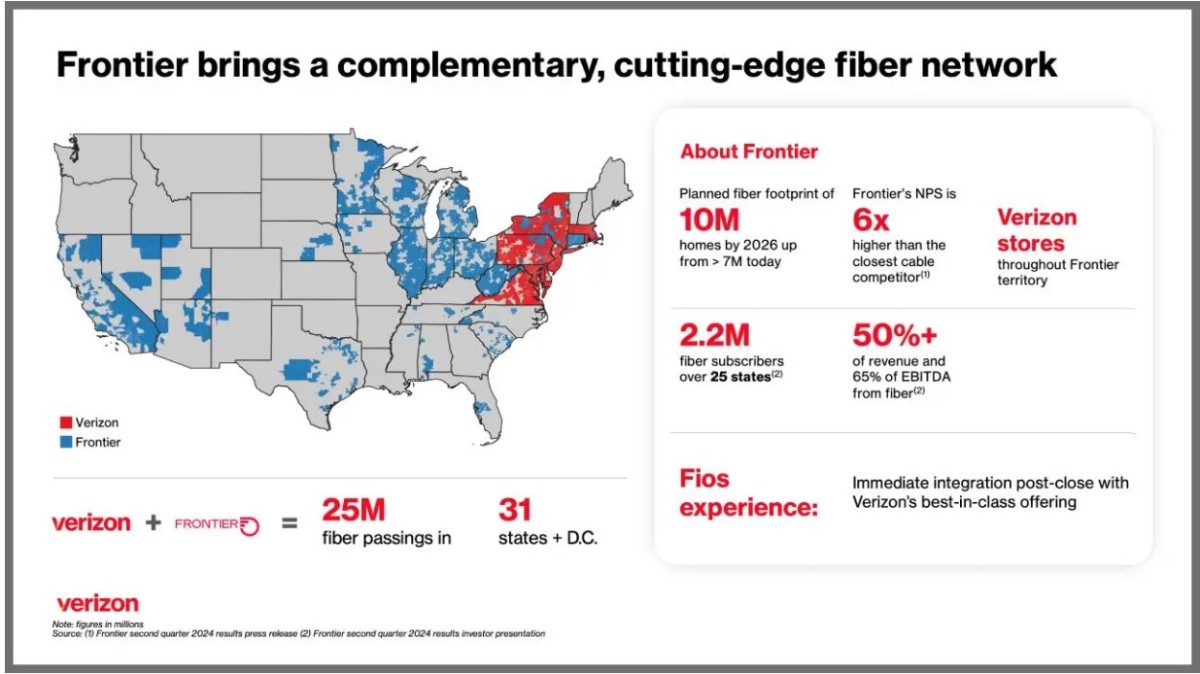

Verizon adds fiber

Verizon Communications (VZ) revealed plans for a $20 billion takeover of Frontier Communications (FYBR) , an all-cash deal that would rapidly expand the carrier's fiber-optic network.

Verizon said it would pay $38.50 a share for Frontier, a 37% premium to the stock's price prior to report of a potential takeover in early September.

Verizon shares were marked 0.75% higher in premarket trading at $41.79 each while Frontier slumped 9.5% to $35 each.

Check back for updates throughout the trading day

Stocks ended mixed Wednesday, with a pullback in tech stocks keeping the Nasdaq in negative territory for the quarter and a modest nudge higher in defensive stocks helping the Dow Jones Industrial Average eke out a meager 38-point gain.

Big moves in the bond market, however, suggest traders are cementing their bets on autumn Federal Reserve interest-rate cuts, particularly after a weaker-than-expected reading for July job openings, which fell to the lowest levels since January 2021.

The CME Group's FedWatch is pegging the odds of an outsized 50 basis point rate cut later this month in Washington at around 45%, and is pricing in at least a full percentage point of easing between now and the end of the year.

Late Wednesday comments from San Francisco Fed President Mary Daly also solidified the case for policy easing, as she told Reuters that keeping rates too high for too long could lead to "additional slowing in the labor market, and to my mind, that would be unwelcome."

Shutterstock

Wall Street's focus is very likely to be focused on that very weakness today with layoff updates from Challenger Gray, ADP's national employment report and weekly jobless claims data from the Labor Department, all of which are set to arrive prior to the opening bell.

Related: Fed rate cuts may not guarantee a September stock market rally

Stock futures were mixed heading into the data releases, with the S&P 500 called 3 point lower and the Dow priced for a 10-point advance. The tech-focused Nasdaq is called 34 points lower.

In the bond market, the yield differential between 2-year and 10-year notes was essentially flat for only the second time in more than two years, with both trading at 3.768% heading into the New York session.

A normalizing of the so-called yield curve suggests investors are betting on a series of Fed rate cuts, which push 2-year yields lower, while also buying longer-date bonds as a defensive tactic against slowing economic growth.

The US (2s-10s) yield curve is on the verge of dis-inverting.#economy #markets pic.twitter.com/qtYHIVCCUt

— Mohamed A. El-Erian (@elerianm) September 4, 2024

In other markets, global oil prices booked modest gains following a report that the OPEC cartel is planning to delay increases to its collective output after crude hit a 14-month low on demand concerns earlier this week.

WTI crude futures for October delivery, the U.S. benchmark which is tightly linked to gasoline prices, was last seen trading 68 cents higher on the session but still below $70 at $69.88 per barrel.

More Wall Street Analysts:

- Analysts reboot Grand Theft Auto maker's stock price target

- American Express stock analyst flags concerning shift in consumer behavior

- Analyst resets Nvidia stock price target before earnings

In Europe, the regional Stoxx 600 benchmark edged 0.1% lower in early Frankfurt trading as markets eyed the spate of U.S. jobs data, while Britain's FTSE 100 rose 0.08%.

Overnight in Asia, the Nikkei 225 fell another 1.05% in Tokyo as the yen rose to a one-month high against the U.S. dollar and held down gains for export stocks. The regionwide MSCI ex-Japan benchmark, meanwhile, was marked 0.33% higher heading into the close of trading.

Related: Veteran fund manager sees world of pain coming for stocks