Stocks ended mixed Wednesday with the S&P 500 and the Nasdaq closing at record highs as the Fed held its benchmark lending rate steady.

The Dow Jones Industrial Average slipped 35.21 points, or 0.09%, to end at 38,712.21, while the S&P 500 gained 0.85% to 5,421.03, and the tech-heavy Nasdaq climbed 1.53% to 17,608.44.

The S&P 500 and Nasdaq both hit all-time highs and posted record closes.

Charlie Ripley, senior investment strategist for Allianz Investment Management, that “in line with widely held expectations, the Fed has left the monetary policy rate unchanged for the seventh consecutive meeting.”

“Inflation appears to be in the eye of the beholder for the Fed as the increase of inflation expectations for the rest of the year looks out of line when reconciled against market expectations,” Ripley said.

“This tells us there is a broader preference from Fed members to risk deploying a more restrictive monetary policy through the end of the year should inflation continue to fall further," he said.

Ripley noted that it is fairly clear the conviction around the path of inflation amongst the Fed is relatively low, "and even though many market participants believe the Fed should begin cutting rates sooner, the Fed has opted to maintain a restrictive stance for most of this year."

"At the end of the day, a calendar is just a mental reference point and the reality is rate cuts are likely closer than they appear," he said.

Updated at 3:33 PM EDT

Late declines

The S&P 500 was last marked 39 points, or 0.74% higher on the session, while the Nasdaq gained 257 points, or 1.52%, into the final half hour of trading as Treasury yields retraced some of their earlier declines following a muted question-and-answer session with Fed Chairman Jerome Powell.

Benchmark 10-year notes yields were last trading at 4.285%, with 2-year notes pegged at 4.755%

It wouldn't be a Powell Fed Day without a sell-off into the close. pic.twitter.com/f2d6U3KHFl

— Bespoke (@bespokeinvest) June 12, 2024

Updated at 2:18 PM EDT

Steady Fed

Related: Fed holds rates steady and pushes back on bets for a September cut

The Fed held its benchmark lending rate steady at between 5.25% and 5.5% Wednesday, but clipped its prior forecast for end-of-year rates cuts as it sees faster core inflation prospects over the coming months.

The Fed's Summary of Economic Projections, better-known as the dot plots, suggest just one quarter point rate cut for this year, compared to a forecast of three that followed its policy meeting in March.

"Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2%," the Fed said in a prepared statement.

U.S. stocks pared earlier gains immediately following the Fed decision, with the S&P 500 marked 50 points, or 0..92%, higher on the session and the Nasdaq marked 291 points, or 1.65%, in the red.

Benchmark 10-year Treasury-note yields rose 2 basis points to 4.282% following the interest rate decision while 2-year notes fell 2 basis points to 4.716%.

Here is the updated set of FOMC economic projections: - GDP unchanged

— Steven Rattner (@SteveRattner) June 12, 2024

- Unemployment projected at 0.1% higher than in March - Inflation projections slightly higher in the short-run pic.twitter.com/DDqIhhCogl

Updated at 12:16 PM EDT

Turbo Tesla

Tesla (TSLA) shares are on pace for one of their strongest session gains in more than three years ahead of a key shareholder vote on CEO Elon Musk's $55.8 billion pay deal and a bold price target from Ark Invest's Cathie Wood.

Wood, a longtime Tesla bull, said Wednesday that she thinks Tesla could be worth $2,000 a share by 2029, a value she ties closely to the group's plans to launch a fleet of autonomous robotaxis.

Musk himself called the target "extremely challenging, but achievable" in a post on the X social media website.

A separate research note from Morgan Stanley's Adam Jonas, meanwhile, raised the notion of Tesla and Musk launching an AI-powered smartphone.

Tesla shares were last marked 5.4% higher on the day at $179.90 each, a move that still leaves the stock down more than 25% for the year.

Related: Top analyst sees Tesla making smartphone as Musk sideswipes Apple

Updated at 10:40 AM EDT

Cat power

Caterpillar (CAT) shares jumped 1.6% in early trading after the industrial equipment maker unveiled plans for a $20 billion buyback and boosted its quarterly dividend by 8%, to $1.41 per share.

$CAT +1.28% after Caterpillar's Board of Directors authorizes the company to add $20B to its share repurchase program. CAT's buyback program now equals $21.8B.

— Hammerstone Markets (@HammerstoneMar3) June 12, 2024

Updated at 9:50 AM EDT

Solid open

The S&P 500 hit a fresh record high of 5,334.88 points in the opening minutes of trading, and was last marked 28 points, or 1.08% higher, while the Nasdaq scaled a new all-time peak and was last trading 267 points, or 1.54%, into the green.

The Dow was last marked 310 points higher, but remains around 1,000 points from its 40,077 point high on May 17.

S&P 500 Opening Bell Heatmap (Jun. 12, 2024)$SPY +0.87% 🟩$QQQ +0.94% 🟩$DJI +0.86% 🟩$IWM +2.57% 🟩 pic.twitter.com/xbwouEG9LB

— Wall St Engine (@wallstengine) June 12, 2024

Updated at 9:25 AM EDT

September bets

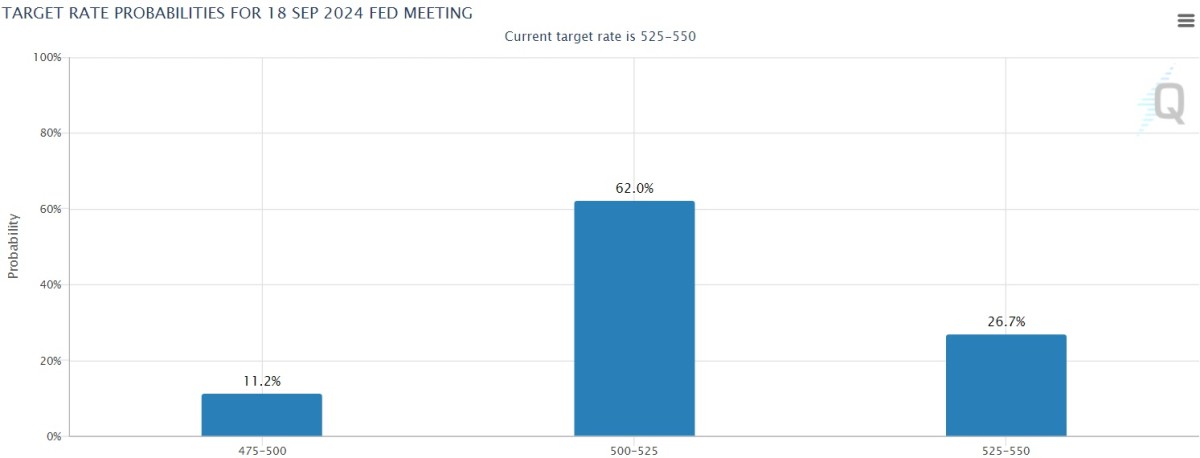

Rate traders are now betting that the Fed will begin the first of two quarter point rate cuts at its autumn policy meeting in September now that inflation appears to be easing towards the central bank's 2% target.

The CME Group's FedWatch pegs the odds of a September cut at around 70%, well up from around 50% prior to the May CPI release, with the odds of a December reduction rising to 72%.

"Markets have taken a sigh of relief following today’s softer than expected inflation print out of the US. Eyes will now be on policy setters at the FOMC to see if this softer print will materially change their interest rate outlook, said Nathaniel Casey, investment strategist at Evelyn Partners.

"However, it is likely committee members will want to see one or two more encouraging inflation reports before committing to their first rate cut," he added.

Updated at 8:45 AM EDT

Inflation shock

The Commerce Department's May inflation report showed the slowest monthly advance in four years, with a rate that was flat to April levels, and a headline rate of 3.3% that topped Street forecasts.

Stocks powered higher on the back of the release, which comes just hours ahead of the Fed's June policy meeting, with the S&P 500 called 40 points higher and the Dow set for a 225 point advance.

Benchmark 10-year note yields fell 10 basis point to 4.293% while 2-year notes fell 13 basis to 4.685%.

The US Inflation Rate has now been above 3% for 38 consecutive months, the longest period of high inflation since the late 1980s/early 1990s.https://t.co/l5IYmkf6Ih pic.twitter.com/HpRXmI24aU

— Charlie Bilello (@charliebilello) June 12, 2024

Stock Market Today

Markets aren't expecting any change in the Fed's benchmark lending rate, which sits at a two-decade high of 5.25% to 5.5%, when the central bank unveils its official statement at 2:00 pm Eastern time, but are focused instead on the new set of growth and inflation projections published by Fed officials each quarter.

The forecasts feed into the so-called Dot Plots, which are a summary of where officials see Fed rates over the coming year and beyond. The last set of Dots, published in March, pointed to three quarter point rate cuts this year.

A series of faster-than-expected inflation reports since then, alongside a robust labor market and an outperforming economy, will likely trigger an overhaul of those forecasts, with today's May CPI update having a heavy influence on the Fed's thinking.

"We expect the longer run fed funds rate will be revised higher, along with the end-of-year rate as rates will likely remain higher for longer," said Jeffrey Roach, chief economist for LPL Financial in Charlotte.

"Inflation is cooling and the Fed should be in a position to begin their rate cutting cycle this year, although the magnitude and speed of cuts will continue to frustrate investors," he added.

Wall Street expects to see the headline reading hold at an annual rate of 3.4%, but ease notably, to 0.1%, when compared to April levels.

So-called core inflation, which strips out volatile food and energy prices, is likely to ease to 3.5% on the year and hold at 0.3% on the month.

Treasury yields are steady ahead of the 8:30 am Eastern time report, with benchmark 10-year note yields trading at 4.402% and 2-year notes pegged at 4.83%.

Stocks on Wall Street, which closed at a fresh record high last night, are set for a modestly firmer open heading into the CPI report and the early afternoon Fed rate decision, with futures tied to the S&P 500 suggest a 6 point advance.

Futures contracts tied to the Dow Jones Industrial Average, meanwhile, are priced for a 20 point gain while those linked to the Nasdaq suggest a 26 point bump.

Stocks on the move include Oracle (ORCL) , which surged 8.6% following a mixed set of fourth quarter earnings that were offset by a new cloud deal with Google (GOOG) and OpenAI.

Apple (AAPL) , which added around $180 billion in market value yesterday tied to the release of its new AI toolkit, and closed at a record high of $207.15 each, was marked 0.38% lower in premarket trading.

Broadcom (AVGO) were marked 1.6% higher ahead of the network equipment maker's second quarter earnings after the closing bell, with analysts looking for a bottom line of $10.84 per share on revenues of $12.03 billion.

More Wall Street Analysts:

- Analyst revamps Microsoft stock price target despite controversy

- Analysts reset Nio stock price targets after earnings

- Dollar Tree’s new price strategy prompts analysts to revise targets

In overseas markets, Europe's region-wide Stoxx 600 was marked 0.46% higher in Frankfurt, with Britain's FTSE 100 rising 0.69% in mid-day London trading.

Overnight in Asia, the Nikkei 225 slipped 0.66% in cautious trading ahead of today's CPI report and Fed rate decision, while the regional MSCI ex-Japan benchmark was up 0.24% into the close of trading.

Related: Veteran fund manager picks favorite stocks for 2024