U.S. stocks printed their second consecutive record high Thursday, while the dollar peeled back from its strongest single-day gain in two years, as investors looked to reset forecasts for growth, inflation and Federal Reserve rate cuts following the likely 'Red Sweep' election victory for former President Donald Trump.

The S&P 500 finished 44 points, or 0.74% higher to close at a fresh all-time peak of 5,973.1 points, a move that extends the benchmark's 2024 gain to around 22%.

More gains for megacap tech stocks, and a pullback in Treasury yields, helped the Nasdaq to a 285 point, or 151% gain, taking it to a new record high of 19,269.46 points.

Bank stock declines, lead by a 4.3% slump for JPMorgan JPM, kept the Dow effectively unchanged on the day, with the last settlement indicating a modest 0.59 point decline.

Stocks got a late-session boost from a relatively uneventful Fed decision and press conference from Chairman Jerome Powell, which seemed more focused on the impact of former President Trump's economic plans, and the pair's ability to work together, than the central bank's assessment of growth and inflation.

"It’s no surprise that Chairman Powell did his best to deflect political-based questions and speculation, reaffirming that the Fed is apolitical — as it should be," said Brent Kenwell, U.S. investment analyst a eToro. "Investors should remain confident with Powell remaining as Fed chairman, given the progress the committee has made on inflation without sacrificing the US economy."

"Powell would not tip his hand on whether the Fed would likely cut rates in December, which shouldn’t surprise investors," he added. "However, the Fed appears more comfortable with the labor market and the current US economic backdrop than they did a few months ago."

Updated at 3:23 PM EST

You can't fire me (and I won't quit)

Powell came out swinging when asked if he was concerned about being removed or demoted as Fed Chair under a new Trump administration, said such a move would be illegal.

"Not permitted under law," Powell responded tersely to a question from two reporters at his regular briefing. "Not permitted under law."

He had earlier said he would not leave his position if asked by the new President or any of his advisors.

Powell, with a grim face, answers "not permitted under the law" when asked whether the President has the power to remove the Fed Chair or a Governor.

— Axel Merk (@AxelMerk) November 7, 2024

Which, I suppose, answers the other question: has the Fed looked into this?

Not asked: why did you look into this?

Updated at 2:44 PM EST

Don't know, don't tell

Fed Chair Jerome Powell refused to be drawn into a discussion as to how, or when, policies from the new Trump administration would start to affect its interest rate decisions or growth and inflation forecasts.

"In the near term the election will have no effects on our policy decisions," he told reporters during his regular press conference in Washington. "We don't guess, we don't speculate, we don't assume" what policies will get put into place" that could change the Fed's forecasts.

LIVE NOW: Press conference with #FOMC Chair Powell: https://t.co/1uJrua5qsH and https://t.co/FJa6TbkDMt

— Federal Reserve (@federalreserve) November 7, 2024

Updated at 2:15 PM EST

Fed delivers

The Federal Reserve lowered its benchmark lending rate for a second consecutive time Thursday, but hinted that it may pay closer attention to the recent tick higher in inflation pressures as it prepares new growth and inflation forecasts for the coming year.

U.S. stocks pared earlier gains following the Fed statement, with the S&P 500 last marked 34 points, or 0.39%, higher on the session. The tech-focused Nasdaq, meanwhile, rose 252 points, or 1.33%, while the Dow was last marked 20 points to the upside.

Benchmark 10-year Treasury note yields, which have risen more than 80 basis points since the Fed's last cut in late September, were little-changed at 4.361%.

The Fed will meet again in December, for its final policy decision of the year, and will publish fresh growth and inflation forecasts for the next two years.

The Fed cut rates by 25 bps, as expected. The decision was unanimous this time.

— Nick Timiraos (@NickTimiraos) November 7, 2024

The FOMC statement had minimal changes. pic.twitter.com/AaAJft7kUY

Updated at 1:28 PM EST

Fed on deck

A pullback in Treasury bond yields is helping stocks build on yesterday's record-setting rally into the Fed rate decision, expected at 2:00 pm Eastern time, with the S&P 500 ups 38 points, or 0.64% on the session.

Benchmark 10-year note yields were last marked 9 basis points lower from overnight levels at 4.347%, while the dollar index fell 0.65% from yesterday's multi-month peak to 104.409.

"Expectations for a 25 basis point rate cut is nearly 100% in the futures market but there’s a lurking concern that future easing may be stymied by higher deficits coupled with potentially higher inflation that are generally perceived to be the downside to the pro-growth Trump platform," said Quincy Krosby, chief global strategist for LPL Financial in Charlotte.

"Although the Fed isn’t going to respond to the possibility of higher tariffs and a package of tax cuts that could lead to an already unwieldy deficit, the Treasury market appears poised to be factoring in more than just the addition of favorable economic data into yields," she added.

10yr yield $TNX is now 5bps below where it was right before the NFP report pic.twitter.com/LrvpkiI1xq

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 7, 2024

Updated at 10:59 AM EST

Showtime!

Warner Bros. Discovery (WBD) shares soared to the highest levels since February in early trading after the media and studio group posted a surprise earnings boost from Olympic ad spending and said a new Trump administration could pave the way to more mergers in the sector.

CEO David Zaslav said a new FTC regulator would be "a positive and accelerated impact on this industry", adding that it could ""bring a pace of change and opportunity for consolidation".

Warner Bros. Discovery shares were last marked 15% higher on the session at $9.64 each, but are still down around 17% for the year.

Warner Bros. Discovery DTC Subscribers $WBD pic.twitter.com/63WidUxoED

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) November 7, 2024

Updated at 9:35 AM EST

Modest bump

The S&P 500 was marked 24 points, or 0.41% higher in the opening minutes of trading, with the Nasdaq rising 131 points, or 0.69%.

The Dow added 9 points to last night's record close while the mid-cap Russell 2000 slipped 5 points, or 0.22%.

S&P 500 Opening Bell Heatmap (Nov. 07, 2024)$SPY +0.40%🟩$QQQ +0.67%🟩$DJI +0.06%🟩$IWM -0.05%🟥 pic.twitter.com/eku05d2GRp

— Wall St Engine (@wallstengine) November 7, 2024

Updated at 8:38 AM EST

Still working

Around 221,000 Americans filed for first-time unemployment benefits last week, the Labor Department reported, a modest 3,000 increase from the prior period that largely matched Wall Street forecasts.

The four-week average, however, fell by around 9,000 to 227,250, suggesting solid underlying strength in the still-resilient job market that was clouded by the storm and strike impacts to last month's non-farm payrolls report.

That said, hiring does appear to be softening, as the level on continued claims, which are reported a week in arrears, rose by 39,000 to $1.892 million.

Initial Claims 4-week moving average rolls off hurricane impacts - lowest since late September. pic.twitter.com/lhxz4clsGI

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 7, 2024

Updated at 7:08 AM EST

London cut

The Bank of England, as expected, lowered its key Bank Rate by 25 basis points today in London, taking it to 4.745%, but said it sees higher inflation pressures ahead following last week's budget statement from the new government's finance chief.

The Bank said "we can't cut interest rates too quickly or by too much" given the economic uncertainty, but noted that "if the economy evolves as we expect it's likely that interest rates will continue to fall gradually from here."

Finance minister Rachel Reeves issued the Labour government's first budget last week which included big increases for taxes, spending and overall borrowing.

The Monetary Policy Committee voted by a majority of 8-1 to reduce #BankRate to 4.75%. Find out more in our #MonetaryPolicyReport: https://t.co/lEYCgPolsz pic.twitter.com/bX4TpXQqB6

— Bank of England (@bankofengland) November 7, 2024

Stock Market Today

Stocks surged higher Wednesday, lifting all three major benchmarks to fresh all-time highs, lead by a 1,500-point advance for the Dow Jones Industrial Average that extended its 2024 gain to just under 16%.

Bank stocks paced the advance, with the financial sector notching its best gain in two years, as investors bet that looser regulations would stoke merger activity and allow for freer lending and fewer balance sheet restrictions.

The prospect of a second Trump administration, however, coupled with what appears to be Republican control of both House of Congress, has investors concerned over the size of next year's Federal Budget. Trump's vow to impose massive tariffs on imported goods its also seen as likely to revive inflation pressures while slowing domestic and global growth prospects.

"Whether this rally will be short-lived remains to be seen," said Lindsay James, investment strategist at London-based Quilter Investors.

"Lower corporate taxes and lighter regulation might be early wins for business, but there are long-term dangers, including potential interference at the Federal Reserve and inflationary pressures from trade tariffs and mass deportations, which could significantly impact ordinary Americans," she said. "Ironically, Trump’s supporters, who have blamed inflation for making them poorer under the Biden administration, might face further economic challenges."

“It could be a case of ‘buy now, pay later’ with bond yields already climbing and a strong dollar hurting exporters who will soon likely face their own barriers to trade as countries retaliate," she added.

That's lead to a major, an ongoing selloff in the bond market, with benchmark 10-year note yields now more than 80 basis points higher than they were when the Fed made its outsized half-point rate cut in September.

Benchmark 10-year note yields were holding steady at 4.426% heading into the start of New York trading, but a mixed auction of $25 billion in 30-year bonds yesterday, which saw a big pullback from foreign buyers, hinted an near-term risks for the $27 trillion market.

Rate-sensitive 2-year note yields were last marked at 4.241% while the U.S. dollar index slipped 0.18% against a basket of its global peers to 104.891.

Focus in Thursday's session is likely to switch to the Fed's November rate decision, expected at 2:00 pm Eastern time, and its projections for policy heading into the final month of the year and beyond.

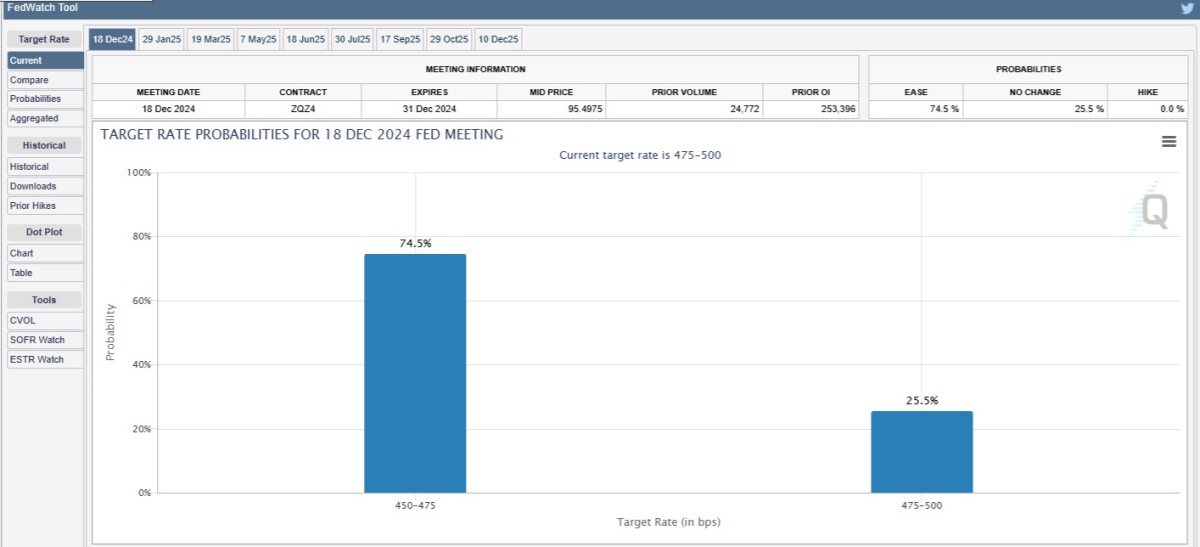

Traders fully expect the Fed to deliver on another quarter-point cut today, taking the Fed Funds rate to between 4.25% and 4.5%, but are paring bets on a December reduction given the new fiscal and trade policy risks from the Trump administration.

Related: Trump election win may put Fed interest rate cuts at risk

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which closed at a record high 5,929.04 points last night to extend its year-to-date gain to around 21.2%, suggest a modest 10 point opening bell gain.

The Dow, meanwhile, is called 115 points higher with the tech-focused Nasdaq priced for a 40 point gain.

Qualcomm (QCOM) shares were a notable early mover, rising 8.2% to $187.10 each after the chipmaker posted stronger-than-expected fourth quarter earnings and issued a solid near-term forecast.

More Wall Street Analysts:

- Analysts reboot Snap stock price target after earnings

- Analysts reset Meta stock price target after earnings

- Analysts update Reddit stock price target after earnings

In overseas markets, Britain's FTSE 100 was marked 0.05% higher in early London trading ahead of a Bank of England rate decision later in the session.

Traders expect a quarter point reduction in the key Bank Rate, only the second in two years, but stubborn inflation pressures could prevent the central bank from further cuts into early 2025.

Overnight in Asia, the regional MSCI ex-Japan benchmark rose 0.78% into the close of trading, while Japan's Nikkei 225 ended 0.25% lower in Tokyo.

Related: Veteran fund manager sees world of pain coming for stocks