Stocks ended higher Friday, with the Dow and the S&P 500 notching fresh records, amid a bullish mix of solid economic data and impressive corporate earnings.

The Dow Jones Industrial Average gained 36 points, or 0.09%, to end the session at 43,275.91, while the S&P 500 climbed 0.40%, to close at 5,864.67 and the tech-heavy Nasdaq rose 0.63% to finished the day at 18,489.55.

The S&P 500 and Nasdaq are up around 0.6% week to date, while the Dow has climbed 0.5%, according to CNBC, and the three major averages were headed for their sixth straight positive week.

That would mark the longest string of weekly advances in 2024 for both the Dow and S&P 500.

“The markets' collective climb higher can't be disputed but there are lingering questions hovering over the markets' trajectory as geopolitical risk edges higher including ever more warnings from Beijing towards Taiwan and worries that the conflict in the Middle East widens on a more precarious path,” said Quincy Krosby, chief global strategist for LPL Financial.

Although a heavy package of economic data releases has assuaged fears of a more serious cooling of the economic landscape, Krosby said the market, still priced for perfection, will need the heavy ammunition that only the hyperscalers underpinned by the “insane” demand from the AI infrastructure cohort.

"A corollary to specific AI-related concerns is whether the market can continue to climb higher without mega-tech participation, despite the current broadening out of the market," he said. "It is highly unlikely that investors and traders alike will feel the anxiety of missing out if the technology sector delivers weaker than expected numbers and softer guidance."

Krosby added that a pullback as we inch closer to overbought technical conditions could offer a modicum of support "as we enter a crucial week for earnings and move closer to what big tech reports and even more important, what big tech sees ahead. "

Updated at 12:29 PM EDT

Big week ahead

Stocks are holding gains into the afternoon session, with the S&P 500 up 18 points, or 0.32% and the Nasdaq rising 100 points, or 0.5%.

With bond markets holding steady, pegging 10-year notes at 4.075%, and falling back under the $20 mark to $18.24 in CBOE trading, focus is now likely to shift to next week's earnings slate, when 114 S&P 500 companies are expected to publish third quarter updates.

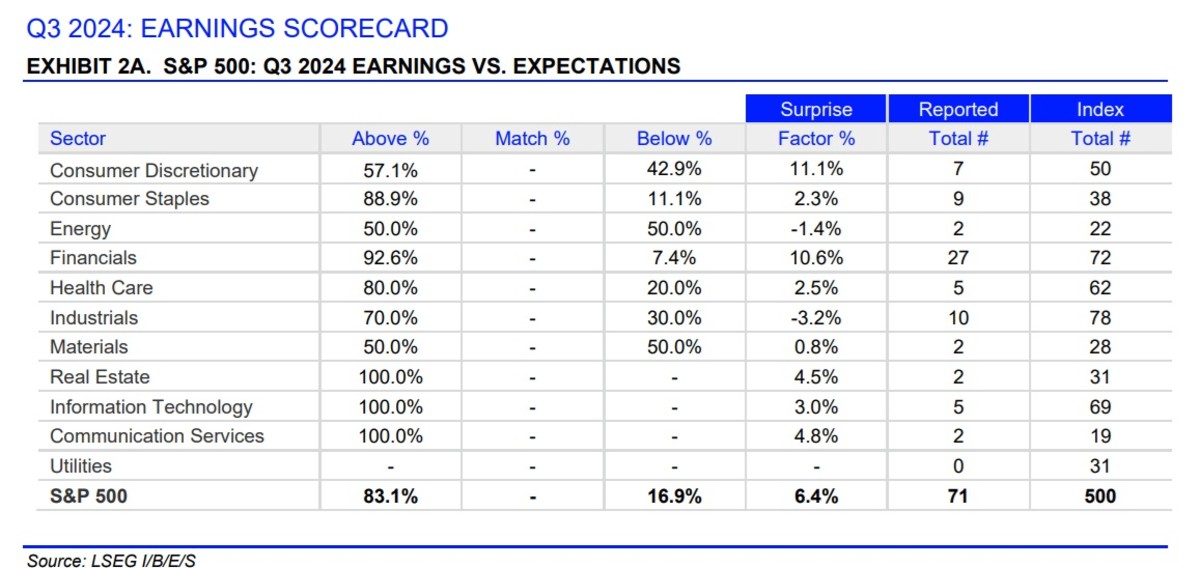

LSEG data suggests collective profits for the benchmark are likely to rise 4% from last year to a share-weighted $506.6 billion. That pace will likely accelerate to 11.9%, however, over the final three months of the year.

Updated at 11:13 AM EDT

Banking on it

JPMorgan (JPM) shares edged higher, pacing late-week gains for banking stocks that have separated themselves from the broader market following a string of stronger-than-expected third quarter earnings reports.

JPMorgan shares are up more 8.4% over the past month, with Morgan Stanley (MS) climbing more than 20% , Goldman Sachs Group (GS) gaining 8.9%, Citigroup (C) up 5.25% and Bank of America (BAC) up 6.8% over the same timeframe.

That compares to a 4.25% gain for the S&P 500 and a 5.2% gain for the tech-focused Nasdaq.

"At a high level, results have been good enough to drive the broader banking space to year-to-date highs," said Adam Turnquist, chief technical strategist at LPL Financial. "The return of animal spirits in deal making has been a major theme as investment banking revenue surged across most major banks."

"A jump in asset management fees, better-than-expected sales and trading activity, and improving net interest income outlooks have been other key themes of the reporting season thus far," he added.

Updated at 9:36 AM EDT

Mixed open

The S&P 500 was marked 10 points, or 0.18% higher in the opening minutes of trading, with the Nasdaq up 104 points, or 0.57%, thanks in part to a solid early gain for Apple AAPL.

The Dow was marked 110 points lower while the mid-cap Russell 2000 inched 4.5 points, or 0.2%, into the green.

Updated at 8:37 AM EDT

Housing stops

The Commerce Department said housing starts fell by 0.5% in September, reversing a big August gain and slowing to an annual rate of 1.354 million units. Permits for new construction, a key indicator of demand, were down 2.9% to 1.428 million.

Updated at 7:06 AM EDT

CVS ill-health

CVS Health (CVS) plunged in premarket trading after the health insurance and pharmacy giant pulled its full-year profit forecast and replaced its CEO amid the ongoing impact of a pullback in Medicare and Medicaid reimbursements.

"In light of continued elevated medical cost pressures in the Health Care Benefits segment, investors should no longer rely on the company’s previous guidance provided on its second quarter 2024 earnings call on August 7, 2024," CVS said.

CVS Health shares were marked 11.6% lower in premarket trading to indicate an opening bell price of $56.30 each, a move that would extend the stock's year-to-date slump to around 35%.

Related: CVS Health stock crushed as Medicare Advantage hit triggers big changes

Stock Market Today

The Dow Jones Industrial Average recorded its fourth record close of the past five sessions last night, rising 161 points on the session to lead gains for the three major benchmarks.

The S&P 500, which saw its gains for the session fade amid another leg higher in Treasury bond yield tied in part to stronger-than-expected retail sales data an a big decline in weekly jobless claims, remains tantalizingly close to the 6,000 point mark as it rides a third quarter gain of around 1.4%.

Stocks could book further gains into the close of the week, with an eye on next week's busy earnings slate, after China unveiled a major round of economic stimulus aimed at meeting the government's full-year GDP-growth targets.

China's economy grew at a 4.6% clip over the third quarter, the slowest pace of gains in more than a year, and its housing market is suffering one of its worst slumps since 2015.

Stimulus news boosted overseas stocks, with benchmarks in China rising more than 3.5% and the regional MSCI ex-Japan benchmark rising 1.52% into the close of trading.

On the flip side, another move higher in Treasury yields, which have risen around 50 basis points since the Federal Reserve's September rate cut, could blunt equity market performance as investors worry about resurgent inflation and the political risks tied to a deadlocked presidential election.

Related: Bond markets are heaving as Fed interest rate bets swing

Benchmark 10-year Treasury note yields were last marked at 4.097%, close to the cycle high of 4.106%, while 2-year notes were trading at 3.969% heading into the start of the New York session.

On Wall Street, futures contracts tied to the S&P 500 suggest a 9 point opening bell gain, with those linked to the Dow priced for a modest 10 point bump.

More Wall Street Analysts:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

- Analyst reboots Reddit stock price target ahead of earnings

Netflix (NFLX) shares were a notable early mover, rising 5.6% to $687.65 each after the streaming media group topped third-quarter-earnings forecasts and added a better-than-expected 5 million new subscribers over the three months ended in September.

Nvidia (NVDA) , meanwhile, extended its recent run of gains, following its fresh all-time high yesterday tied to the stronger-than-expected earnings and outlook from chip contractor Taiwan Semiconductor (TSM) .

Related: Veteran fund manager sees world of pain coming for stocks