Stocks finished higher Tuesday, as investors clawed back some of yesterday's tech-led declines while eyeing developments in the middle east and a major selloff in China.

The Dow Jones Industrial Average rose 126.13 points, or 0.30%, to finish the session at 42,080.37, while the S&P 500 gained 0.97% to 5,751.13 and the tech-heavy Nasdaq jumped 1.45% to end the day at 18,182.92.

Oil prices were falling amid concerns about concerns about the conflict in the Middle East.

"Over the last week, price recovered to End of August levels after geopolitical risk premium surged following Iran's strike on Israel," Vikas Dwivedi, global energy strategist at Macquarie. "The concern over a potential Israeli strike on Iranian oil infrastructure initiated the rally which was further aided by large, speculative short-covering."

"We anticipate additional volatility as the market weighs bearish fundamentals against supply risk due to rising Middle East tensions," Dwivedi added. "Ultimately, we expect a correction in 4Q24 as large S/D surpluses start to realize."

The analysts said that the aforementioned bearish fundamentals are due to late year US supply growth, the partial return of OPEC+ barrels, and soft oil demand led by distillate demand weakness in addition to demand displacement via LNG truck switching in China and from biofuels in the US.

Updated at 11:38 AM EDT

We're #2!

Nvidia shares are extending their solid autumn run, rising more than 24% over the past month to overtake Microsoft MSFT as the world's second-most valuable company with a market cap of just over $3.25 trillion.

A robust update on GPU deliveries from Super Micro SMCI, which uses Nvidia chips in its liquid-cooled servers, as well as a solid quarterly earnings from Foxconn and the ongoing AI demand boom have supported Nvidia shares for much of the past two sessions, while a update from Morgan Stanley on the Blackwell production ramp is adding to the stock's bullish thesis.

Nvidia shares were marked 3.5% higher in premarket trading to indicate an opening bell price of $132.18 each

Related: Analysts update outlook for Nvidia's Blackwell chips amid AI boom

Updated at 9:35 AM EDT

Solid open

The S&P 500 was marked 25 points, or 0.43% higher in the opening minutes of trading, while the Nasdaq gained 98 points, or 0.56%.

The Dow took back 15 points from last night's decline while the mid-cap Russell 2000 index rose 0.44 points, or 0.02%.

S&P 500 Opening Bell Heatmap (Oct. 08, 2024)$SPY +0.44%🟩$QQQ +0.45%🟩$DJI +0.21%🟩$IWM -0.10%🟥 pic.twitter.com/HGRLKUMGgl

— Wall St Engine (@wallstengine) October 8, 2024

Updated at 8:40 AM EDT

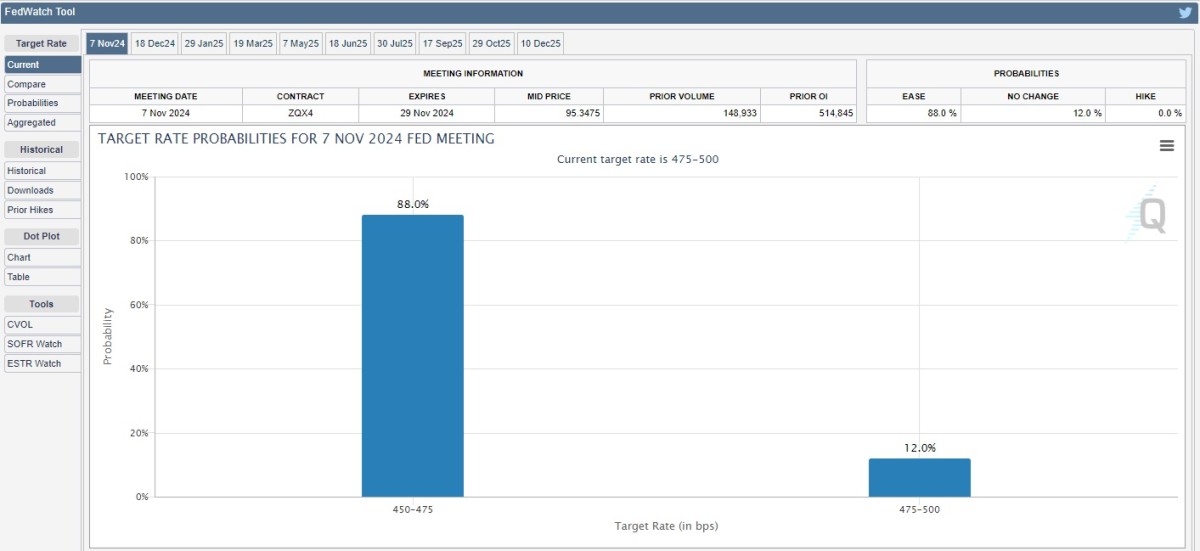

Rate patience

New York Fed President John Williams told London's Financial Times that he would support lowering rates "over time", adding that markets shouldn't take September's outsized half point reduction as a template for future decisions.

In an interview published Tuesday, Williams said that current rates are "well positioned" against the Fed's recent summary of economic projections, which sees easing inflation pressures against slower growth and softening labor markets. "It's a very good base case with an economy that’s continuing to grow and inflation co% ming back to 2%," he said.

Updated at 7:21 AM EDT

No fizz

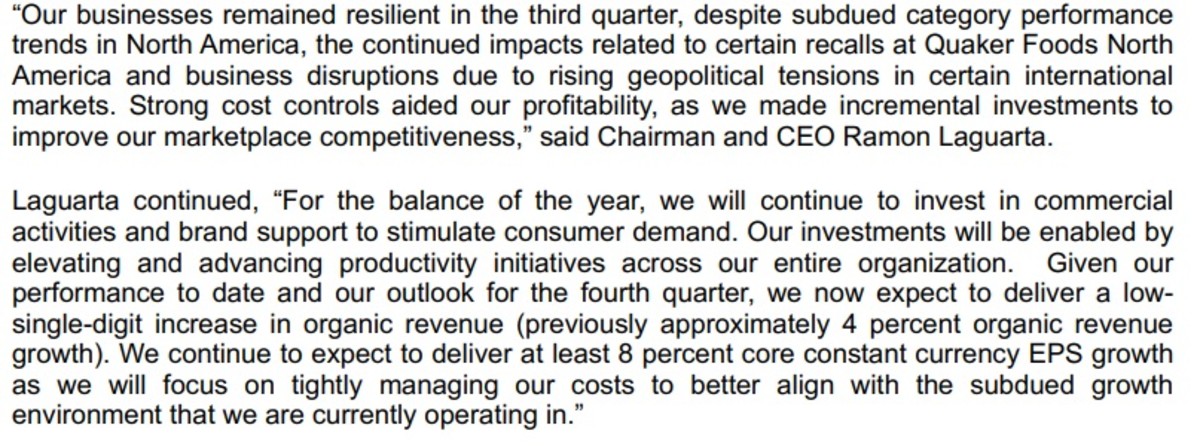

PepsiCo (PEP) shares slipped in premarket trading after the drinks and snacks group cut its full-year sales forecast following a muted earnings report.

PepsiCo posted a 0.6% decline in revenue over the three months ending on September 7, the group's fiscal third quarter, and said full-year sales would rise by "low single digits", down from its prior estimate of a 4% gain.

PepsiCo shares were marked 1.2% lower in premarket trading to indicate an opening bell price of $165.23, a move that would extend the stock's six-month decline to around 3%

Check back for updates throughout the trading day`

Stocks ended firmly lower on Monday, with the S&P 500 falling just under 1% and the Nasdaq sliding 1.18% following a series of downgrades on big tech names from Wall Street analysts, including Apple (AAPL) , Amazon (AMZN) and Google parent Alphabet (GOOGL) , that blunted investor sentiment.

A sharp move higher in Treasury bond yields, as well as a supply-concern rally in oil tied to the ongoing war in the middle east region, added to the session's downbeat tone. The benchmark Vix volatility index touched the highest levels since early September.

Focus in Tuesday's session is likely to remain tied to the bond market, with a $58 billion auction of new 3-year notes expected later today, the first of three coupon sales expected to raise $117 billion this week.

Benchmark 10-year note yields were marked at 4.014% heading into the start of the New York trading session, with 2-year notes pegged at 3.965%.

The U.S. dollar index, which tracks the greenback against a basket of six global currency peers, was marked 0.15% lower at 102.384.

On Wall Street, stocks are set for a modest bump at the start of trading, with the S&P 500 priced for an opening bell gain of around 22 points and the Dow Jones Industrial Average called 40 points to the upside.

Related: Goldman Sachs analyst overhauls S&P 500 targets for 2024 and 2025

The tech-focused Nasdaq, meanwhile, is priced for a 95-point opening bell gain thanks to premarket advances for Nvidia (NVDA) , Tesla (TSLA) and Advanced Micro Devices (AMD) .

Other stocks on the move include Honeywell (HON) , which was marked 2.8% higher following a report from The Wall Street Journal that suggested it could spin off its advanced materials division.

In overseas markets, European stocks remained stuck in the red following yesterday's weak session on Wall Street and the selloff in Asia stocks overnight, with the Stoxx 600 marked 0.82% lower in early Frankfurt trading.

More Wall Street Analysts:

- Analysts revise Corning stock price targets after investor meeting

- Analysts retool Carnival stock price targets ahead of earnings

- Analyst revisits Costco stock price target, rating ahead of earnings

China's chief economic planner, Zheng Shanjie, briefed reporters in Beijing on the government's stimulus plan. But he provided little detail as to how it would direct the billions in new support it has planned in order to meet aggressive growth targets for the year.

That triggered a big reversal of gains around the region, and although benchmarks in Shanghai and Shenzhen posted solid gains after the Golden Week holiday break, stocks in Hong Kong fell 9.4% by the close, the biggest single-day decline since 2008.

Japan's Nikkei 225, meanwhile, ended 1% lower in Tokyo as tech stocks weakened and the yen found favor against the dollar during the broader Asia selling.

Related: The 10 best investing books, according to our stock market pros