U.S. stocks closed firmly lower Thursday amid one of the biggest bond market rallies of the year, as investors grow increasingly worried that the Federal Reserve may have waited too long to ease its key lending rate and increased the risk of recession.

The S&P 500 ended 76 points lower, or 1.37%, with the tech-focused Nasdaq leading major index declines with a slump of 405 points, or 2.3%. The gave back nearly 500 points by the close of the session.

Benchmark 10-year Treasury note yields fell 9 basis points to 3.969%, dipping under the 4% threshold for the first time since February, while 2-year notes hit a six-month low of 4.177%.

"With a package of data released today suggesting the economy is cooling at a faster - and perhaps too fast - pace, the drop in the ten-year Treasury yield to below 4% reflects a looming economic growth scare and further questions whether the Fed is correct in waiting until September to begin its easing cycle," said LPL Financial's chief global strategist Quincy Krosby.

"The market remains hyper mindful that the Fed waited too long to begin raising interest rates as it now wonders if the Fed is too late in transitioning monetary policy," she added.

S&P 500 Closing Bell Heatmap (Aug. 01, 2024)$SPY -1.41%🟥$QQQ -2.40% 🟥$DJI -1.21%🟥$IWM -3.23%🟥 https://t.co/kKM7sod3aN pic.twitter.com/nfRJix1hcz

— Wall St Engine (@wallstengine) August 1, 2024

Updated 1:50 PM EDT

Extending declines

Wall Street is resetting a host of rate and value assumptions following the Fed's dovish rate signaling and a weak ISM manufacturing reading for the month of July that underscored concerns for the growth prospects of the world's biggest economy.

The S&P 500 was last marked 96 points, or 1.76% lower on the session, extending an intraday swing of more than 140 points, with the Dow 640 points and the Nasdaq falling 477 points, or 2.7%.

Looking for a day in past few years when $SPX opened green and closed > 2.5% off morning highs.

— Tom Hearden (@followtheh) August 1, 2024

Can't find it.

Updated 11:48 AM EDT

Not working

The S&P 500 has swung more than a hundred points since the ISM reported a weaker-than-expected reading for manufacturing activity over the month of July earlier this morning, and was last marked 62 points, or 1.13% lower on the session.

The Dow is down more than 500 points on the day, with the Nasdaq falling 290 points, or 1.65%.

"The latest weak data releases command attention to the downside risks to the (economic) outlook," said Comerica's chief economist Bill Adams. "If the economy weakens more than expected, the Fed could cut rates more aggressively than in our baseline forecast", which calls for two cuts between now and the end of the year.

Related: The Fed's biggest problem isn't inflation anymore

Updated 11:07 AM EDT

Red sea

Stocks are turning sharply lower heading into the mid-day session, with investors focused on weakening growth and job market data that has triggered a sharp pullback in Treasury yields.

Benchmark 10-year Treasury note yields fell below the 4% mark for the first time since February, and were last trading 10 basis points lower on the session at 3.969% following the jump in weekly jobless claims and a rough reading for July manufacturing activity from the ISM.

The S&P 500 is now down 37 points, or 0.67% on the session, with the Dow falling 400 points and the Nasdaq down 162 points, or 0.93%.

BREAKING: The Dow Jones Industrial Average just fell 500+ points in 45 minutes.

— The Kobeissi Letter (@KobeissiLetter) August 1, 2024

This came after the ISM Manufacturing Index fell to 46.8, its lowest level since August 2023.

Markets are worried that the US is heading into a recession. pic.twitter.com/OAIyS1hrks

Updated at 9:45 AM EDT

Solid open

The S&P 500 was marked 34 points higher, or 0.62%, in the opening minutes of trading, with the Nasdaq rising 110 points, or 0.63%.

The Dow, meanwhile, was marked 160 points while the small cap Russell 2000 gained 5 points, or 0.24%.

Benchmark 10-year Treasury note yields, meanwhile, were flirting with the 4% threshold and changing hands at 4.008%, while 2-year notes hit a multi-week low of 4.239%.

S&P 500 Opening Bell Heatmap (Aug. 01, 2024)$SPY +0.47%🟩$QQQ +0.36% 🟩$DJI +0.42%🟩$IWM +0.23%🟩 pic.twitter.com/XA3ZjQAUIs

— Wall St Engine (@wallstengine) August 1, 2024

Updated at 8:36 AM EDT

Cooling labor market

Weekly jobless claims jumped higher over the period ending on July 27, with 249,000 Americans filing for unemployment benefits, a 14,000 increase from the prior reading.

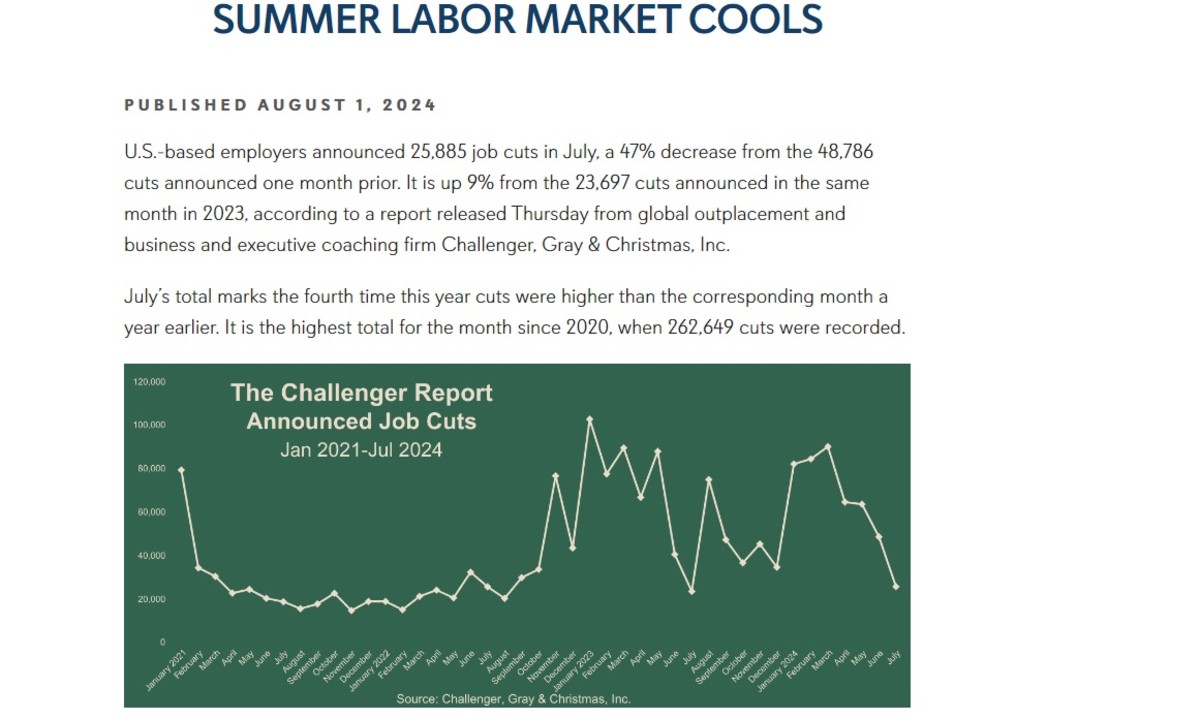

Challenger Gray, meanwhile, noted that job cuts rose for a fourth time this year (on an annual basis) in July, taking the year-to-date total to 460,530. That's down 4.4% from last year, but overall hiring is running at the slowest pace since 2012, the report noted.

Updated at 7:58 AM EDT

Long-awaited release

Evan Gershkovich, a reporter for The Wall Street Journal who has been held on espionage charges in Russia for the past 18 months, was released in a prisoner swap with the U.S., according to multiple media reports.

Gershkovich, who was charged in March of last year and last month was handed a sixteen year sentence, will return to the U.S. along with former Marine Paul Whelan.

NEW: Russia is releasing @WSJ reporter Evan Gershkovich and former US Marine Paul Whelan in major prisoner swap with the US. via @business https://t.co/U1wEuf1Rvu

— Jim Roberts (@nycjim) August 1, 2024

Updated at 7:10 AM EDT

Hawkish cut?

The Bank of England cut its key lending rate for the first time in four years, taking it to 5% from 5.25%, in a knife-edge vote that suggests deep divisions among policy makers.

The central bank's nine-member policy committee voted 5-4 in favor of the cut, the first since August 2020, even as it forecast that inflation is likely to accelerate over the coming months.

"Inflationary pressures have eased enough that we've been able to cut interest rates today. But we need to make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much," said BoE Governor Andrew Bailey.

The Monetary Policy Committee voted by a majority of 5-4 to reduce #BankRate to 5%. Find out more: https://t.co/zBZeLlwSxD pic.twitter.com/YOcCTfER5o

— Bank of England (@bankofengland) August 1, 2024

Stock Market Today

Outsized tech moves, particularly in the chip sector, helped both the Nasdaq and the S&P 500 post their biggest single-gains since February last night as Nvidia (NVDA) added a record $330 billion in market value amid a 12.8% surge.

Fed Chairman Jerome Powell's suggestion that a September rate cut is now on the table, provided that jobs and inflation data continue to support the central bank's twin mandate, also added to broader market gains after the Fed kept rates at a 22-year high of between 5.25% and 5.5%.

Shutterstock

Benchmark 10-year Treasury bond yields, which have now fallen more than 25 basis points since the most recent Fed meeting in July, retreated to 4.055% in overnight trading, with 2-year notes pegged at 4.284%.

The CME Group's FedWatch, meanwhile, suggests traders have locked in bets for a September rate cut, with the odds of a 50 basis point move pegged at 13.5%.

Related: Fed drops biggest hint yet on next interest rate move

With today's session likely focused on June-quarter updates from Apple (AAPL) and Amazon (AMZN) after the bell, last night's stronger-than-expected earnings report from Meta Platforms (META) is driving shares in the Facebook parent firmly higher.

The group posted a Wall-Street-beating revenue tally of $39.1 billion, thanks in part to what it called "healthy global advertising demand," and issued a solid near-term forecast that could offset its AI-spending ramp.

Meta shares were marked 7.2% higher in premarket trading and on track to add around $85 billion in market value.

Heading into the start of the trading day, the S&P 500, which ended the month of July with a 1.13% gain, is priced for a 19-point opening bell advance, with the Dow Jones Industrial Average called 61 points to the upside.

The tech-focused Nasdaq, which recorded a 0.75% decline in July, is set to open 87 points higher.

In overseas markets, Britain's FTSE 100 was little changed ahead of a key Bank of England rate decision later in London, while the Europe-wide Stoxx 600 benchmark slipped 0.38% to kick off August trading.

More Wall Street Analysts:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Analysts prescribe new Walgreens stock price targets after earnings

- Analyst revises Facebook parent stock price target in AI arms race

Overnight in Asia, a sharp move higher in the yen, which traded through the 150 mark against the U.S. dollar, clipped gains for the Nikkei 225, which ended 2.49% lower in Tokyo.

The regional MSCI ex-Japan benchmark, meanwhile, was marked 0.45% higher heading into the close of trading.

Related: Veteran fund manager sees world of pain coming for stocks