Stocks finished in record territory yet again on Wednesday, as investors keyed in on interest-rate-cut signals from the Federal Reserve and look to the start of second-quarter-earnings season later in the week.

The Dow Jones Industrial Average ended up 429.39 points, or 1.09%, to finish the session at 39,721.36.

The S&P 500 gained 1.02% to end at 5,633.91, breaking above 5,600 for the first time, while the tech-heavy Nasdaq climbed 1.18% to reach an all-time high of 18,647.45.

This was the 37th record close in 2024 for the S&P 500, and the 27th for the tech-heavy Nasdaq. The S&P 500 also marked its seventh straight day of gains.

Updated at 1:07 PM EDT

Bond auction

The Treasury sold $39 billion in re-opened 10-year notes Wednesday in a closely-tracked auction that drew solid interest from foreign buyers amid easing inflation pressures.

Investors placed bids worth just over $100 million for the $39 billion in paper on offer, generating a so-called 'bid-to-cover' ratio of 2.58, down from the 2.67 level notched in June but ahead of the six-month auction average of 2.52.

Indirect bidders, which represent foreign central banks, took down 67.6% of the sale, just ahead of last month's tally of 67.2%.

The notes were last seen trading at 4.28%, down 2 basis points from their pre-auction levels.

10-Year Treasury Auction Results

— Kevin Green (KG), MSDA (@KGBULLANDBEAR) July 10, 2024

$39B Offering

High Yield: 4.276%

Dealer-takedown: 11.53% vs 11.58% prev

Previous Bid-to-cover: 2.58 vs 2.67 prev

Updated at 12:13 PM EDT

Extending gains

The S&P 500 was last marked 23 points higher, or 0.4%, heading into the afternoon session, with the Nasdaq up 100 points, or 0.54%. The Dow added 102 points to just under 39,400 points.

Benchmark 10-year note yields were last trading at 4.286% as markets eye results of a $39 billion auction in about an hours' time.

Related: Goldman Sachs on 'correction watch' as stocks track CPI, Powell shift

Updated at 10:34 AM EDT

Microsoft seat dump

Microsoft (MSFT) shares nudged higher in early trading after the tech giant said it would give up a seat on the board of OpenAI, a move that could ease regulator concern over its alleged influence on the ChatGPT creator.

"Over the past eight months we have witnessed significant progress by the newly formed board and are confident in the company's direction," Microsoft said in a letter published on July 9. "Given all of this we no longer believe our limited role as an observer is necessary."

$MSFT $AAPL Microsoft and Apple ditch OpenAI board seats amid regulatory scrutiny - The Vergehttps://t.co/LzwnjrQ7gP

— Open Outcrier (@OpenOutcrier) July 10, 2024

Updated at 9:43 AM EDT

Solid start

The S&P 500 was marked 13 points, or 0.22%, higher in the opening minutes of trading, while the Nasdaq gained 84 points, or 0.45%, after printing a fresh intra-day record of 18,520.49 points. The Dow, meanwhile, was marked 2 points higher.

S&P 500 Opening Bell Heatmap (Jul. 10, 2024)$SPY +0.22%🟩$QQQ +0.31%🟩$DJI +0.07%🟩$IWM +0.55%🟩 pic.twitter.com/HeTdcAMP2O

— Wall St Engine (@wallstengine) July 10, 2024

Updated at 9:04 AM EDT

Lilly launch pad

Eli Lilly (LLY) shares edged higher in early trading, extending the stock's year-to-date gain to around 61%, following a price target upgrade from Barclays that looks to have offset news the CFO Anat Ashkenazi will step down next week to purse a new career opportunity.

Related: Analyst revamps Eli Lilly stock price target ahead of Q2 earnings

Stock Market Today

Stocks ended higher again Tuesday, with the S&P 500 notching its thirty-sixth record close of the year to extend its 2024 gain to just under 17%. The tech-focused Nasdaq, riding a rebound in Nvidia (NVDA) and another record close for Apple (AAPL) , also hit an all-time peak to take its year-to-date gain past 22.7%.

Related: Top Wall Street analyst issues stark warning for stocks

Both benchmarks were also helped by lower Treasury bond yields, which continue to trade at multi-month lows following the first day of testimony on Capitol Hill from Fed Chairman Jerome Powell.

Powell, who will face questions from the House Financial Services Committee later today, told the Senate Banking Committee that while he did not want to signal the Fed's next rate move, “more good data would strengthen our confidence that inflation is moving sustainably toward 2%."

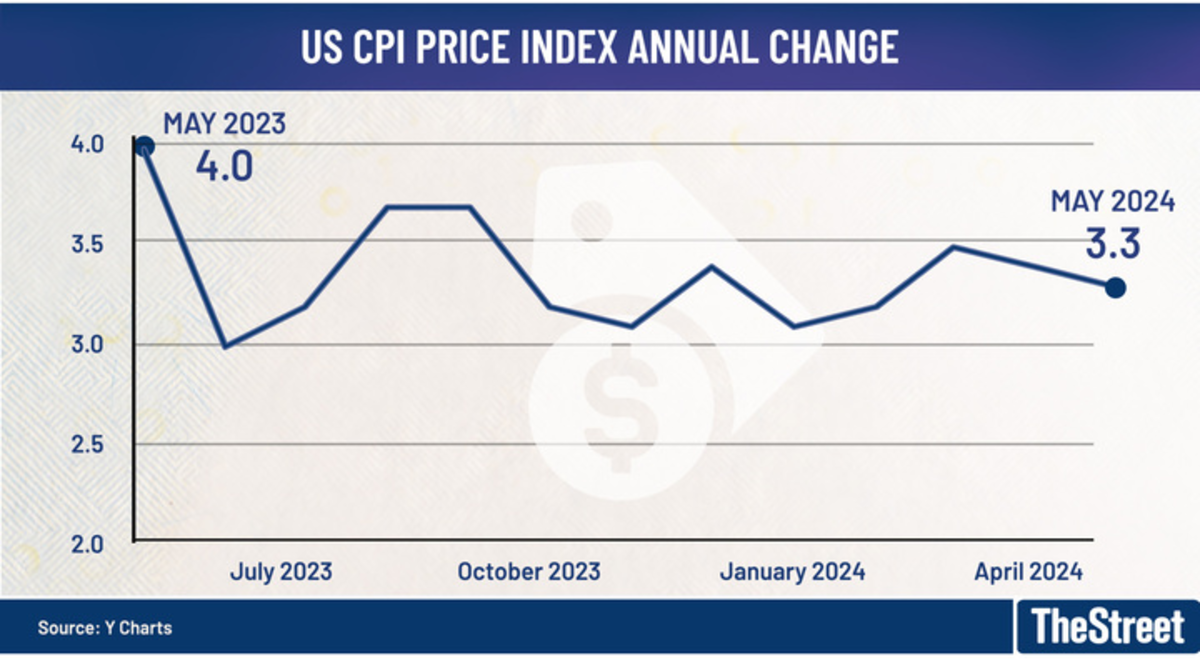

That puts market focus squarely on tomorrow's June Consumer Price Index report, which is expected to show headline pressures easing to an annual rate of 3.1%, the lowest in a year, with core inflation holding at 3.4%.

Y charts

CME Group's FedWatch pegs the odds of a July rate move at just 5% but sees the odds of a September reduction, the first rate move since July of last year, at around 73.3%.

That has benchmark 2-year notes trading at a three-month low of 4.62% heading into the start of the New York session, with 10-year notes pegged at 4.276% ahead of a $39 billion benchmark auction later in the day.

Related: Analyst resets Nvidia stock price target in chip-sector overhaul

On Wall Street, futures contracts tied to the S&P 500 suggest an 13 point opening-bell gain, while those linked to the Dow Jones Industrial Average are priced for a 5 point bump.

The Nasdaq, which is up nearly 4% for the month, is priced to add 677 points to last night's record close.

Nvidia shares were the market's most-active stock in premarket trading, rising nearly 1% to $132.62, while Apple extended its recent run of gains, adding 0.2% to $229.13

Amazon (AMZN) shares, meanwhile, were up 0.4% after Founder Jeff Bezos sold another $863.4 million of stock in the retail and web services giant, taking his overall sales for the year to just under $10 billion.

More Wall Street Analysts:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Analysts prescribe new Walgreens stock price targets after earnings

- Analyst revises Facebook parent stock price target in AI arms race

In overseas markets, Europe's Stoxx 600 was marked 0.61% higher in Frankfurt, with Britain's FTSE 100 rising 0.58% in London.

Overnight in Asia, Japan's Nikkei 225 hit another all-time high, rising 0.61% to 41,831.99 points, while the regional MSCI ex-Japan benchmark slipped 0.1% into the close of trading.

Related: Veteran fund manager sees world of pain coming for stocks