Stocks finished mixed Friday, with the Dow reaching a fresh record high, as investors picked through August inflation data that could pave the way for more Federal Reserve interest-rate cuts.

The Dow Jones Industrial Average gained 137.89 points, or 0.33%, to finish the session at a fresh record high of 42,313. The S&P 500 slipped 0.13% to end at 5,738.17, while the tech-heavy Nasdaq ended the day down 0.39% to 18,119.59.

The three major indexes are higher for the week, with the S&P 500 up nearly 1% and the Dow on pace to rise 0.7%. The Nasdaq is on track for a roughly 1% week-to-date advance, according to CNBC.

"The PCE inflation data came in at or below expectations, so that should be marginally good for markets, but the more important fact is that it is lower than the prior month, showing that inflation is receding," said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

He said that as the Fed cuts rates – especially in the absence of recessionary growth – "it is a great tailwind for both stock and bond markets and should eventually provide some relief for those consumers that are more interest-rate sensitive."

"We expect the Fed to continue cutting through the rest of the year – including the meeting in the same week as the presidential election and that should provide a floor for the stock market, even if volatility increases around the election," Zaccarelli said.

Updated at 11:54 AM EDT

Holding gains

A stronger-than-expected reading for September consumer sentiment, detailed in today's University of Michigan survey, offers something of a counterweight to Conference Board data from earlier in the week and suggests at least some spending firmness into the autumn months.

That's helping the 'soft landing" theme in this week's rally, which has the S&P 500 up 6 points, or 0.1% on the session and nearly 5.4% for the quarter, and the Dow marching 406 points higher with only a handful of stocks in negative territory.

"Inflation is no longer the story in the PCE data for the Fed.; it’s now all about spending and keeping the economy strong," said Jamie Cox, managing partner at Harris Financial Group. "If you were second guessing the Fed going [50 basis points] in September, you aren’t now."

Final September read for UMich Consumer Sentiment Index up to 70.1 vs. 69 in prior month … expectations component up sharply to 74.4 vs. 73 prior pic.twitter.com/tAq06kGUDj

— Liz Ann Sonders (@LizAnnSonders) September 27, 2024

Updated at 9:33 AM EDT

Solid open

The S&P 500 was marked 10 points higher, or 0.17%, in the opening minutes of trading with the Nasdaq rising 25 points, or 0.14%.

The Dow was marked 126 points higher while the midcap Russell 2000 rose 20 points, or 0.91%.

"All quiet on the inflation front," said Chris Larkin, managing director for trading and investing at E-Trade from Morgan Stanley. "Add today’s PCE Price Index to the list of economic data landing in a sweet spot. Inflation continues to keep its head down, and while economic growth may be slowing, there’s no indication it’s falling off a cliff."

S&P 500 Opening Bell Heatmap (Sept. 27, 2024)$SPY +0.18%🟩$QQQ +0.12%🟩$DJI +0.32%🟩$IWM +0.96%🟩 pic.twitter.com/kI2NFnWnG6

— Wall St Engine (@wallstengine) September 27, 2024

Updated at 9:13 AM EDT

More 50s?

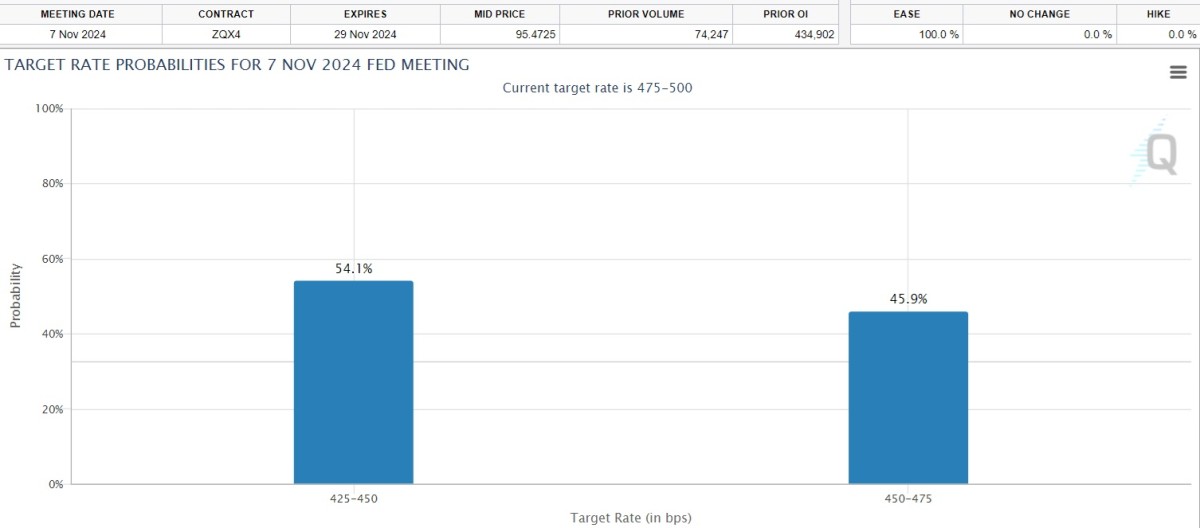

Traders are boosting bets on another 50 basis point (0.5 percentage point) iinterest-rate cut when the Fed meets again in November, just a day after the U.S. presidential elections, as cooling in both inflation pressures and personal spending suggests further easing into the final months of the year.

"Weakness is spreading," said David Russell, global head of market strategy at TradeStation. "Not only was the price index cool, but so were personal income and spending."

"The inflation story could get even more dovish from here, given the recent drop in energy prices," he added. "These numbers confirm the Fed’s easing path. Weaker spending and income validate Powell’s recent pivot to employment.”

Updated at 8:43 AM EDT

Dovish PCE data

The Fed's preferred inflation gauge ticked higher on an annual basis last month, but showed easing when compared with July levels, suggesting slowing pressures into the autumn months.

The Bureau of Economic Analysis's PCE Price Index report showed that core prices rose at an annual rate of 2.7% last month, just ahead of last month's reading of 2.6%, while core pressures, which strip away volatile food and energy prices, were up 0.1% on the month.

Stock futures nudged higher following the inflation data release, with futures contracts tied to the S&P 500 suggesting a 10 point opening bell gain and the Dow Jones Industrial Average called 95 points higher. The Nasdaq is priced for a 40 point bump.

Benchmark 10-year note yields slipped 2 basis points to 3.768% following the data release, while 2-year notes eased 3 basis points to 3.598%.

US PCE, Income & Spending: inflation up 0.1% in both the headline & core and is up 2.2% on the topline & 2.7% in the core. At 2.2% the Fed is essentially at its 2% target and the door is open to a less restrictive policy stance.

— Joseph Brusuelas (@joebrusuelas) September 27, 2024

This supports the possibility of another 50bps…

Updated at 8:04 AM EDT

Bristol Myers boost

Bristol Myers (BMY) shares were one of the top early gainers on Wall Street Friday, rising nearly 4% after the drugmaker won approval for its new schizophrenia treatment.

Cobenfy, the first new antipsychotic medicine to receive Food and Drug Administration approval in more than 20 years, was acquired in 2023 by Bristol Myers through its $14 billion acquisition of Karuna Therapeutics. It should go on sale this year with an annual cost of $22,500.

Bristol Myers shares were last marked 3.75% higher in premarket trading to indicate an opening bell price of $52 each.

The 🇺🇸 FDA approved Bristol Myers' $BMY highly anticipated schizophrenia drug, the first novel type of treatment for the debilitating, chronic mental disorder in more than 7 decades

— Evan (@StockMKTNewz) September 26, 2024

The company expects the twice-daily pill, which will be sold under the brand name Cobenfy, to be… pic.twitter.com/b1EbnE7vOJ

Check back for updates throughout the trading day

Stocks closed higher across the board Thursday, powered in part by dovish signals on rate cuts from a host of Federal Reserve officials and the ongoing impact of China's extraordinary fiscal and monetary stimulus, which has helped lift global stocks to the highest levels on record.

A better-than-expected reading for weekly jobless claims, meanwhile, as well as a firm final reading of second quarter GDP added to bets for a so-called soft landing in the world's biggest economy, which was paired with another extended rally in heavyweight tech stocks.

Olivier Douliery/Bloomberg via Getty Images

Focus on the Friday session will switch firmly to data from the Fed's preferred inflation gauge, the PCE price index, which is expected to show only a modest monthly increase and could cement the case for another outsized rate cut in November.

CME Group's FedWatch pegs the odds of a 50 basis point reduction, a cut that would match the Fed's September move, at around 50.8% heading into today's PCE data.

Related: Here's why stocks are soaring and the surprise autumn rally has room to run

Benchmark 2-year Treasury note yields, however, are edging higher, and were last marked at 3.627% heading into the start of the New York trading session. The market move suggested that bond investors were holding on to residual concerns of a surprise inflation spike over the final months of the year.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which is up 5.2% for the quarter, are priced for a modest 3 opening bell decline

Futures linked to the Dow Jones Industrial Average, meanwhile, suggest a 5 point bump with the tech-focused Nasdaq called 30 points lower.

Stocks on the move include Costco Wholesale (COST) , which slipped 1% in premarket dealing after reporting a mixed set of fiscal-fourth-quarter numbers, including a rare miss of Wall Street estimates of same-store sales for the bulk discount retailer.

Intel (INTC) shares were also active, rising 0.1% following a Bloomberg report that the chipmaker turned down a bid from Arm Holdings for its product division.

More Wall Street Analysts:

- Analysts revise Corning stock price targets after investor meeting

- Analysts retool Carnival stock price targets ahead of earnings

- Analyst revisits Costco stock price target, rating ahead of earnings

In overseas markets, European Stoxx 600 backed away from its early-session peak heading into the U.S. inflation data and was last marked 0.29% higher in Frankfurt trading. Britain's FTSE 100, meanwhile, rose 0.45% in London.

Overnight in Asia, veteran politician Sanae Tackaichi won a leadership contest within the ruling Liberal Democratic Party that will pave his path to the prime minister's office, a move seen as dovish for Bank of Japan rate projections.

That helped the Nikkei 225 to a 2.32% gain to close out the week, putting the benchmark just 130 points shy of the 40,000 mark.

More rate cuts in China, this time focused on bank-to-bank borrowing rates over seven and 14 days, closed out a week of extraordinary measures from the People's Bank of China and lifted the regional MSCI ex-Japan benchmark to a 1.21% gain heading into the close of trading.

Related: Veteran fund manager sees world of pain coming for stocks