Stocks finished mixed Wednesday, as investors looked through a key inflation reading that could accelerate repricing of the so-called 'Trump Trade' and test the market's solid post-election rally.

The Dow Jones Industrial Average gained 47.21 points, or 0.11%, to end the session at 43,958.19, while the S&P 500 edge up 0.02% to close at 5,985.38 and the tech-heavy Nasdaq slipped 0.26% to 19,230.74.

“The sticky components of inflation continue to ease, giving the Fed some leeway to cut rates next month but they will most likely pause in January,” said Jeffrey Roach, Chief Economist for LPL Financial. “The strength of some cohorts of the consumer is keeping upward pressure on prices as consumer spending hasn’t slowed yet."

"Stronger than expected economic growth is likely keeping bond yields elevated," he added.

Updated at 12:05 PM EST

Buy American?

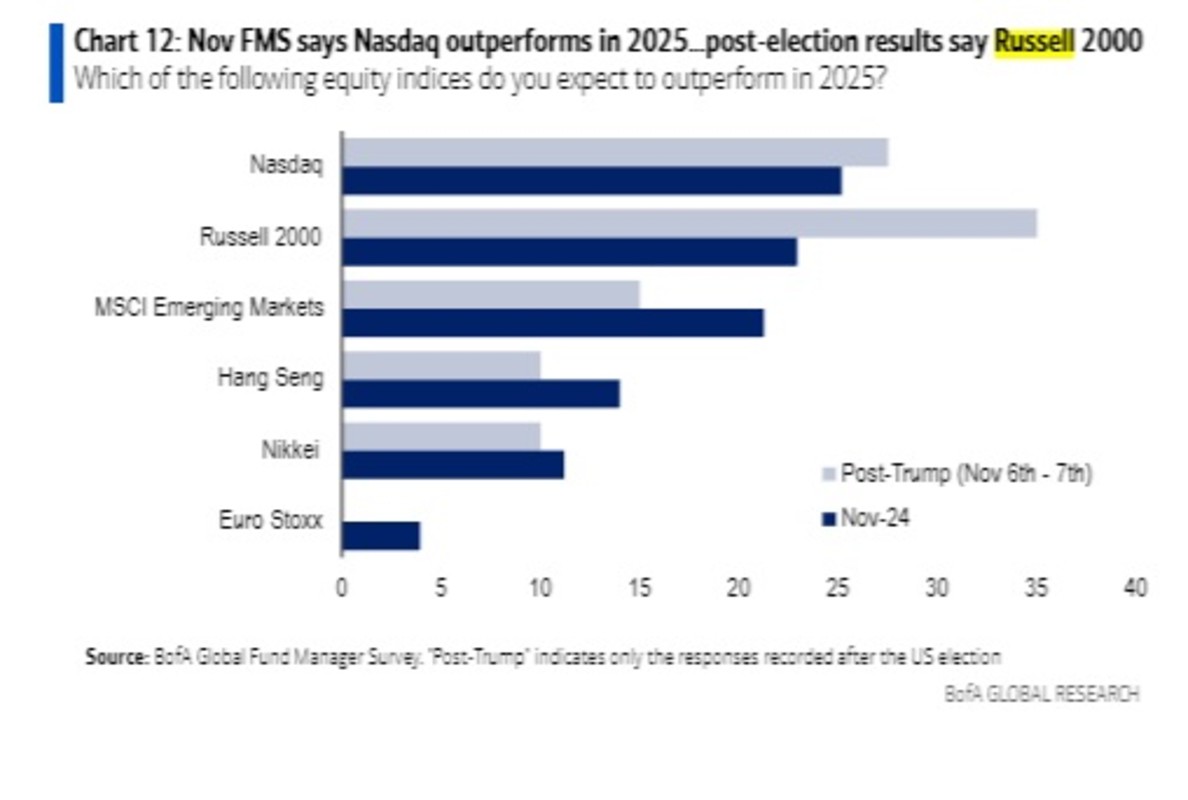

The biggest global investors see U.S. mid-cap stocks as the top performing asset class next year, based on data from Bank of America's monthly Global Fund Manager Survey, as the new Trump administration looks to deregulate domestic markets.

Around 43% of those polled in the November survey, around a fifth of which took place after the election result, said U.S. stocks would outperform their global counterparts next year, with 35% saying the Russell 2000 would be the best-performing index.

"Post-election results show higher global & US growth expectations, higher inflation expectations, lower probability of a 'soft landing', lower cash levels, higher allocations to US & Japanese equities, higher tech weighting, and big expectation for small caps and high yield bonds to outperform," the survey noted.

"Post-election respondents expect the Russell 2000 to be the best performer, followed by the Nasdaq (28%) and MSCI Emerging Markets (15%)," the report added.

The Russell 2000 was last marked 15 points, or 0.65% higher on the Wednesday session, a move that extends its November gain to around 10%. For the year, the mid-cap benchmark is up 18.75%, compared to a 25.8% gain for the S&P 500 and a 28.4% advance for the Nasdaq.

Updated at 11:00 AM EST

Morning creeper

Treasury yields are creeping higher into mid-morning session, after having eased in the wake of the October CPI inflation figures, as investors resume the repricing of the Trump Trade in fixed income markets.

Benchmark 10-year note yields were last marked at 4.418%, essentially flat from overnight levels, while 2-year notes traded at 4.269%.

The S&P 500 was last marked 3 points higher on the session, with the Dow up 125 points and the Nasdaq down 33 points.

"This inflation print is unlikely to derail the Fed’s rate-cutting cycle and we continue to expect the Fed to cut rates by 25 basis points at their final 2024 meeting next month," said Nathaniel Casey, investment strategist at wealth management firm Evelyn Partners.

"However, we remain vigilant of any further deviations in the inflation trajectory, given the resilience of the US economy and the potentially expansive fiscal policy that could accompany the Trump Presidency in January," he added.

There are three pillars to the Trump trade in markets: (i) fiscal easing that powers near-term growth and a rise in the Dollar; (ii) tariffs that could bring a much bigger rise in the Dollar medium-term; (iii) a resurgence of inflation and yield curve un-inversion longer-term... pic.twitter.com/39HOANSznp

— Robin Brooks (@robin_j_brooks) November 13, 2024

Updated at 9:37 AM EST

Modest open

The S&P 500 was marked 5 points, or 0.09%, higher in the opening minutes of trading, with the Nasdaq rising 18 points, or 0.1%.

The Dow, meanwhile, gained 67 points and the midcap Russell 2000 rose 17 points, or 0.7%, following the largely expected reading for October consumer inflation from the Commerce Department.

"No surprises from the CPI, so for now the Fed should be on course to cut rates again in December," said Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management.

"Next year is a different story, though, given the uncertainty surrounding potential tariffs and other Trump administration policies," she added.

"The markets are already weighing the possibility that the Fed will cut fewer times in 2025 than previously thought, and that they may hit the pause button as early as January."

S&P 500 Opening Bell Heatmap (Nov. 13, 2024)$SPY +0.07%🟩$QQQ -0.09%🟥$DJI +0.14%🟩$IWM +0.53%🟩 pic.twitter.com/2dbBI1rXE2

— Wall St Engine (@wallstengine) November 13, 2024

Updated at 8:44 AM EST

Consumer inflation in line with estimates

U.S. inflation ticked higher in October, rising to 2.6%, but stable core price pressures and tame month-on-month gains prompted a sigh of relief on Wall Street and likely supported bets for a end-of-year interest rate cut from the Federal Reserve.

Stocks reversed declines following the data release, with the S&P 500 suggesting a 15-point opening-bell gain and those linked to the Dow Jones Industrial Average priced for a 100-point bump. The tech-focused Nasdaq, meanwhile, is called 45 points higher.

Benchmark 2-year Treasury note yields eased 4 basis points to 4.271% while 10-year notes fell 6 basis points to 4.378%.

US October CPI: The disinflationary trend that has worked its way through the economy for much of the year modestly abated in October as the topline Consumer Price index increased 0.2% and the core 0.3% with overall inflation up 2.6% and 3.3% in the core rate from one year ago.… pic.twitter.com/grvFsNiheA

— Joseph Brusuelas (@joebrusuelas) November 13, 2024

Stock Market day

Stocks ended lower across the board Tuesday, with the S&P 500 passing the 6,000-point mark in early trading, only to give back all those gains and end 0.3% lower on the session. A surge in Treasury bond yields blunted risk appetite.

Benchmark 10-year note yields climbed 12 basis points from late Friday levels and were last marked at 4.422% in early New York dealing. The move came as markets adjusted for President-elect Donald Trump's sweeping election victory and the impact of his trade, tax and spending policies on U.S. borrowing costs.

Olivier Douliery/Bloomberg via Getty Images

That adjustment will get another tweak today with the publication of the Commerce Department's October CPI inflation report, which is expected to show further increases in both core and headline prices pressures that could challenge market bets on an end-of-year rate cut from the Federal Reserve.

CME Group's FedWatch tool pegs those odds at around 62%, down from as high as 85% last month, and a hot inflation reading could pare that even further as the economy continues to outperform forecasts over the final months of the year.

"Following the election there are also questions as to the extent and timing of the Trump administration's tariff agenda and the ensuing effect on prices and inflation, which would impact the dollar," said Quincy Krosby, chief global strategist for LPL Financial.

"Inflation-related data releases take on heightened importance as markets try to ascertain whether the Fed can, absent weakness in the labor market, deliver the rate cut cycle it had expected just a few months ago - and whether the already extended market can withstand the possibility that the Fed could remain higher for longer," she added.

Stocks are also facing concern that the post-election runup has stretched overall market valuations, with the S&P 500 now trading at a 22.2x multiple to forward 12-month earnings projections, a level that could prove difficult to maintain if the economy slows, profit growth tapers and inflation reaccelerates.

That's weighing on futures heading into the start of the trading day on Wall Street, with the S&P 500 called 68 points lower from last night's close and the Dow Jones Industrial Average priced for a 65 point pullback.

The tech-focused Nasdaq, meanwhile, is called 20 points lower, although market heavyweights such as Tesla (TSLA) and Nvidia (NVDA) are edging higher in the premarket.

Related: Top analyst lays out bold bull case for Tesla stock price target

Tesla, which is up 2.55%, is getting a boost from news last night that Trump has appointed CEO Elon Musk, as well as the biotech investor Vivek Ramaswamy, to lead a government efficiency drive aimed at slashing spending from the $6.75 trillion federal Budget.

“This will send shockwaves through the system, and anyone involved in government waste, which is a lot of people,” said Musk.

More Wall Street Analysts:

- Analysts reboot Snap stock price target after earnings

- Analysts reset Meta stock price target after earnings

- Analysts update Reddit stock price target after earnings

In overseas markets, the regional Stoxx 600 benchmark slipped 0.1% in early Frankfurt trading, while the Britain's FTSE 100 edged 0.1% higher in London.

Overnight in Asia, China stocks posted modest gains, but weakness in South Korea, Hong Kong and India pulled the MSCI ex-Japan index 0.76% lower into the close of trading. Japan's Nikkei 225 ended 1.66% lower, following on from last night's selloff on Wall Street.

Related: Veteran fund manager sees world of pain coming for stocks