Stocks ended mixed Tuesday, with the Dow closing at a fresh record high, as investors looked ahead to Nvidia's earnings later in the week to extend the market's recent gains into the autumn months.

The Dow Jones Industrial Average edged up 10 points, or 0.02%, to end the session 41,250.50, marking its second record close in a row.

The S&P 500 gained 0.16% to 5,625.80 and the tech-heavy Nasdaq advanced 0.16% to finish the day at 17,754.82.

“For now, in this very slow week of trading, Nvidia's earnings after the close tomorrow is the next milestone which may have strong ripple effects,” said Louis Navellier of Navellier Calculated Investing.

“The VIX has recovered from the August 5th peak but remains somewhat elevated north of 16, and will likely fall if Nvidia goes well,” he added, referring to the CBOE Volatility Index, which is sometimes called the Fear Index.

Confidence rose to the highest level since February as inflation expectations improved, The Conference Board said, while inflation expectations fell the lowest since the onset of the pandemic as consumer prices have moderated in recent months.

However, Jeffrey Roach, chief economist for LPL Financial, said labor market conditions deteriorated in August and a weaker job market will likely be a key reason the Fed will consistently cut rates through the balance of this year.

"We see weakening perception about the job market, likely putting a crimp on consumer spending in the coming months," Roach said. "Investors recently heard from companies that consumers are becoming more selective, looking for deals and discounts."

Offsetting this potential weakness is the Fed pivot, Roach said, "which could positively impact risk appetite."

"We expect the Fed to be especially watchful over labor market conditions and could cut aggressively should conditions warrant," he added.

Check back for updates throughout the trading day

U.S. stocks edged lower Tuesday, while Treasury yields nudged higher and the dollar held steady,

Updated at 1:42 PM EDT

Dovish auction

The Treasury's auction of $69 billion in new 2-year notes drew a muted reaction Tuesday as overall demand waned amid the ongoing pullback in government bond yields.

Investors placed bids worth $185 billion for the $69 billion on offer, generating a so-called 'bid-to-cover' ratio of 2.68, down from the 2.81 level at last month's sale. Indirect bidders, however, which represent foreign central banks, took down 68.96% of the sale, down from 74.82% in July.

However, the headline yield of 3.874% was sharply lower than the July sale of 4.434%, suggesting a dovish outlook on Fed rates heading into the final months of the year.

US 2-Year Note Sale:

— The Market Zeus (@TheGodMarket) August 27, 2024

- High Yield Rate: 3.874% (prev 4.434%)

- Bid-Cover Ratio: 2.68 (prev 2.81)

- Direct Accepted: 19.1% (prev 14.4%)

- Indirect Accepted: 69.0% (prev 76.6%)

- WI: 3.880%https://t.co/OGR2A8YMQt

Updated at 10:26 AM EDT

Rating confidence

The Conference Board's closely-tracked reading of consumer confidence jumped higher in August, with the outlook for economic expectations over the next six months rising to the highest levels in a year.

The headline reading of 103.3 topped Street forecasts and was firmly higher than the upwardly-revised 101.9 print recorded in July.

Chief economist Dana Peterson , however, noted that " consumers’ assessments of the current labor situation, while still positive, continued to weaken, and assessments of the labor market going forward were more pessimistic.”

Consumers’ assessments of their Family’s Financial Situation going forward improved.https://t.co/AD8ScjEbKV pic.twitter.com/ktJ5err0tW

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) August 27, 2024

Updated at 10:19 AM EDT

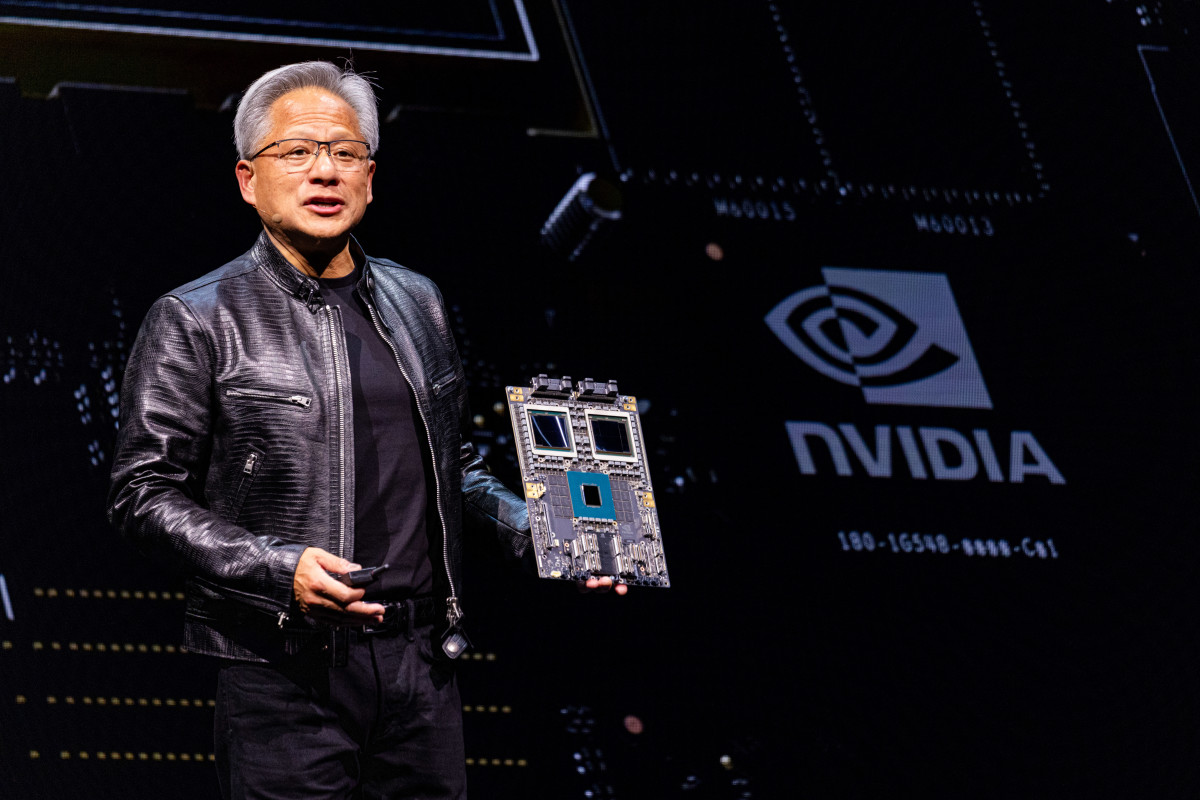

Nvidia on deck

Nvidia shares are moving in and out of positive territory in early trading as markets continue to focus on the chipmaker's Q2 update after the closing bell on Wednesday.

Nvidia shares were last marked 0.17% higher on the session at $126.66 each, extending their one-month gain to around 13.5%, well ahead of the Nasdaq's 1.87% advance over the same timeframe

Related: Analyst updates Nvidia stock price target with Q2 earnings in focus

Updated at 9:37 AM EDT

Soft open

The S&P 500 was marked 15 points, or 0.28% lower in the opening minutes of trading, with the Nasdaq down 68 points, or 0.15% at the same time.

The Dow, meanwhile, was marked 54 points to the downside, with the small-cap Russell 2000 down 13 points, or 0.63%.

Benchmark 10-year Treasury note yields were last seen 2 basis points higher at 3.856% while 2-year notes were changing hands at 3.971%

S&P 500 Opening Bell Heatmap (Aug. 27, 2024)$SPY -0.29%🟥$QQQ -0.36%🟥$DJI -0.15%🟥$IWM -0.70%🟥 pic.twitter.com/7jkbVSXN1z

— Wall St Engine (@wallstengine) August 27, 2024

Updated at 7:44 AM EDT

Weight loss

Eli Lilly (LLY) shares slipped in the premarket, with relatively limited trading volume, after the drugmaker said it would sell vials of its blockbuster weight loss treatment Zepbound at steeply discounted prices.

Lilly said patients could buy single-use doses of the drug for $399 a month through its branded website, around half the price for a syringe-based injection in a move aimed at addressing supply shortages identified by the Food and Drug Administration.

Lilly shares were marked 0.72% lower in premarket trading to indicate an opening bell price of $943.70 each.

Some more news for the $HIMS crowd that think GLP-1s aren't the story for the company

— Paul Cerro (@paulcerro) August 27, 2024

" $LLY is now selling vials of its blockbuster weight-loss drug Zepbound to patients for as little as $399 through their DTC site."

This is a direct response to pharmacies compounding. pic.twitter.com/TlQaOy3ep9

Stock Market Today

Stocks wavered into the close of trading Monday, with the S&P 500 ending modestly lower on the session and the Nasdaq drifting similarly into the red. Investors pared their risk exposure to Nvidia (NVDA) ahead of its highly-anticipated second quarter report after the closing bell on Wednesday.

Wall Street forecasts are pointing to a consensus bottom line of 64 cents a share, a 137% increase from the year-earlier quarter, with revenue more than doubling to $28.55 billion.

Nvidia told investors in May that current-quarter revenue would rise to around $28 billion, a stronger-than-expected estimate assuaged investors' concern about delays for orders of H100 chips tied to the launch of its new Blackwell processors.

Nvidia earnings, as well as a key reading of the Federal Reserve's preferred inflation gauge, the PCE price index, are likely to highlight a difficult week for Wall Street as investors look to protect their hard-fought August gains amid thin holiday liquidity and a dearth of headline events heading into the Labor Day weekend.

Only 16 S&P 500 companies are slated to report earnings this week, including retailers such as Kohl's (KSS) , Nordstrom (JWN) , Foot Locker (FL) and Best Buy Co. (BBY) , effectively closing out a better-than-expected second quarter earnings season.

Related: Analysts: What to know before Nvidia earnings are reported this week

LSEG data suggest collective S&P 500 profits are likely to have risen 12.7% from last year to $502.1 billion, a $5 billion improvement from early forecasts, with third-quarter earnings forecast to rise 5.7% to $512.8 billion.

Bond markets are also likely to be in focus today as the Treasury kicks off a week in which it aims to raise $183 billion from benchmark coupon auctions with a $69 billion sale of 2-year notes later in the session.

The paper was last marked little changed from last night's close at 3.945% while benchmark 10-year notes were pegged at 3.837% heading into the start of the New York session.

On Wall Street, futures tied to the S&P 500, which is up 1.7% for the month and 17.76% for the year, are priced for a 4 point opening bell decline. The Dow Jones Industrial Average, which closed at a record 41,240.52 points last night, is called 27 points lower.

The tech-heavy Nasdaq, which has risen just 0.72% for the month but is up 18.08% for the year, is priced for a 15 point dip.

Stocks on the move include Cava Group (CAVA) , after SEC filings showed CEO Brent Schulman and several of his executive colleagues sold shares in the restaurant group after its better-than-expected second-quarter earnings last week.

Apple (AAPL) shares, meanwhile, slipped 0.15% to $226.83 each after the tech giant said finance chief Luca Maestri would step down for a smaller role within the group on Jan. 1, making way for his deputy, Kevan Parekh.

In overseas markets, Europe's Stoxx 600 edged 0.3% higher in Frankfurt following data showing the German economy, the region's largest, shrank 0.1% over the three months ended in June.

Britain's FTSE 100, meanwhile, rose 0.2% in London, with mining and resource stocks powering the benchmark's early gains.

Overnight in Asia, the regional MSCI ex-Japan benchmark slipped 0.28% into the close of trading, while Japan's Nikkei 225 rose 0.47% in Tokyo as the yen drifted to 144.81 against the slumping U.S. dollar.

Related: Veteran fund manager sees world of pain coming for stocks